A) is approved by the House of Representatives and the Senate.

B) serves a four-year term.

C) is independent of the Board of Governors, to maintain objectivity.

D) All of these are true.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The institution ultimately responsible for managing the nation's money supply and coordinating the banking system to ensure a sound economy is called a:

A) central bank.

B) national bank.

C) public banking system.

D) peoples' bank.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compared to the other tools the Fed uses to change the money supply, the discount window is used:

A) less often than open market operations, but more often than the reserve requirement.

B) more often than open market operations and the reserve requirement.

C) about the same as open market operations, but more often than the reserve requirement.

D) more often than open market operations, and about the same as the reserve requirement.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wide acceptance of money without intrinsic value comes largely from the fact that it:

A) has a stable value.

B) is convenient to use.

C) is hard to counterfeit.

D) can be used domestically and internationally.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When banks hold excess reserves the:

A) money multiplier overestimates how much money will be created in the economy.

B) money multiplier underestimates how much money will be created in the economy.

C) reserve ratio is not fully functioning, and should be raised.

D) reserve ratio is not fully functioning, and should be lowered.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The discount window provides:

A) guaranteed emergency funds for banks in trouble at a higher interest rate than federal funds rate.

B) loans to banks at low interest rates, so they can lend more money out to the public.

C) guaranteed emergency funds for banks in trouble at a lower interest rate than others.

D) loans to banks at low interest rates, only when the economy is doing well.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

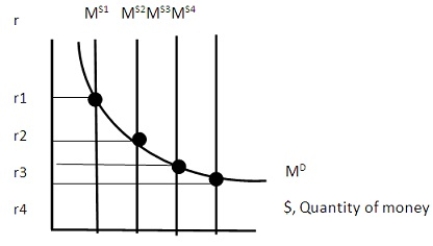

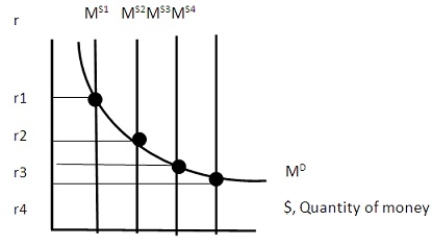

If the money supply in the economy were at MS2, to engage in contractionary policy the Federal Reserve Bank would use open market operation to move money supply to:

A) MS1

B) MS3

C) MS4

D) it would stay at MS2

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The larger is the reserve ratio, the:

A) smaller is the money multiplier, and the less money will be created in the economy.

B) smaller is the money multiplier, and the more money will be created in the economy.

C) larger is the money multiplier, and the less money will be created in the economy.

D) larger is the money multiplier, and the more money will be created in the economy.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the money supply in the economy were at MS2, and the Federal Reserve Bank used open market operations to move money supply to MS1 the overall result in the economy would be:

A) Aggregate demand shifted in, causing GDP to fall.

B) Aggregate supply shifted in, causing GDP to fall.

C) Aggregate demand shifted out, causing GDP to rise

D) LRAS move to the FE level of output.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed buys bonds through open market operations, it gives banks money in return, which:

A) increases their ability to lend, and increases aggregate demand.

B) decreases their ability to lend, and increases aggregate demand.

C) increases their ability to lend, and decreases aggregate demand.

D) decreases their ability to lend, and decreases aggregate demand.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Banks historically have used the discount window:

A) sparingly, because it is often seen as a sign of financial trouble for a bank.

B) often, because it provides instant access to needed funds for banks.

C) often, because its low interest rate can serve as a source of profit for banks.

D) only during times of economic boom, when there is a high demand for loans.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would cause the money demand curve to shift to the left?

A) An increase in interest rates

B) Inflation

C) A technological advance, like online shopping

D) An increase in GDP

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed wishes to slow economic activity, it might actively pursue:

A) expansionary fiscal policy.

B) expansionary monetary policy.

C) contractionary fiscal policy.

D) contractionary monetary policy.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because a bank earns money when it makes a loan to a borrower it:

A) has an incentive to loan out as much of each deposit as it can.

B) has an incentive to borrow from the government as much as it can to loan out.

C) needs to loan out more than it takes in through deposits to make money.

D) has more of an incentive to loan out money than take money in through deposits.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The lending facility that allows any bank to borrow reserves from the Fed is called the:

A) discount window.

B) reserve window.

C) reserve rate.

D) borrower of last resort.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed wishes to increase the money supply, it could:

A) buy bonds.

B) increase the reserve requirement.

C) increase the discount rate.

D) print more currency.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of a good that can be used for money that has intrinsic value is:

A) cigarettes.

B) fish.

C) gold.

D) All of these have intrinsic value.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of owning a government bond is ____________, and the benefit of owning one is ______________.

A) that it is as liquid as cash; interest earned

B) interest earned; that it is not very liquid

C) that it is highly liquid;interest charged

D) interest charged; that it is not very liquid

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the simple liquidity preference model, changes to the money supply will have a smaller effect on interest rates the:

A) flatter, more elastic is the money demand curve.

B) flatter, less elastic is the money demand curve.

C) steeper, more elastic is the money demand curve.

D) steeper, less elastic is the money demand curve.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The narrowest definition of money is:

A) hard money.

B) M1.

C) M2.

D) L.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 153

Related Exams