A) F0 − FT

B) F0 − S0

C) FT − F0

D) FT − S0

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The advantage that standardization of futures contracts brings is that ________ is improved because ________.

A) liquidity; all traders must trade a small set of identical contracts

B) credit risk; all traders understand the risk of the contracts

C) pricing; convergence is more likely to take place with fewer contracts

D) trading cost; trading volume is reduced

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the S&P 500 Index futures contract is overpriced relative to the spot S&P 500 Index, you should ________.

A) buy all the stocks in the S&P 500 and write put options on the S&P 500 Index

B) sell all the stocks in the S&P 500 and buy call options on S&P 500 Index

C) sell S&P 500 Index futures and buy all the stocks in the S&P 500

D) sell short all the stocks in the S&P 500 and buy S&P 500 Index futures

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor would want to ________ to exploit an expected fall in interest rates.

A) sell S&P 500 Index futures

B) sell Treasury-bond futures

C) buy Treasury-bond futures

D) buy wheat futures

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Interest rate futures contracts exist for all of the following except ________.

A) federal funds

B) Eurodollars

C) banker's acceptances

D) repurchase agreements

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At maturity of a futures contract, the spot price and futures price must be approximately the same because of ________.

A) marking to market

B) the convergence property

C) the open interest

D) the triple witching hour

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Futures contracts have many advantages over forward contracts except that ________.

A) futures positions are easier to trade

B) futures contracts are tailored to the specific needs of the investor

C) futures trading preserves the anonymity of the participants

D) counterparty credit risk is not a concern on futures

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sahali Trading Company has issued $100 million worth of long-term bonds at a fixed rate of 9%. Sahali Trading Company then enters into an interest rate swap where it will pay LIBOR and receive a fixed 8% on a notional principal of $100 million. After all these transactions are considered, Sahali's cost of funds is ________.

A) 17%

B) LIBOR

C) LIBOR + 1%

D) LIBOR − 1%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following refers to the daily settlement of obligations on future positions?

A) marking to market

B) the convergence property

C) the open interest

D) the triple witching hour

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At year-end, taxes on a futures position ________.

A) must be paid if the position has been closed out

B) must be paid if the position has not been closed out

C) must be paid regardless of whether the position has been closed out or not

D) need not be paid if the position supports a hedge

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A market timer now believes that the economy will soften over the rest of the year as the housing market slump continues, and she also believes that foreign investors will stop buying U.S. fixed-income securities in the large quantities that they have in the past. One way the timer could take advantage of this forecast is to ________.

A) buy T-bond futures and sell stock-index futures

B) sell T-bond futures and buy stock-index futures

C) buy stock-index futures and buy T-bond futures

D) sell stock-index futures and sell T-bond futures

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

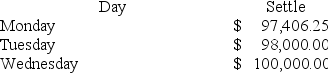

On Monday morning you sell one June T-bond futures contract at $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700, and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer the following questions.

On which of the given days do you get a margin call?

On which of the given days do you get a margin call?

A) Monday

B) Tuesday

C) Wednesday

D) none of these options

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 92 of 92

Related Exams