A) a decrease in accounts receivable.

B) an increase in prepaid expenses.

C) an increase in accrued liabilities.

D) an increase in property, plant and equipment.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

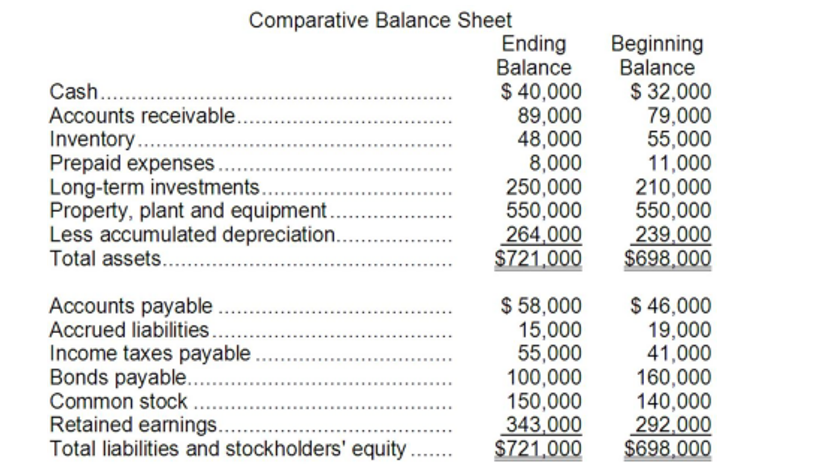

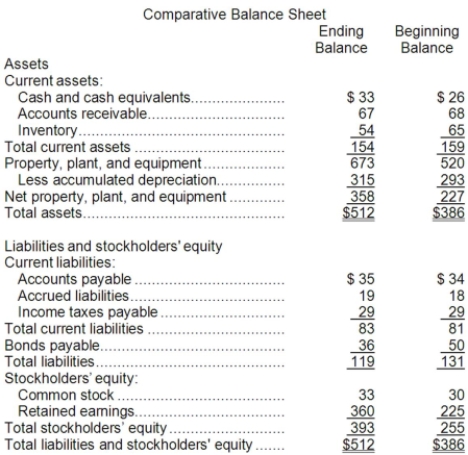

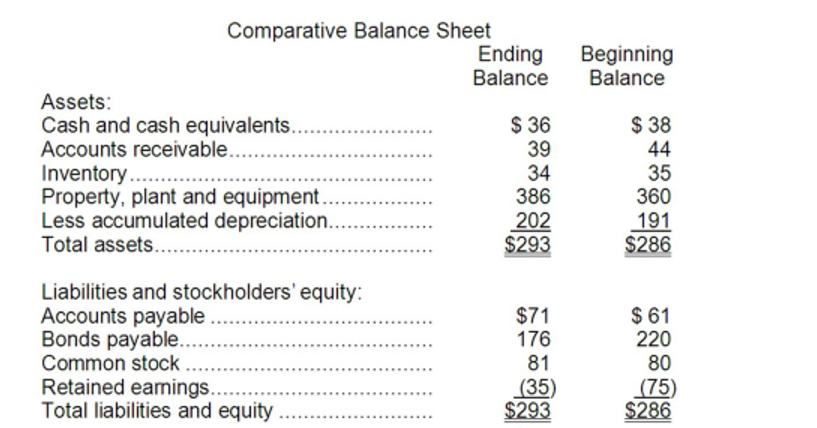

Walmouth Corporation's comparative balance sheet and income statement for last year appear below:

The company declared and paid a cash dividend of $54,000 during the year. It did not purchase or dispose of any property, plant, and equipment. It did not issue any bonds or repurchase any of its own common stock. The following question pertain to the company's statement of cash flows.

-The net cash provided by (used in) financing activities last year was:

The company declared and paid a cash dividend of $54,000 during the year. It did not purchase or dispose of any property, plant, and equipment. It did not issue any bonds or repurchase any of its own common stock. The following question pertain to the company's statement of cash flows.

-The net cash provided by (used in) financing activities last year was:

A) $(104,000)

B) $104,000

C) $(60,000)

D) $60,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

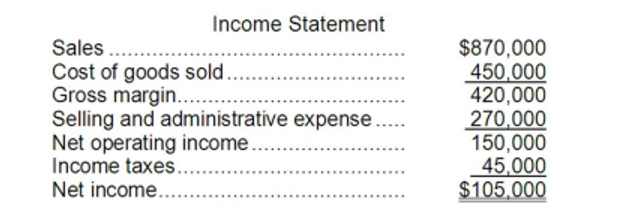

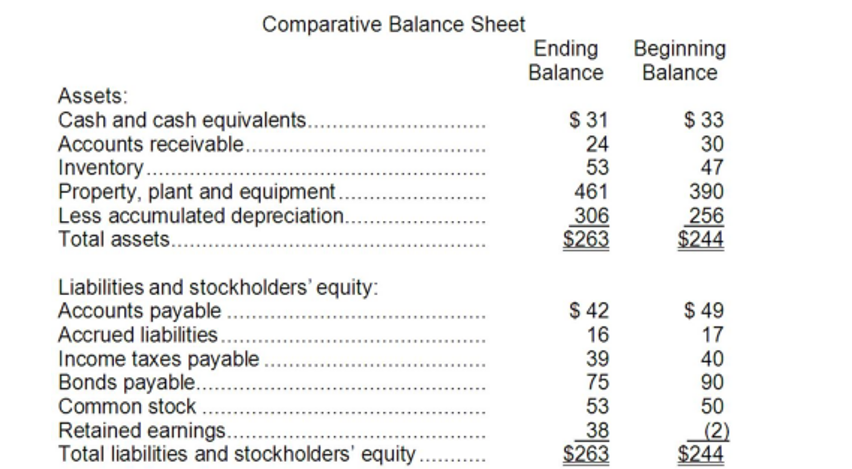

The following transactions occurred last year at Jogger Corporation:  Based solely on the above information, the net cash provided by financing activities for the year on the statement of cash flows would be:

Based solely on the above information, the net cash provided by financing activities for the year on the statement of cash flows would be:

A) $424,000

B) $(138,000)

C) $(1,000)

D) $7,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

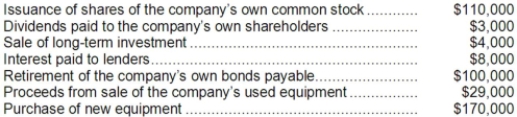

Krech Corporation's comparative balance sheet appears below:

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities.

-Which of the following is correct regarding the operating activities section of the statement of cash flows?

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities.

-Which of the following is correct regarding the operating activities section of the statement of cash flows?

A) The change in Accounts Receivable will be subtracted from net income; The change in Inventory will be added to net income

B) The change in Accounts Receivable will be added to net income; The change in Inventory will be subtracted from net income

C) The change in Accounts Receivable will be added to net income; The change in Inventory will be added to net income

D) The change in Accounts Receivable will be subtracted from net income; The change in Inventory will be subtracted from net income

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

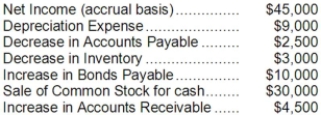

The data given below are from the accounting records of the Kuhn Corporation:  Based on this information, the net cash provided by operating activities using the indirect method would be:

Based on this information, the net cash provided by operating activities using the indirect method would be:

A) $55,000

B) $58,000

C) $50,000

D) $60,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Buying property, plant, or equipment would be reported as a cash outflow on the investing activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be considered a cash inflow in the financing activities section of the statement of cash flows?

A) Issuing bonds payable.

B) Receiving cash from customers.

C) Sale of equipment.

D) Collection of a loan made to another company.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

When computing the net cash provided by operating activities under the indirect method on the statement of cash flows, a decrease in common stock would be subtracted from net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

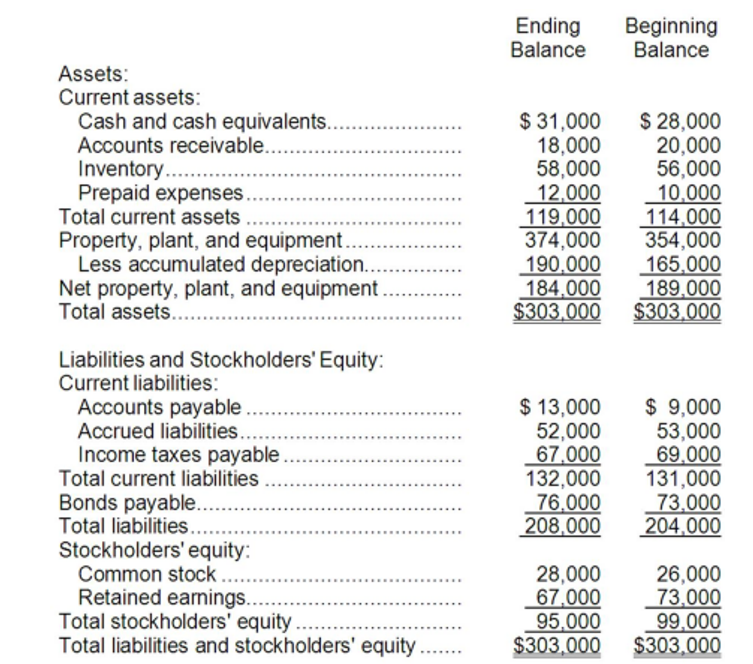

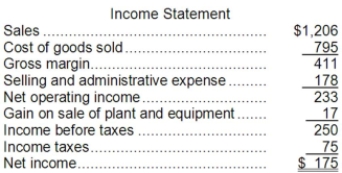

Autry Corporation's balance sheet and income statement appear below:

Cash dividends were $40. The company sold equipment for $19 that was originally purchased for $6 and that had accumulated depreciation of $4. The net cash provided by (used in) investing activities for the year was:

Cash dividends were $40. The company sold equipment for $19 that was originally purchased for $6 and that had accumulated depreciation of $4. The net cash provided by (used in) investing activities for the year was:

A) $19

B) $140

C) ($159)

D) ($140)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The direct method of preparing the statement of cash flows will show the same increase or decrease in cash as the indirect method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following transactions should be classified as a financing activity on the statement of cash flows?

A) Purchase of equipment.

B) Purchase of the company's own stock.

C) Sale of a long-term investment.

D) Payment of interest to a lender.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Excerpts from Neuwirth Corporation's comparative balance sheet appear below:  Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

A) The change in Accounts Receivable is added to net income; The change in Inventory is added to net income

B) The change in Accounts Receivable is added to net income; The change in Inventory is subtracted from net income

C) The change in Accounts Receivable is subtracted from net income; The change in Inventory is subtracted from net income

D) The change in Accounts Receivable is subtracted from net income; The change in Inventory is added to net income

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Marks Corporation's balance sheet appears below:  Net income for the year was $77. Cash dividends were $13. The company did not dispose of any property, plant, and equipment, retire any bonds payable, or repurchase any of its own common stock during the year.

Required:

Prepare a statement of cash flows in good form using the indirect method.

Net income for the year was $77. Cash dividends were $13. The company did not dispose of any property, plant, and equipment, retire any bonds payable, or repurchase any of its own common stock during the year.

Required:

Prepare a statement of cash flows in good form using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

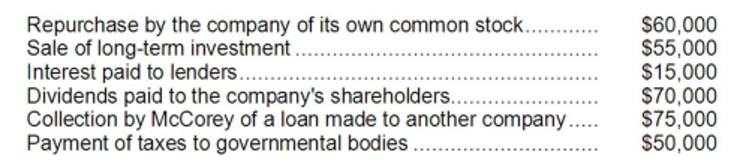

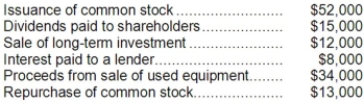

McCorey Corporation recorded the following events last year:

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

-Beacham Corporation's net cash provided by operating activities was $115; its net income was $95; its capital expenditures were $65; and its cash dividends were $17. The company's free cash flow was:

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

-Beacham Corporation's net cash provided by operating activities was $115; its net income was $95; its capital expenditures were $65; and its cash dividends were $17. The company's free cash flow was:

A) $292

B) $13

C) $33

D) $128

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a company pays cash to repurchase its own common stock, this is reported as a cash outflow in the financing activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Excerpts from Aultman Corporation's comparative balance sheet appear below:  Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

A) The change in Inventory is added to net income; The change in Accounts Payable is added to net income

B) The change in Inventory is added to net income; The change in Accounts Payable is subtracted from net income

C) The change in Inventory is subtracted from net income; The change in Accounts Payable is added to net income

D) The change in Inventory is subtracted from net income; The change in Accounts Payable is subtracted from net income

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

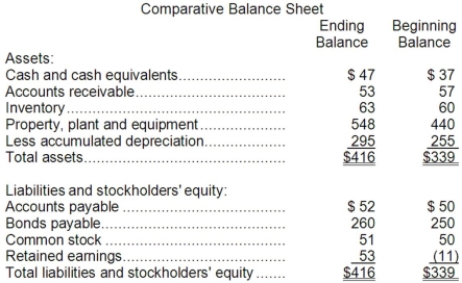

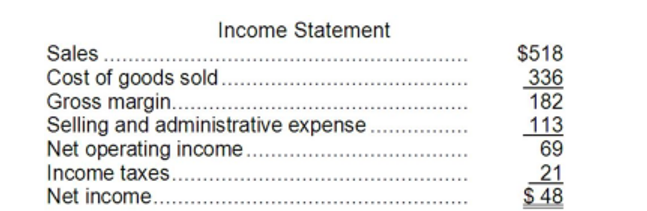

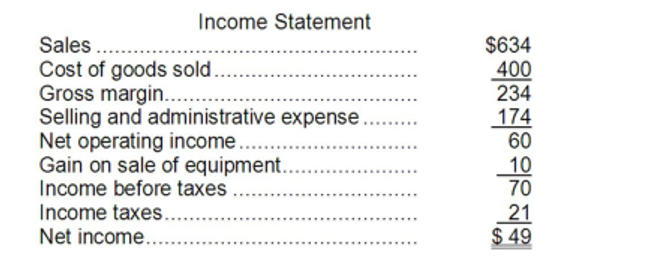

Financial statements of Rukavina Corporation follow:

Cash dividends were $8. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following question pertain to the company's statement of cash flows.

-The net cash provided by (used in) operating activities for the year was:

Cash dividends were $8. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following question pertain to the company's statement of cash flows.

-The net cash provided by (used in) operating activities for the year was:

A) $21

B) $75

C) $27

D) $69

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Salsedo Corporation's balance sheet and income statement appear below:

Cash dividends were $9. The company sold equipment for $15 that was originally purchased for $10 and that had accumulated depreciation of $5. It did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided by (used in) investing activities for the year was:

Cash dividends were $9. The company sold equipment for $15 that was originally purchased for $10 and that had accumulated depreciation of $5. It did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided by (used in) investing activities for the year was:

A) $(81)

B) $(66)

C) $66

D) $15

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Investing activities on the statement of cash flows generate cash inflows and outflows related to borrowing from and repaying principal to creditors and completing transactions with the company's owners such as selling or repurchasing shares of common stocks and paying dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following events occurred last year for the Cart Corporation:  Based solely on the above information, the net cash provided by financing activities for the year on the statement of cash flows was:

Based solely on the above information, the net cash provided by financing activities for the year on the statement of cash flows was:

A) $12,000

B) $24,000

C) $20,000

D) $49,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 132

Related Exams