A) ($19)

B) $77

C) $3

D) $15

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

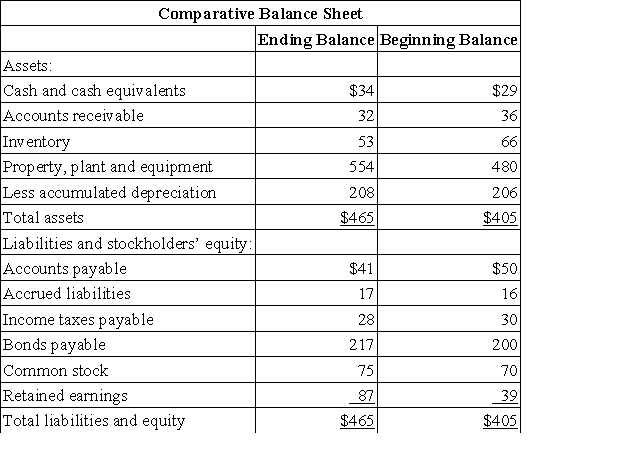

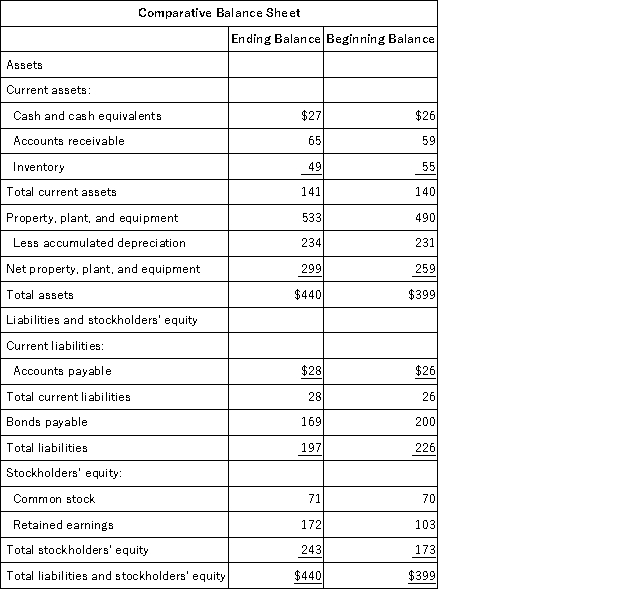

Alcoser Corporation's most recent balance sheet appears below:  Net income for the year was $60.Cash dividends were $12.The company did not dispose of any property,plant,and equipment.It did not issue any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) financing activities for the year was:

Net income for the year was $60.Cash dividends were $12.The company did not dispose of any property,plant,and equipment.It did not issue any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) financing activities for the year was:

A) $10

B) $5

C) ($12)

D) $17

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

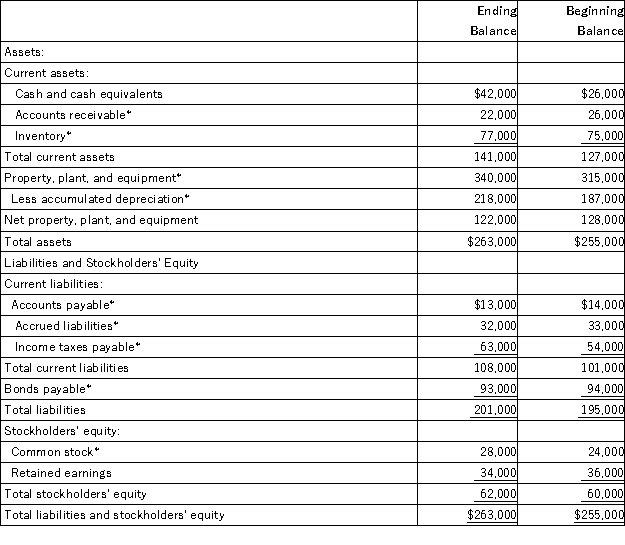

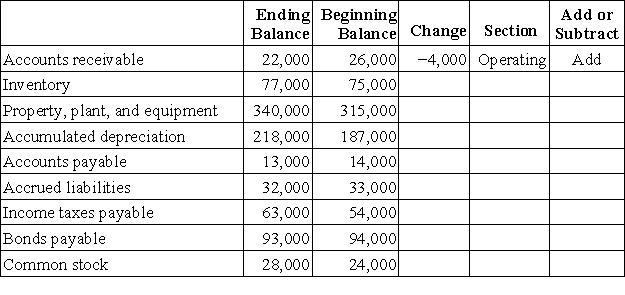

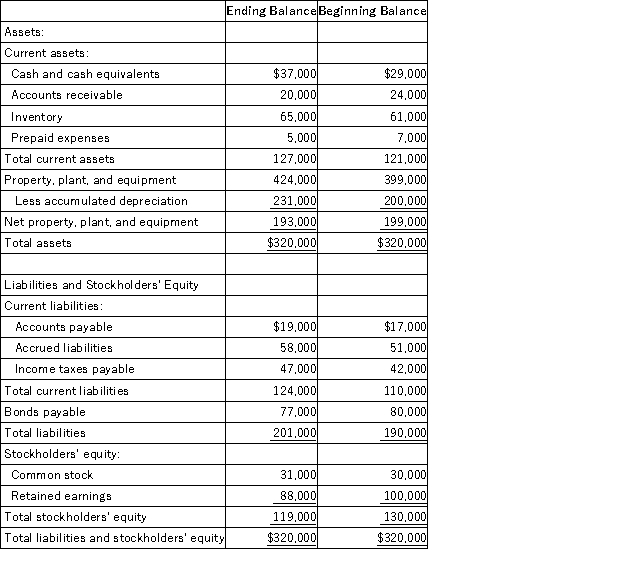

Manila Corporation's comparative balance sheet appears below:  The company's net income (loss)for the year was $0 and its cash dividends were $2,000.It did not dispose of any property,plant,and equipment,issue any bonds payable,or repurchase any of its own common stock during the year.

Required:

Compute the change in each balance sheet account denoted with an asterisk (*).Indicate whether the change in each balance will be recorded in the operating,investing,or financing activities section of the statement of cash flows.For items recorded in the operating activities section,also indicate whether the change will be added to or subtracted from net income.For all other items,indicate whether the change will be added as a cash inflow or subtracted as a cash outflow.The first entry has been filled in as an example.

The company's net income (loss)for the year was $0 and its cash dividends were $2,000.It did not dispose of any property,plant,and equipment,issue any bonds payable,or repurchase any of its own common stock during the year.

Required:

Compute the change in each balance sheet account denoted with an asterisk (*).Indicate whether the change in each balance will be recorded in the operating,investing,or financing activities section of the statement of cash flows.For items recorded in the operating activities section,also indicate whether the change will be added to or subtracted from net income.For all other items,indicate whether the change will be added as a cash inflow or subtracted as a cash outflow.The first entry has been filled in as an example.

Correct Answer

verified

Correct Answer

verified

True/False

Collecting the principal on a loan to another company would be reported on the investing activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

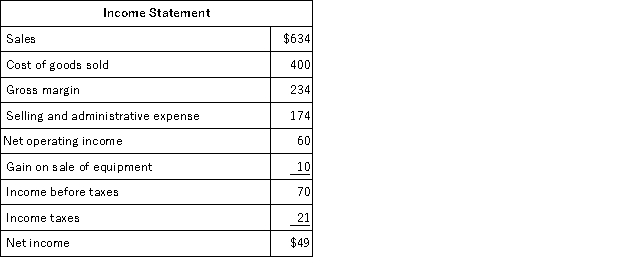

Salsedo Corporation's balance sheet and income statement appear below:

Cash dividends were $9.The company sold equipment for $15 that was originally purchased for $10 and that had accumulated depreciation of $5.It did not issue any bonds payable or repurchase any of its own common stock. The net cash provided by (used in) investing activities for the year was:

Cash dividends were $9.The company sold equipment for $15 that was originally purchased for $10 and that had accumulated depreciation of $5.It did not issue any bonds payable or repurchase any of its own common stock. The net cash provided by (used in) investing activities for the year was:

A) ($81)

B) ($66)

C) $66

D) $15

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in accounts receivable of $1,000 over the course of a year would be shown on the company's statement of cash flows prepared under the indirect method as:

A) an addition to net income of $1,000 in order to arrive at net cash provided by operating activities.

B) a deduction from net income of $1,000 in order to arrive at net cash provided by operating activities.

C) an addition of $1,000 under financing activities.

D) a deduction of $1,000 under financing activities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

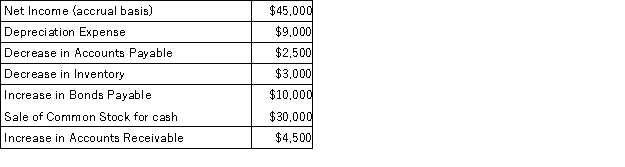

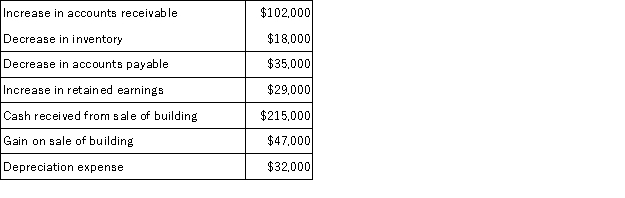

The data given below are from the accounting records of the Kuhn Corporation:  Based on this information,the net cash provided by operating activities using the indirect method would be:

Based on this information,the net cash provided by operating activities using the indirect method would be:

A) $55,000

B) $58,000

C) $50,000

D) $60,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kaeser Corporation's most recent balance sheet appears below:  The company's net income for the year was $52 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $9.The net cash provided by (used in) investing activities for the year was:

The company's net income for the year was $52 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $9.The net cash provided by (used in) investing activities for the year was:

A) $17

B) $67

C) ($17)

D) ($67)

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

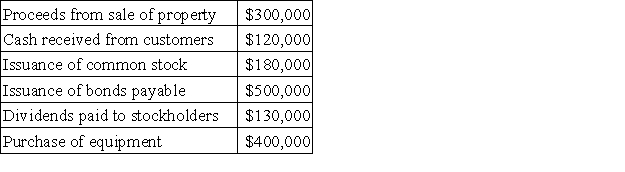

Randal Corporation recorded the following activity for the year just ended:  The net cash provided by (used in) investing activities for the year was:

The net cash provided by (used in) investing activities for the year was:

A) $100,000

B) ($100,000)

C) ($400,000)

D) $400,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

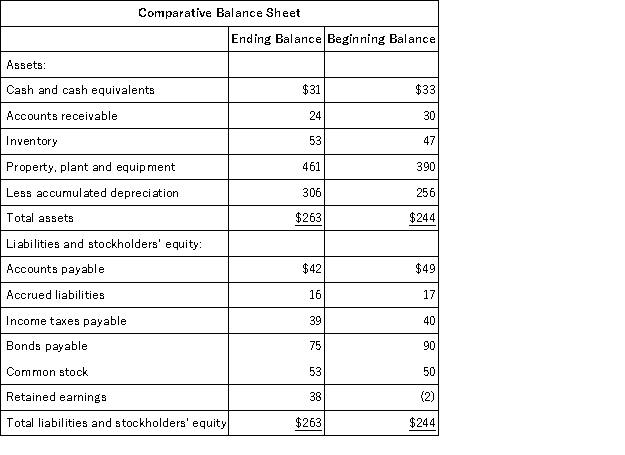

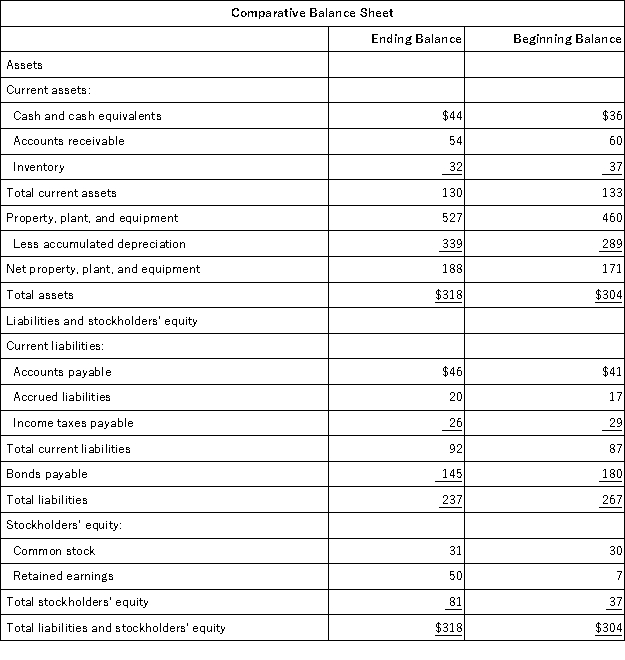

Birchett Corporation's most recent balance sheet appears below:  The company's net income for the year was $91 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $22.The net cash provided by (used in) operating activities for the year was:

The company's net income for the year was $91 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $22.The net cash provided by (used in) operating activities for the year was:

A) $86

B) $5

C) $96

D) $130

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Money received from issuing bonds payable would be included as part of a company's financing activities on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Free cash flow decreases when a company issues common stock for cash.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When computing the net cash provided by operating activities under the indirect method on the statement of cash flows,a decrease in common stock would be subtracted from net income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In the statement of cash flows,collecting cash from customers is treated as a cash inflow in the financing activities section.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Negative free cash flow does not automatically signal poor performance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Furis Corporation's cash and cash equivalents consist of cash and marketable securities.Last year the company's cash account decreased by $12,000 and its marketable securities account increased by $19,000.Cash provided by operating activities was $18,000.Net cash used in financing activities was $12,000.Based on this information,the net cash flow from investing activities on the statement of cash flows was:

A) a net $12,000 decrease.

B) a net $1,000 increase.

C) a net $6,000 decrease.

D) a net $6,000 increase.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the Inventory account of a company from $10,000 at the beginning of the year to $15,000 at the end of the year would be shown on the company's statement of cash flows prepared under the indirect method as:

A) an addition to net income of $5,000 in order to arrive at net cash provided by operating activities.

B) a deduction from net income of $5,000 in order to arrive at net cash provided by operating activities.

C) an addition to net income of $15,000 in order to arrive at net cash provided by operating activities.

D) a deduction from net income of $10,000 in order to arrive at net cash provided by operating activities.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

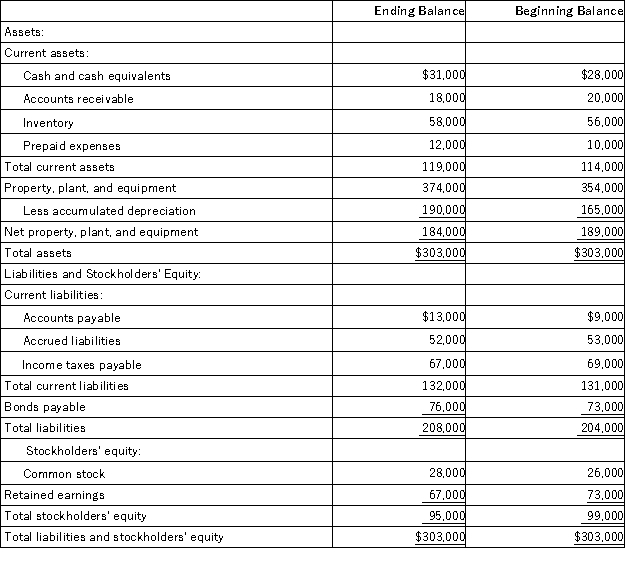

The most recent comparative balance sheet of Giacomelli Corporation appears below:  The company uses the indirect method to construct the operating activities section of its statements of cash flows. Which of the following is correct regarding the operating activities section of the statement of cash flows?

The company uses the indirect method to construct the operating activities section of its statements of cash flows. Which of the following is correct regarding the operating activities section of the statement of cash flows?

A) The change in Prepaid Expenses will be added to net income;The change in Income Taxes Payable will be subtracted from net income

B) The change in Prepaid Expenses will be subtracted from net income;The change in Income Taxes Payable will be subtracted from net income

C) The change in Prepaid Expenses will be subtracted from net income;The change in Income Taxes Payable will be added to net income

D) The change in Prepaid Expenses will be added to net income;The change in Income Taxes Payable will be added to net income

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Majorn Auto Parts Store had net income of $81,000 for the year just ended.Majorn collected the following additional information to prepare its statement of cash flows for the year:  Majorn uses the indirect method to prepare its statement of cash flows.What is Majorn's net cash provided (used) by operating activities?

Majorn uses the indirect method to prepare its statement of cash flows.What is Majorn's net cash provided (used) by operating activities?

A) $41,000

B) ($53,000)

C) $185,000

D) $279,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Krech Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000.It did not sell or retire any property,plant,and equipment during the year.The company uses the indirect method to determine the net cash provided by operating activities. The company's net cash provided by operating activities is:

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000.It did not sell or retire any property,plant,and equipment during the year.The company uses the indirect method to determine the net cash provided by operating activities. The company's net cash provided by operating activities is:

A) $29,000

B) $19,000

C) $27,000

D) $21,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 133

Related Exams