A) $80,000

B) $10,000

C) $20,000

D) $30,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following below is not one of the four major forms of business entities that are discussed in this chapter?

A) Sole proprietorship

B) Corporation

C) Partnership

D) Subchapter S corporation

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Teri, Doug, and Brian are partners with capital balances of $20,000, $30,000, and $50,000 respectively. They share income in the ratio of 3:2:1. Income Summary with a debit balance of $30,000 is closed to the capital accounts. Doug withdraws from the partnership. How much cash does he get upon withdrawal?

A) $30,000

B) $20,000

C) $40,000

D) $24,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The capital accounts of Harrison and Marti have balances of $160,000 and $110,000, respectively, on January 1, 2014, the beginning of the current fiscal year. On April 10, Harrison invested an additional $20,000. During the year, Harrison and Marti withdrew $96,000 and $78,000, respectively, and net income for the year was $264,000. The articles of partnership make no reference to the division of net income. Based on this information, the statement of partners' equity for 2010 would show what amount as total capital for the partnership on December 31, 2010?

A) $228,000

B) $176,000

C) $404,000

D) $752,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Revenue per employee may be used to measure partnership (LLC) efficiency.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Immediately prior to the process of liquidation, partners Micco, Niccum, and Orwell have capital balances of $70,000, $20,000, and $30,000 respectively. There is a cash balance of $10,000, noncash assets total $160,000, and liabilities total $50,000. The partners share net income and losses in the ratio of 2:2:1.

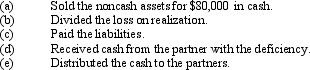

Journalize the entries to record the liquidation outlined below, using Assets as the account title for the noncash assets and Liabilities as the account title for all creditors' claims.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An advantage of the partnership form of business organization is

A) unlimited liability

B) mutual agency

C) ease of formation

D) limited life

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a partnership is formed, assets contributed by the partners should be recorded on the partnership books at their

A) book values on the partners' books prior to their being contributed to the partnership

B) fair market value at the time of the contribution

C) original costs to the partner contributing them

D) assessed values for property purposes

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a new partner is admitted by making an investment in the partnership, the old partners' capital accounts are always credited.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The characteristic of a partnership that gives the authority to any partner to legally bind the partnership and all other partners to business contracts is called

A) unlimited liability

B) ease of formation

C) mutual agency

D) dissolution

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 190 of 190

Related Exams