Correct Answer

verified

Correct Answer

verified

True/False

Using the indirect method,if land costing $85,000 was sold for $145,000,the amount reported in the financing activities section of the statement of cash flows would be $85,000.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

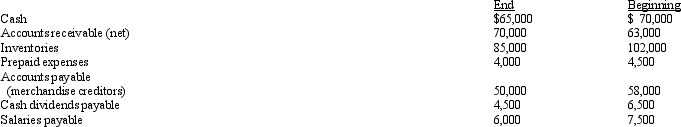

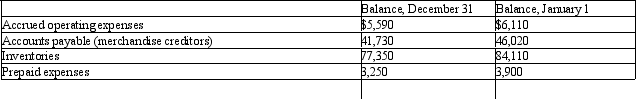

The net income reported on an income statement for the current year was $58,000.Depreciation recorded on fixed assets for the year was $24,000.In addition,equipment with an original cost of $130,000 and accumulated depreciation of $115,000 on the date of the sale,was sold for $20,000.Balances of the current asset and current liability accounts at the end and beginning of the year are listed below.Prepare the cash flows from operating activities section of a statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company had net income of $252,000.Depreciation expense is $26,000.During the year,Accounts Receivable and Inventory increased by $15,000 and $40,000,respectively.Prepaid Expenses and Accounts Payable decreased by $2,000 and $4,000,respectively.There was also a loss on the sale of equipment of $3,000.How much cash was provided by operating activities?

A) $217,000.

B) $224,000.

C) $284,000.

D) $305,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

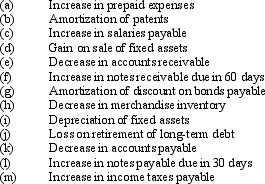

Indicate whether each of the following would be added to or deducted from net income in determining net cash flow from operating activities by the indirect method:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

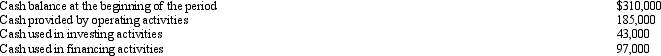

The current period statement of cash flows includes the flowing:

The cash balance at the end of the period is

The cash balance at the end of the period is

A) $45,000

B) $635,000

C) $355,000

D) $125,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

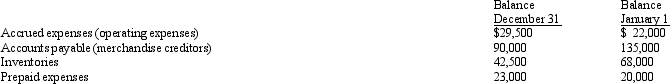

Selected data for the current year ended December 31 are as follows:

During the current year,the cost of merchandise sold was $620,000 and the operating expenses other than depreciation were $142,000.The direct method is used for presenting the cash flows from operating activities on the statement of cash flows.

Determine the amount reported on the statement of cash flows for (a)cash payments for merchandise and (b)cash payments for operating expenses.

During the current year,the cost of merchandise sold was $620,000 and the operating expenses other than depreciation were $142,000.The direct method is used for presenting the cash flows from operating activities on the statement of cash flows.

Determine the amount reported on the statement of cash flows for (a)cash payments for merchandise and (b)cash payments for operating expenses.

Correct Answer

verified

Correct Answer

verified

Essay

Selected data taken from the accounting records of Laser Inc.for the current year ended December 31,are as follows:

During the current year,the cost of merchandise sold was $448,500,and the operating expenses other than depreciation were $78,000.The direct method is used for presenting the cash flows from operating activities on the statement of cash flows.

Required:

Determine the amount reported on the statement of cash flows for:

(1)Cash payments for merchandise;and

(2)Cash payments for operating expenses.

During the current year,the cost of merchandise sold was $448,500,and the operating expenses other than depreciation were $78,000.The direct method is used for presenting the cash flows from operating activities on the statement of cash flows.

Required:

Determine the amount reported on the statement of cash flows for:

(1)Cash payments for merchandise;and

(2)Cash payments for operating expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If accounts payable have increased during a period

A) revenues on an accrual basis are less than revenues on a cash basis.

B) expenses on an accrual basis are less than expenses on a cash basis.

C) expenses on an accrual basis are the same as expenses on a cash basis.

D) expenses on an accrual basis are greater than expenses on a cash basis.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

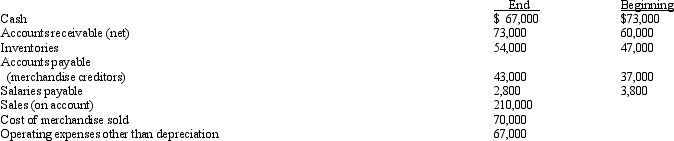

Balances of the current asset and current liability accounts at the end and beginning of the year are as follows:

Use the direct method to prepare the cash flows from operating activities section of a statement of cash flows.

Use the direct method to prepare the cash flows from operating activities section of a statement of cash flows.

Correct Answer

verified

Correct Answer

verified

True/False

If land costing $145,000 was sold for $205,000,the $60,000 gain on the sale would be added to net income in of the operating activities section of the statement of cash flows (prepared by the indirect method).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Operating expenses other than depreciation for the year were $400,000.Prepaid expenses increased by $17,000 and accrued expenses decreased by $30,000 during the year.Cash payments for operating expenses to be reported on the cash flow statement using the direct method would be

A) $353,000

B) $413,000

C) $447,000

D) $383,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The direct method of preparing the operating activities section of the statement of cash flows reports major classes of gross cash receipts and gross cash payments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following does not represent an outflow of cash and therefore would not be reported on the statement of cash flows as a use of cash?

A) purchase of noncurrent assets

B) purchase of treasury stock

C) discarding an asset that had been fully depreciated

D) payment of cash dividends

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

There are two alternatives to reporting cash flows from operating activities in the statement of cash flows: (1)the direct method and (2)the indirect method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash dividends of $45,000 were declared during the year.Cash dividends payable were $10,000 at the beginning of the year and $15,000 at the end of the year.The amount of cash for the payment of dividends during the year is

A) $50,000

B) $40,000

C) $55,000

D) $35,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

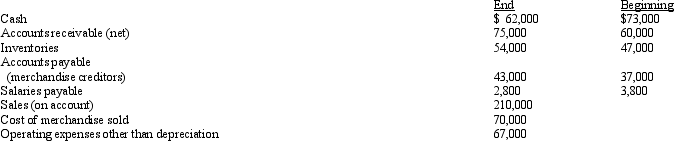

Balances of the current asset and current liability accounts at the end and beginning of the year are as follows:

Use the direct method to prepare the cash flows from operating activities section of a statement of cash flows.

Use the direct method to prepare the cash flows from operating activities section of a statement of cash flows.

Correct Answer

verified

Correct Answer

verified

Essay

Sales reported on the income statement were $690,000.The accounts receivable balance declined $39,000 over the year.Determine the amount of cash received from customers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following below should be added to net income in calculating net cash flow from operating activities using the indirect method?

A) a gain on the sale of land

B) a decrease in accounts payable

C) an increase in accrued liabilities

D) dividends paid on common stock

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Cash inflows and outflows are not netted in the investing or financing sections of the statement of cash flows but are separately disclosed to give the reader full information.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 160

Related Exams