Correct Answer

verified

Correct Answer

verified

True/False

As product costs are incurred in the manufacturing process, they are accounted for as assets and reported on the balance sheet as inventory.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The document that serves as the basis for recording direct labor on a job cost sheet is the time ticket.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Materials purchased on account during the month amounted to $180,000. Materials requisitioned and placed in production totaled $165,000. From the following, select the entry to record the transaction on the day the materials were bought.

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

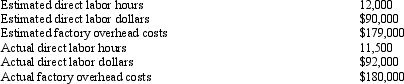

The following budget data are available for Happy Company:  If factory overhead is to be applied based on direct labor dollars, the predetermined overhead rate is

If factory overhead is to be applied based on direct labor dollars, the predetermined overhead rate is

A) 199%

B) 196%

C) $14.92

D) $15.65

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Direct labor cost is an example of a period cost.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Job order cost accounting systems may be used to evaluate a company's efficiency.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Job order cost accounting systems may be used for planning and controlling a service business.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A process cost accounting system is best used by manufacturers of like units of product that are not distinguishable from each other during a continuous production process.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of a job order costing system?

A) It accumulates cost for each department within the factory.

B) It provides a separate record for the cost of each quantity of product that passes through the factory.

C) It is best suited for industries that manufactures custom goods.

D) Uses only one work in process account.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

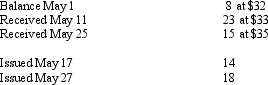

The balance of Material Q on May 1 and the receipts and issuances during May are as follows:

Determine the cost of each of the issuances under a perpetual system, using the first-in, first-out method.

Determine the cost of each of the issuances under a perpetual system, using the first-in, first-out method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

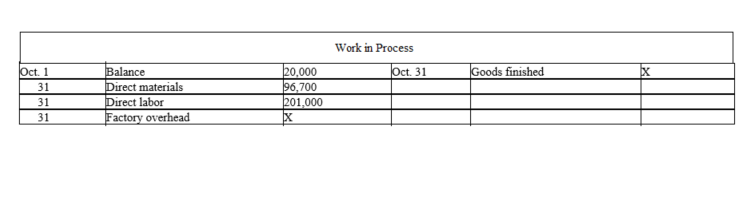

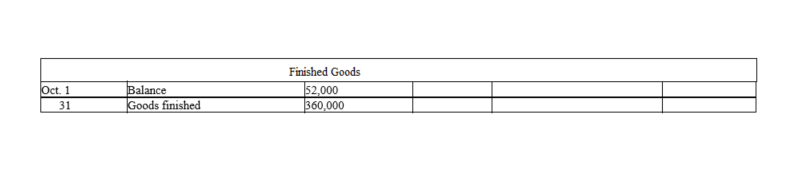

Selected accounts with some debits and credits omitted are presented as follows:

If the balance of Work in Process at October 31 is $21,000, what was the amount of factory overhead applied in October?

If the balance of Work in Process at October 31 is $21,000, what was the amount of factory overhead applied in October?

A) $63,300

B) $21,300

C) $42,300

D) $11,300

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following entries would probably not be found on the books of a service provider?

A) Debit Work in Process; credit Materials

B) Debit Work in Process; credit Wages Payable

C) Debit Work in Process; credit Overhead

D) Debit Cost of Services; credit Work in Process

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The inventory accounts generally maintained by a manufacturing firm are only finished goods and materials.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For which of the following businesses would the job order cost system be appropriate?

A) Meat processor

B) Automobile manufacturer

C) Oil refinery

D) Construction contractor

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that factory overhead costs would be $360,000 and direct labor hours would be 30,000. Actual manufacturing overhead costs incurred were $377,200, and actual direct labor hours were 36,000. The entry to apply the factory overhead costs for the year would include a

A) debit to factory overhead for $360,000.

B) credit to factory overhead for $432,000.

C) debit to factory overhead for $377,200.

D) credit to factory overhead for $360,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A process cost accounting system accumulates costs for each of the departments or processes within the factory.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

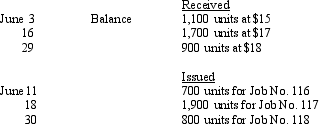

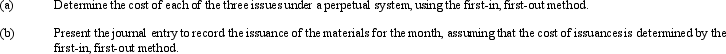

During June, the receipts and issuances of Material No. A2FO are as follows:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of time spent by each employee and the labor cost incurred for each individual job or for factory overhead are recorded on:

A) pay stubs.

B) in-and-out cards.

C) time tickets.

D) employees' earnings records.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

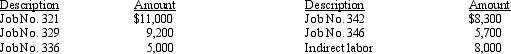

A summary of the time tickets for August follows:

Present the journal entries to record (a) the labor cost incurred and (b) the application of factory overhead to production for August. The factory overhead rate is 70% of direct labor cost.

Present the journal entries to record (a) the labor cost incurred and (b) the application of factory overhead to production for August. The factory overhead rate is 70% of direct labor cost.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 176

Related Exams