A) $40,000

B) $100,000

C) $60,000

D) $130,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Managerial accounting focuses on information needed by lenders,customers,and the federal government.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jackson Electric Services Company incurred $800 as a repair expense and paid for it in cash.The company is a sole proprietorship.This transaction will ________.

A) decrease the owner's equity

B) increase the assets of the business

C) increase the liabilities of the business

D) decrease the liabilities of the business

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The field of accounting that focuses on providing information for external decision makers is ________.

A) managerial accounting

B) financial accounting

C) cost accounting

D) nonmonetary accounting

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

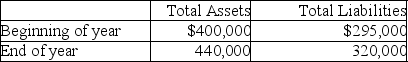

The total assets and the total liabilities of Atlas Financial Services are shown below.There were no capital contributions and no withdrawals during the year.  What was the amount of net income for the year?

What was the amount of net income for the year?

A) $40,000

B) $25,000

C) $15,000

D) $65,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best defines financial statements?

A) Financial statements are the information systems that record monetary and nonmonetary business transactions.

B) Financial statements are the verbal statements made to business news organizations by chief financial officers.

C) Financial statements are business documents that report on a business in monetary terms,providing information to help users make informed business decisions.

D) Financial statements are plans and forecasts for future time periods based on information from past financial periods.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The balance sheet helps analyze the business's performance in terms of profitability.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The left side of the accounting equation always equals the right side of the accounting equation.

B) False

Correct Answer

verified

Correct Answer

verified

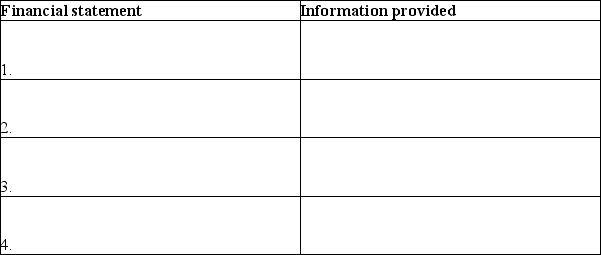

Essay

List the four financial statements and describe the information provided by each.

Correct Answer

verified

Correct Answer

verified

True/False

The Sarbanes-Oxley Act (SOX)requires companies to review internal control and take responsibility for the accuracy and completeness of their financial reports.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A law firm provides legal services for clients who do not pay immediately.As a result of this transaction,assets and revenues increase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will be categorized as a financing activity on the statement of cash flows?

A) Cash received by selling old equipment

B) Cash paid for purchase of new machinery

C) Cash paid for rent

D) Cash contribution by owner

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct order of preparation of financial statements?

A) Income statement → statement of owner's equity → balance sheet → statement of cash flows

B) Statement of owner's equity → balance sheet → income statement → statement of cash flows

C) Balance sheet → statement of owner's equity → income statement → statement of cash flows

D) Balance sheet → income statement → statement of owner's equity → statement of cash flows

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions will affect the balance of Owner,Capital?

A) paid accounts payable

B) paid rent expense for the month

C) purchased land for cash

D) collection on account

F) C) and D)

Correct Answer

verified

Correct Answer

verified

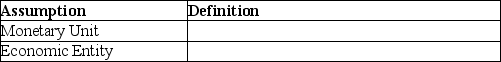

Essay

Provide the definition of each of the following accounting assumptions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Country Homes Company just recorded a transaction in its books.If this transaction increased the total liabilities by $16,000,then ________.

A) assets must increase,or equity must decrease by $16,000

B) either assets or equity must decrease by $16,000

C) both assets and equity must each decrease by $8,000

D) assets must decrease by $16,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the ________,acquired assets should be recorded at the amount actually paid rather than at the estimated market value.

A) going concern assumption

B) economic entity concept

C) cost principle

D) monetary unit assumption

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The statement of owner's equity informs users about changes in the owner's capital account over a period of time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Managerial accounting provides information to ________.

A) internal decision makers

B) outside investors and lenders

C) creditors

D) taxing authorities

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The statement of owner's equity informs users about changes in the owner's capital account over a period of time.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 246

Related Exams