B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measurements would not be affected by the choice of depreciation methods?

A) Debt-to-assets ratio

B) Total assets

C) Total cash flow from investing activities

D) Return-on-equity ratio

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jackson Incorporate purchased a truck for $36,000.The truck had a useful life of 150,000 miles over 4 years and a $6,000 salvage value.Jackson drove the truck 40,000 miles in Year 1 and 24,000 miles in Year 2.If Jackson uses the units-of-production method,what is the accumulated depreciation at the end of Year 2?

A) $4,800

B) $8,000

C) $12,800

D) $16,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Late in a plant asset's useful life,the amount of depreciation that would be recorded with the double-declining-balance method is less than the amount that would be recognized with the straight-line method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

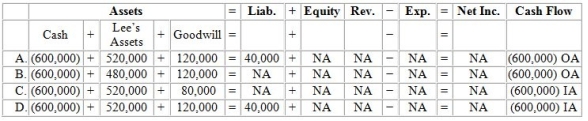

Grant Company acquired Lee Company for $600,000 cash.The fair value of Lee's assets was $520,000,and the company had $40,000 in liabilities.Which of the following choices would reflect the acquisition on elements of Grant's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Eller Company purchased an asset that had cost $24,000.The asset had an 8-year useful life and an estimated salvage value of $1,000.Eller depreciates its assets on the straight-line basis.On January 1,Year 5,the company spent $6,000 to improve the quality of the asset.How does the Year 5 depreciation expense impact the elements of the financial statements?

A) Increase total assets by $4,375

B) Decrease stockholders' equity by $4,375

C) Decrease total assets by $4,625

D) Increase stockholders' equity by $4,625

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method of depreciation is used by most U.S.companies for financial reporting purposes?

A) Straight-line

B) Units-of-production

C) Double-declining-balance

D) MACRS

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Milton Manufacturing Company purchased equipment with a list price of $88,000.A total of $4,000 was paid for installation and testing.During the first year,Milton paid $6,000 for insurance on the equipment and another $2,200 for routine maintenance and repairs.Milton uses the units-of-production method of depreciation.Useful life is estimated at 100,000 units,and estimated salvage value is $8,000.During Year 1,the equipment produced 13,000 units.What is the amount of depreciation for Year 1?

A) $10,920

B) $11,960

C) $11,700

D) $12,740

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Gains and losses are reported as part of operating income on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an asset that has an identifiable useful life?

A) Goodwill

B) Patents

C) Renewable franchises

D) Trademarks

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does the recognition of depletion expense affect the elements of the financial statements?

A) Decreases assets and stockholders' equity and decreases cash flow from investing expenses under the direct approach.

B) Decreases cash flow from operating activities,and does not affect the amount of total assets.

C) Increases assets,equity,and cash flow from operating activities.

D) Decreases assets and equity,and does not affect cash flow.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pierce Corporation,a U.S.business,is a direct competitor of Zeiss Company,a German firm.The two firms not only compete for customers,but also for investment capital.In Year 1,each company spent about $35,000 U.S.dollars or the equivalent on research and development.U.S.GAAP requires the entire amount to be expensed,while Germany requires its businesses to record R&D expenditures as an asset and then to expense it over its useful life.Assuming the treatment of R&D is the only difference between the two firms,which of the following is correct?

A) Pierce will have higher total assets than Zeiss in Year 1.

B) Pierce will have a higher debt-to-assets ratio than Zeiss in Year 1.

C) Zeiss will have a lower net income for Year 1.

D) This difference in accounting principles does not affect the total amount of assets reported by the two companies.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true concerning the modified accelerated cost recovery system (MACRS) for the recognition of depreciation expense,for tax purposes?

A) 7-year property will be depreciated more rapidly than 10-year property under the MACRS depreciation method.

B) Under MACRS more depreciation will be recorded in the second accounting period than in the first accounting period because of the half-year convention.

C) MACRS is used for the determination of depreciation expense that is reported on an income tax return.

D) All of these answer choices are true.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The use of estimates and revision of estimates are uncommon in financial reporting.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Zach Company purchased equipment that cost $50,000.The equipment had a useful life of 5 years and a $10,000 salvage value.Zach Company used the double-declining-balance method to depreciate its assets.What is the accumulated depreciation at the end of Year 2?

A) $10,000

B) $12,000

C) $20,000

D) $32,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chico Company paid $950,000 for a basket purchase that included office furniture,a building and land.An appraiser provided the following estimates of the market values of the assets if they had been purchased separately: Office furniture,$190,000;Building,$740,000;and Land,$132,000.Based on this information,what is the cost that should be allocated to the office furniture? (Round allocation percentage to two decimal places. )

A) $171,000

B) $190,000

C) $316,667

D) $105,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

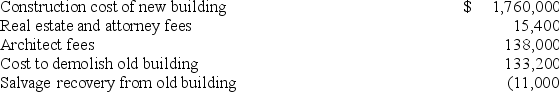

Multiple Choice

On January 6,Year 1,Mount Jackson Corporation purchased a tract of land for a factory site for $1,500,000.An existing building on the site was demolished and the new factory was completed on October 11,Year 1.Additional cost data are shown below:

Which of the following are the capitalized costs of the land and the new building,respectively?

Which of the following are the capitalized costs of the land and the new building,respectively?

A) $1,637,600 and $1,898,000

B) $1,515,400 and $2,020,200

C) $1,648,600 and $1,887,000

D) $1,500,000 and $2,035,600

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of Year 5,the equipment was still owned by Jing Company.What is the book value of the office equipment using the straight-line method and double-declining-balance method,respectively?

A) $12,000 and $1,680.

B) $12,000 and $12,000.

C) $0 and $0.

D) None of these answer choices are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be classified as a tangible asset?

A) Land

B) Goodwill

C) Copyright

D) Trademark

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following general journal entries shows the proper recording of an impairment loss of $15,000 relating to goodwill?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 110

Related Exams