A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On September 1,Year 1,Orville Corporation has unrestricted retained earnings of $600,000,appropriated retained earnings of $400,000,cash of $850,000,and accounts payable of $50,000.What is the maximum amount that can be used for cash dividends?

A) $850,000

B) $600,000

C) $800,000

D) $450,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Establishing a sole proprietorship generally requires the owner to get a charter from the state government.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Chisolm Corporation issued 10,000 shares of $5 par common stock for $22 per share.As a result of this transaction,Chisolm's legal capital increased by $50,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Personal liability is a significant disadvantage of the partnership form of business organization.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Articles of incorporation,prepared by a business that wishes to incorporate,normally include,but are not limited to,the corporation's name and purpose,its location,and provisions for capital stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A partner is responsible for his/her own actions,but not for actions taken by another partner on behalf of the partnership.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Powell Corporation had $10 par stock with a market price of $60,when it declared a 2-for-1 stock split.After the stock split,the number of shares outstanding will double,and the market price of the stock should drop to about $30.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about Treasury Stock is correct?

A) The balance in the Treasury Stock account increases paid-in capital.

B) The balance in the Treasury Stock account reduces paid-in capital.

C) The balance in the Treasury Stock account reduces total Stockholders' Equity.

D) The balance in the Treasury Stock reduces Retained Earnings.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How would the declaration of a cash dividend affect the calculation of a company's price-earnings ratio? (Hint: Do not consider any change in the market price of the stock that might occur because of the declaration of the dividend. )

A) It will have no effect on the price-earnings ratio.

B) The effect depends on the market price of the stock at the time the dividend is declared.

C) It will decrease the price-earnings ratio.

D) It will increase the price-earnings ratio.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

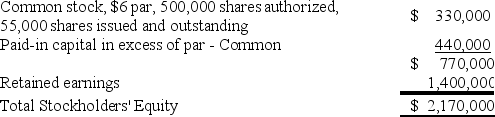

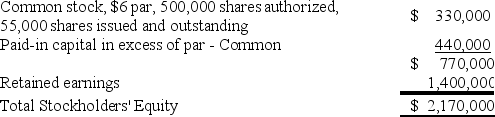

Gilligan Corporation was established on February 15,Year 1.Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock.As of December 31,Year 3,Gilligan's stockholders' equity accounts report the following balances:

At the end of Year 3,Gilligan decides to issue a 5% stock dividend.At the time of issue,the market price of the stock was $22 per share.

-What is the number of shares outstanding after the stock dividend is issued?

At the end of Year 3,Gilligan decides to issue a 5% stock dividend.At the time of issue,the market price of the stock was $22 per share.

-What is the number of shares outstanding after the stock dividend is issued?

A) 57,750

B) 55,000

C) 52,250

D) 525,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following journal entries will be used to record the stock dividend?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A corporation might buy some of its own stock to help keep the market price from falling.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not normally a preference given to the holders of preferred stock?

A) The right to receive a specified amount of dividends prior to any being paid to common stockholders.

B) The right to vote before the common stockholders at the corporation's annual meeting.

C) The right to receive preference over common stockholders as to the distribution of assets during a liquidation process.

D) All of these are preferences given to preferred stock.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The book value of a share of stock is equal to the market or selling price of the stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

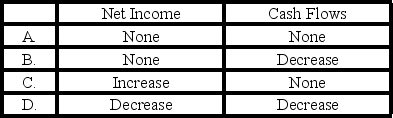

What effect will the declaration and distribution of a stock dividend have on net income and cash flows?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In accordance with restrictive debt covenants,Maynard Company appropriated $20,000 of retained earnings.Which of the following entries would be required to recognize this appropriation?

A) ![]()

B) ![]()

C) ![]()

D) No entry would be required.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gilligan Corporation was established on February 15,Year 1.Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock.As of December 31,Year 3,Gilligan's stockholders' equity accounts report the following balances:

At the end of Year 3,Gilligan decides to issue a 5% stock dividend.At the time of issue,the market price of the stock was $22 per share.

-What is the amount of retained earnings that will be transferred to paid-in capital as a result of the stock dividend issued by Gilligan Corporation?

At the end of Year 3,Gilligan decides to issue a 5% stock dividend.At the time of issue,the market price of the stock was $22 per share.

-What is the amount of retained earnings that will be transferred to paid-in capital as a result of the stock dividend issued by Gilligan Corporation?

A) $60,500

B) $16,500

C) $44,000

D) $108,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Llewelyn Company purchased 1,000 shares of its own $10 par value common stock when the market price of the stock was $36 per share.Which of the following journal entries would be used to record the purchase of treasury stock?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

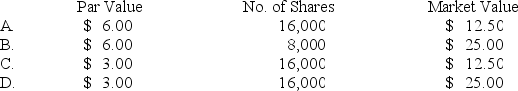

Helena Corporation declared a 2-for-1 stock split on 8,000 shares of $6 par value common stock.If the market price of the stock had been $25 a share before the split,the par value,number of shares,and approximate market value after the split would be:

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 92

Related Exams