A) $15,000

B) $36,500

C) $6,500

D) $21,500

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Amounts withheld from each employee for social security and Medicare vary by state.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year,when a $20,000,90-day,5% interest-bearing note payable matures,total payment will be

A) $21,000

B) $1,000

C) $20,250

D) $250

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee receives an hourly rate of $15,with time and a half for all hours worked in excess of 40 during the week.Payroll data for the first week of the calendar year are as follows: hours worked,46; federal income tax withheld,$110; Social security tax rate,6%; and Medicare tax rate,1.5%; state unemployment compensation tax,3.4% on the first $7,000; federal unemployment compensation tax,0.8% on the first $7,000.What is the net amount to be paid to the employee? If required,round your answers to the nearest cent.

A) $569.87

B) $539.00

C) $625.00

D) $544.88

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

For proper matching of revenues and expenses,the estimated cost of fringe benefits must be recognized as an expense of the period during which the employee earns the benefits.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Kelly Howard has the following transactions.Prepare the journal entries.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Proper payroll accounting methods are important for a business for all the reasons below except

A) good employee morale requires timely and accurate payroll payments

B) payroll is subject to various federal and state regulations

C) to help a business with cash flow problems by delayed payments of payroll taxes to federal and state agencies

D) payroll and related payroll taxes have a significant effect on the net income of most businesses

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following key (a-d) to identify the proper treatment of each contingent liability. -Event is reasonably possible but amount is not estimable

A) Record only

B) Record and disclose

C) Disclose only

D) Do not record or disclose

![]()

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An installment note is a debt that requires the borrower to make equal periodic payments to the lender for the term of the note.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company borrows money from a bank as an installment note,the interest portion of each annual payment will

A) equal the interest rate on the note times the carrying amount of the note at the beginning of the period

B) remain constant over the term of the note

C) equal the interest rate on the note times the face amount

D) increase over the term of the note

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year,the interest charged by the bank,at the rate of 6%,on a 90-day,discounted note payable of $100,000 is

A) $6,000

B) $1,500

C) $500

D) $3,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An interest-bearing note is a loan in which the lender deducts interest from the amount loaned before the money is advanced to the borrower.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Salaries Payable would be recorded in the amount of

A) $8,200

B) $6,830

C) $8,630

D) $7,450

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Payroll taxes are based on the employee's net pay.

B) False

Correct Answer

verified

Correct Answer

verified

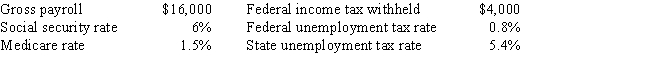

Multiple Choice

Lee Company has the following information for the pay period of December 15-31:

Assuming no employees are subject to ceilings for taxes on their earnings,Salaries Payable would be recorded for

Assuming no employees are subject to ceilings for taxes on their earnings,Salaries Payable would be recorded for

A) $16,000

B) $9,808

C) $10,800

D) $11,040

F) B) and C)

Correct Answer

verified

Correct Answer

verified

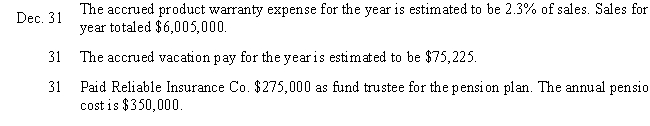

Essay

Journalize the following transactions for Riley Corporation:

Correct Answer

verified

Correct Answer

verified

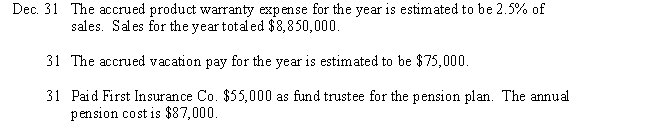

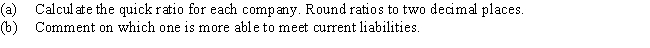

Essay

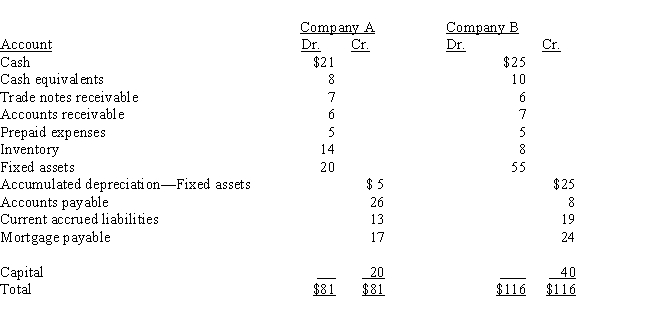

For Company A and Company B:

Correct Answer

verified

Correct Answer

verified

True/False

In a defined benefits plan,the employer bears the investment risks in funding a future retirement income benefit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

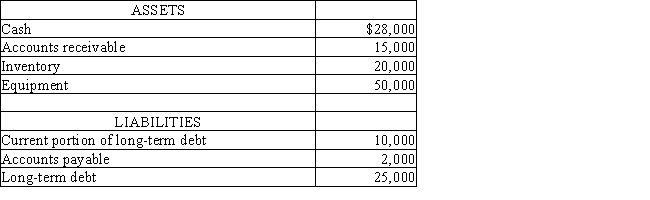

The Crafter Company has the following assets and liabilities:

Determine the quick ratio (rounded to one decimal point) .

Determine the quick ratio (rounded to one decimal point) .

A) 5.3

B) 3.6

C) 3.3

D) 2.3

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current liabilities are due

A) but not receivable for more than one year

B) but not payable for more than one year

C) and receivable within one year

D) and payable within one year

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 188

Related Exams