B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The labor rate variance is

A) $4,920 unfavorable

B) $4,920 favorable

C) $4,560 favorable

D) $4,560 unfavorable

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Nonfinancial performance output measures are used to improve the input measures.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

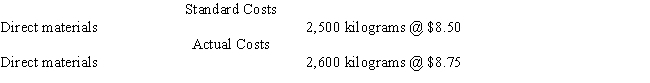

The standard costs and actual costs for direct materials for the manufacture of 2,500 actual units of product are

The amount of the direct materials quantity variance is

The amount of the direct materials quantity variance is

A) $875 favorable variance

B) $850 unfavorable variance

C) $850 favorable variance

D) $875 unfavorable variance

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the fiscal year,variances from standard costs are usually transferred to the

A) direct labor account

B) factory overhead account

C) cost of goods sold account

D) direct materials account

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Volume variance measures the use of fixed factory overhead resources.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Variances from standard costs are reported to

A) suppliers

B) stockholders

C) management

D) creditors

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Accounting systems that use standards for product costs are called standard cost systems.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A favorable cost variance occurs when

A) actual costs are more than standard costs

B) standard costs are more than actual costs

C) standard costs are less than actual costs

D) actual costs are the same as standard costs

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

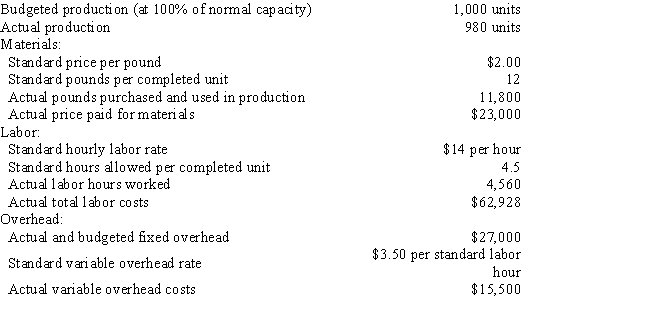

What is the amount of the variable factory overhead controllable variance?

A) $10,000 favorable

B) $2,500 unfavorable

C) $10,000 unfavorable

D) $2,500 favorable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The formula to compute the direct labor rate variance is to calculate the difference between

A) Actual costs + (Actual hours × Standard rate)

B) Actual costs - Standard cost

C) (Actual hours × Standard rate) - Standard costs

D) Actual costs - (Actual hours × Standard rate)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculate the total direct materials cost variance.

A) $9,262.50 unfavorable

B) $9,262.50 favorable

C) $3,780.00 unfavorable

D) $3,562.50 favorable

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The principle of exceptions allows managers to focus on correcting variances between

A) standard costs and actual costs

B) variable costs and actual costs

C) competitor's costs and actual costs

D) competitor's costs and standard costs

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Incurring actual indirect factory wages in excess of budgeted amounts for actual production results in a

A) quantity variance

B) controllable variance

C) volume variance

D) rate variance

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A negative fixed overhead volume variance can be caused due to the following except

A) sales orders at a low level

B) machine breakdowns

C) employee inexperience

D) increase in utility costs

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Non-financial measures are often linked to the inputs or outputs of an activity or process.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard costs are used in companies for a variety of reasons.Which of the following is not one of the benefits for using standard costs?

A) used to indicate where changes in technology and machinery need to be made

B) used to estimate cost of inventory

C) used to plan direct materials,direct labor,and variable factory overhead

D) used to control costs

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following data is given for the Bahia Company:

Overhead is applied on standard labor hours.

The fixed factory overhead volume variance is

Overhead is applied on standard labor hours.

The fixed factory overhead volume variance is

A) $65 unfavorable

B) $65favorable

C) $540 unfavorable

D) $540 favorable

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The formula to the compute direct labor time variance is to calculate the difference between

A) Actual costs - Standard costs

B) Actual costs + Standard costs

C) (Actual hours × Standard rate) - Standard costs

D) Actual costs - (Actual hours × Standard rate)

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Though favorable fixed factory overhead volume variances are usually good news,if inventory levels are too high,additional production could be harmful.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 130

Related Exams