A) Journal entries

B) Adjusting journal entries

C) Closing journal entries

E) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

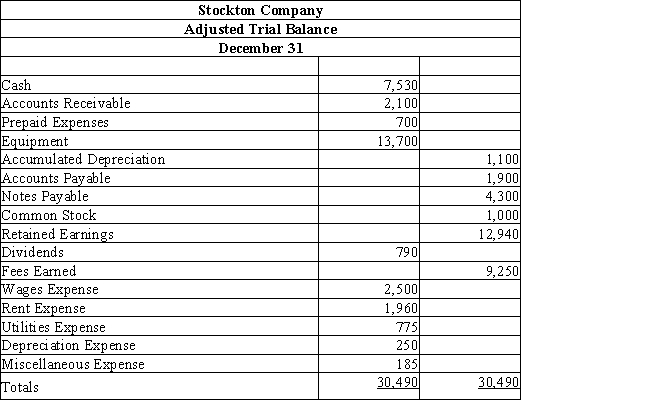

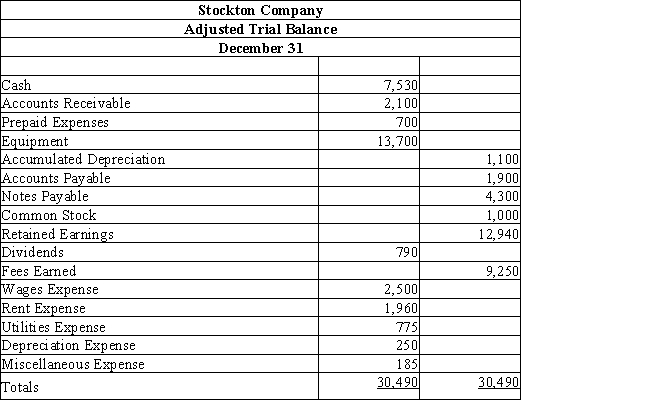

Use the adjusted trial balance for Stockton Company below to answer the questions that follow.

-Determine the total liabilities for the period.

-Determine the total liabilities for the period.

A) $1,900

B) $6,200

C) $4,300

D) $20,240

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the end-of-period processing, which of the following best describes the logical order of steps?

A) preparation of adjustments, adjusted trial balance, financial statements

B) preparation of income statement, adjusted trial balance, balance sheet

C) preparation of adjusted trial balance, cross-referencing, journalizing

D) preparation of adjustments, adjusted trial balance, posting

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An end-of-period spreadsheet heading is dated for a period of time.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

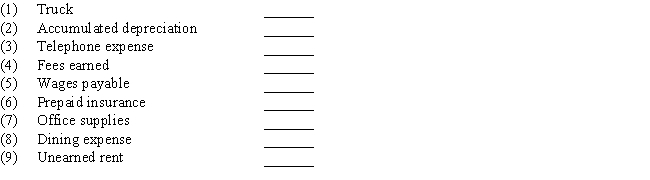

Indicate whether each of the following would be reported in the financial statements as a (a) current asset, (b) property, plant, and equipment, (c) current liability, (d) revenue, or (e) expense:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following accounts were taken from the Adjusted Trial Balance columns of the end-of-period spreadsheet:  Net income for the period is

Net income for the period is

A) $5,500

B) $11,900

C) $17,400

D) $8,700

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The income summary account is closed to the retained earnings account.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Entries required to close the balances of the temporary accounts at the end of the period are called final entries.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The majority of businesses end their fiscal year on December 31.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each journal entry that follows as one of the types of journal entries (a-c) below. -Utilities Expense 430 Cash 430

A) Journal entries

B) Adjusting journal entries

C) Closing journal entries

E) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

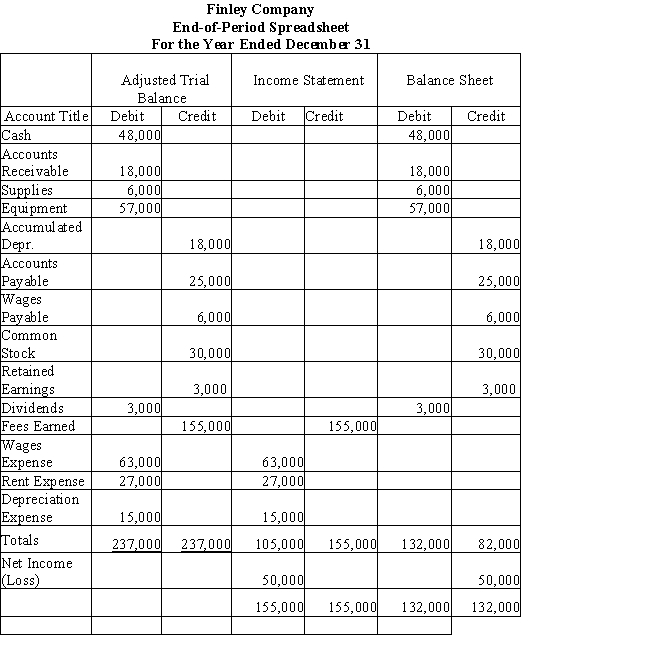

Use this end-of-period spreadsheet to answer the questions that follow.

-The entry to close the dividends account would be

-The entry to close the dividends account would be

A) debit Retained Earnings, $3,000; credit Dividends, $3,000

B) debit Retained Earnings, $12,000; credit Dividends, $12,000

C) debit Dividends, $3,000; credit Retained Earnings, $3,000

D) debit Dividends, $12,000; credit Retained Earnings, $12,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the totals of the Income Statement Debit and Credit columns of an end-of-period spreadsheet are $27,000 and $29,000, respectively, after all account balances have been extended, the amount of the net loss is $2,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the accounts below would not appear in the balance sheet columns of the end-of-period spreadsheet?

A) Common Stock

B) Service Revenue

C) Unearned Revenue

D) Cash

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each journal entry that follows as one of the types of journal entries (a-c) below. -Cash 450 Fees Earned 450

A) Journal entries

B) Adjusting journal entries

C) Closing journal entries

E) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts will be closed to the retained earnings account at the end of the fiscal year?

A) Rent Expense

B) Fees Earned

C) Income Summary

D) Depreciation Expense

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance sheet should be prepared

A) before the income statement and the retained earnings statement

B) before the income statement and after the retained earnings statement

C) after the income statement and the retained earnings statement

D) after the income statement and before the retained earnings statement

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an essential part of the accounting records?

A) the journal

B) the ledger

C) the chart of accounts

D) the end-of-period spreadsheet

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the adjusted trial balance for Stockton Company below to answer the questions that follow.

-Determine the net income (loss) for the period.

-Determine the net income (loss) for the period.

A) net income $9,250

B) net loss $790

C) net loss $5,670

D) net income $3,580

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Journalizing and posting closing entries must be completed before financial statements can be prepared.

B) False

Correct Answer

verified

Correct Answer

verified

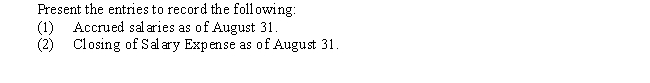

Essay

Prior to adjustment at August 31, Salary Expense has a debit balance of $298,500. Salaries owed but not paid as of the same date total $4,200.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 213

Related Exams