A) depreciation expense

B) gain on sale of land

C) a loss on the sale of equipment

D) dividends declared and paid

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be added to net income in calculating net cash flow from operating activities using the indirect method?

A) a gain on the sale of land

B) a decrease in accounts payable

C) an increase in accrued expenses

D) dividends paid on common stock

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If 800 shares of $40 par common stock are sold for $43,000, the $43,000 would be reported in the cash flows from financing activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current period statement of cash flows includes the following: The cash balance at the end of the period is

A) $45,000

B) $635,000

C) $355,000

D) $125,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows, a $7,500 gain on the sale of fixed assets would be

A) added to net income in converting the net income reported on the income statement to cash flows from operating activities

B) deducted from net income in converting the net income reported on the income statement to cash flows from operating activities

C) added to dividends declared in converting the dividends declared to the cash flows from financing activities related to dividends

D) deducted from dividends declared in converting the dividends declared to the cash flows from financing activities related to dividends

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be deducted from net income in calculating net cash flow from operating activities using the indirect method?

A) a decrease in inventory

B) a decrease in accounts payable

C) preferred dividends declared and paid

D) a decrease in accounts receivable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Equipment with an original cost of $75,000 and accumulated depreciation of $20,000 was sold at a loss of $7,000. As a result of this transaction, cash would

A) increase by $48,000

B) decrease by $7,000

C) increase by $55,000

D) decrease by $27,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

The board of directors of Kendall Co. declared cash dividends totaling $390,000 during the current year. The comparative balance sheet indicates dividends payable of $58,000 at the beginning of the year and $73,000 at the end of the year. What was the amount of cash payments Kendall Co. made to stockholders during the year?

Correct Answer

verified

Correct Answer

verified

Essay

Samuel Company's accumulated depreciation-equipment increased by $6,000, while patents decreased by $2,200 between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a loss of $3,200 from the sale of investments. Assume no changes in noncash current assets and liabilities. Reconcile a net income of $92,000 to net cash flow from operating activities.

Correct Answer

verified

Correct Answer

verified

Essay

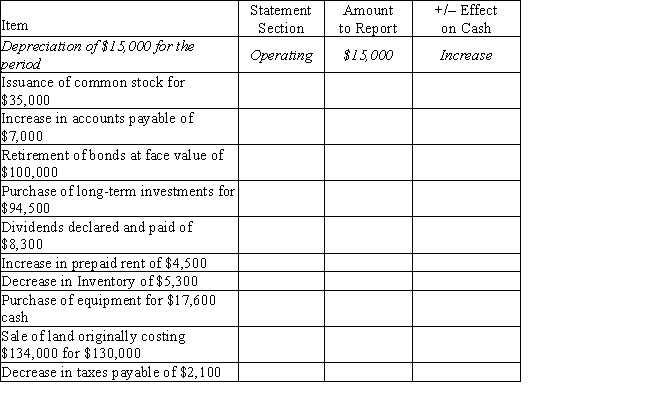

Complete each of the columns on the table below, indicating in which section each item would be reported on the statement of cash flows (operating, investing, or financing), the amount that would be reported, and whether the item would create an increase or decrease in cash. For item that affect more than one section of the statement, indicate all affected. Assume the indirect method of reporting cash flows from operating activities.

The first item has been completed as an example.

Correct Answer

verified

Correct Answer

verified

Essay

State the section(s) of the statement of cash flows prepared by the indirect method (operating activities, investing activities, financing activities, or not reported) and the amount that would be reported for each of the following transactions: (a) Received from the sale of land costing (b) Purchased investments for (c) Declared cash dividends on stock. dividends were payable at the beginning of the year, and were payable at the end of the year (d) Acquired equipment for cash (e) Declared and issued 100 shares of par common stock as a stock dividend, when the market price of the stock was a share (f) Recognized depreciation for the year, (g) Issued 85,000 shares of par common stock for a share, receiving cash (h) Issued of 20 -year, bonds payable at 99 (i) Borrowed from Regional Bank, issuing a 5 -year, note for that amount A)Operating activities B)Financing activities C)Investing activities D)Schedule of noncash financing and investing

Correct Answer

verified

Correct Answer

verified

Essay

Dorman Company reported the following data: Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be classified as an operating activity?

A) payment of accrued interest expense

B) payment of accrued income taxes

C) payment of dividends

D) payment of accrued selling expenses

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

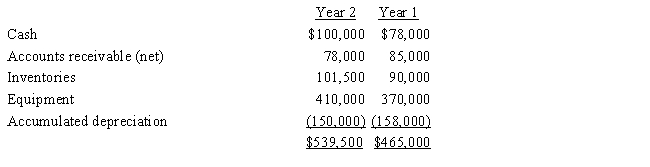

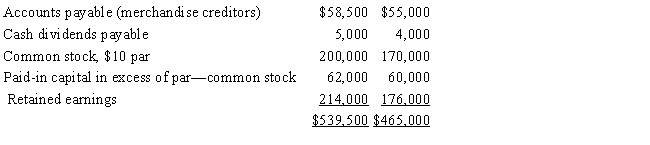

The following data for Larson Co. for the year ending December 31, Year 2, and the preceding year ended December 31, Year 1, are available:

In addition to the balance sheet data, assume that:

• Equipment costing $125,000 was purchased for cash.

• Equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000.

• The stock was issued for cash.

• The only entries in the retained earnings account were net income of $51,000 and cash dividends declared of $13,000.

What are the net cash flows from operating, investing, and financing activities for Year 2?

In addition to the balance sheet data, assume that:

• Equipment costing $125,000 was purchased for cash.

• Equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000.

• The stock was issued for cash.

• The only entries in the retained earnings account were net income of $51,000 and cash dividends declared of $13,000.

What are the net cash flows from operating, investing, and financing activities for Year 2?

A) operating: $112,000; investing: $110,000; financing: $20,000

B) operating: $112,000; investing: ($110,000) ; financing: $20,000

C) operating: $61,000; investing: ($110,000) ; financing: $71,000

D) operating: $144,000; investing: ($110,000) ; financing: ($12,000)

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If $475,000 of bonds payable are sold at 101, $475,000 would be reported in the cash flows from financing activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following would be added to or deducted from net income in determining net cash flow from operating activities by the indirect method:

Correct Answer

Multiple Choice

The operating cash flow available for company use after purchasing the fixed assets that are necessary to maintain current operations is called the

A) free cash flow

B) modified cash flow

C) PPE cash flow

D) restricted cash flow

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows, the cash flows from operating activities section would include

A) receipts from the issuance of common stock

B) receipts from the sale of investments

C) payments for the acquisition of investments

D) cash receipts from sales of merchandise

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In preparing the statement of cash flows, the correct order of reporting cash activities is financing, operating, and investing.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

Indicate the section in which each of the following would be reported on the statement of cash flows prepared by the indirect method.

Correct Answer

Showing 121 - 140 of 195

Related Exams