B) False

Correct Answer

verified

Correct Answer

verified

True/False

The primary focus of financial statement audits is the discovery of fraud.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In preparing a bank reconciliation, typical adjustments to the book balance include bank service charges, customer NSF checks, and certified checks.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Separation of duties in an organization should be required to reduce the likelihood of theft.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In preparing a bank reconciliation, typical adjustments to the bank balance are deposits in transit and outstanding checks.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Preparing a bank reconciliation is a requirement to obtain an unqualified audit opinion, but is not an important internal control for a business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

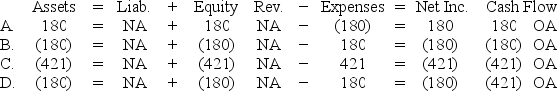

While performing its monthly bank reconciliation, the bookkeeper for the Mosaic Company discovered that a check written for $421 for advertising expense was recorded in the firm's books as $241. Which of the following shows the effect of the correcting entry on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about materiality is not true?

A) Materiality is different for each company.

B) A material error would change the opinion of the average prudent investor.

C) Any error greater than $5,000 is considered material in a financial statement audit.

D) Material misstatements should not exist in order for a company to receive an unqualified audit opinion.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Certified public accountants are obligated to act in a way that serves the public interest.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For which of the following bank reconciliation adjustments would an adjusting journal entry not be necessary?

A) An error in which the company's accountant recorded a check as $235 that was written correctly for $253.

B) A check for $37 deposited during the month, but returned for non-sufficient funds.

C) An error in which the bank charged the company $83 for a check that had been written by another account holder.

D) All of these answer choices would require adjusting journal entries.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The true cash balance can only be determined if both the unadjusted bank balance and the unadjusted cash balance are known.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Which of the following statements concerning internal controls is true?

A) Internal administrative controls are designed to limit the amount of funds spent on investments.

B) Strong internal controls provide reasonable assurance that the objectives of a company will be accomplished.

C) Internal accounting controls are limited to the policies and procedures used to protect the company from embezzlement.

D) The control procedure, separation of duties, prohibits the employment of a husband and wife or other closely related parties within the same company.

F) A) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Rainey Company's true cash balance at October 31 is $5,710. The following information is available for the bank reconciliation: Outstanding checks, $600 Deposits in transit, $450 Bank service charges, $90 The bank had collected an account receivable for Rainey Company, $1,000 The bank statement included an NSF check written by one of Ramsey's customers for $600. Based on this information Rainey's unadjusted book balance at October 31 is:

A) $5,870.

B) $5,400.

C) $6,400.

D) $5,490.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Most companies strive to receive an unqualified audit opinion.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The ethical standards for certified public accountants only require that such accountants comply with applicable laws and regulations.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

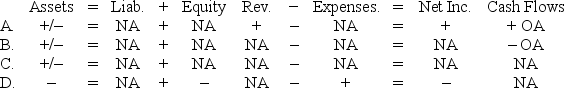

Keatts Company's bank statement included an NSF check written by one of its customers. What effect will the entry to recognize the NSF check have on the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chester Company has established internal control policies and procedures in order to achieve the following objectives: 1) Effective evaluation of management performance. 2) Assure that the accounting records contain reliable information. 3) Safeguard the company's assets. "4) Assure that employees comply with company policy. Which of these objectives are achieved by accounting controls?"

A) Objectives 1 and 2

B) Objectives 2 and 3

C) Objectives 3 and 4

D) All four objectives

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

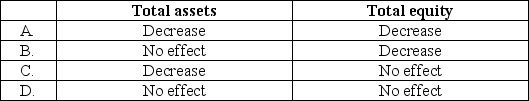

Jasper Company accepted a check from Harp Company as payment for services rendered. Jasper's bank statement revealed that the Harp check was an NSF check. What effect will the entry to record the NSF check have on the accounting equation of Jasper Company?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

After adjusting entries have been made related to a bank reconciliation, the book balance will be equal to the true cash balance.

B) False

Correct Answer

verified

Correct Answer

verified

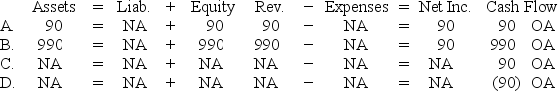

Multiple Choice

While performing its monthly bank reconciliation, the bookkeeper for the Grace Corporation noted that a deposit of $990 (received from a customer on account) was recorded in the company books as $900. Which of the following shows the effect of the correcting entry on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 79

Related Exams