A) All three companies have equal holding costs

B) Company X

C) Company Y

D) Company Z

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Warner Company purchased two units of a product for $36 and later purchased one more for $40.If the company uses the weighted average cost flow method,and it sold one unit of the product for $60,its gross margin would be $22.00.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Generally accepted accounting principles restrict or limit a company's freedom to change inventory cost flow methods from one year to the next.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barker Company paid cash to purchase two identical inventory items.The first purchase cost $18.00 cash and the second cost $20.00 cash.Barker sold one inventory item for $30.00 cash.Based on this information alone,without considering the effect of income taxes,which of the following statements is correct?

A) Cash flow from operating activities is $11.00 assuming the weighted-average inventory cost flow method is used.

B) Cash flow from operating activities is $12.00 assuming the FIFO inventory cost flow method is used.

C) Cash flow from operating activities is $10.00 assuming the LIFO inventory cost flow method is used.

D) The amount of cash flow from operating activities is not affected by the inventory cost flow method chosen.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taylor Co.had beginning inventory of $400 and ending inventory of $600.Taylor Co.had cost of goods sold amounting to $1,800.What is the amount of inventory that was purchased during the period?

A) $1,600

B) $2,800

C) $2,000

D) $2,400

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In a period of rising inventory prices,use of the FIFO cost flow method would cause a company to pay more income taxes than would use of LIFO.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a company applies the lower-of-cost-or-market rule to the entire stock of inventory in the aggregate,its write-down of inventory is likely to be greater than if it applies the rule to individual items of inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following methods of applying the lower-of-cost-or-market rule will result in the fewest number of inventory write-downs?

A) Each individual inventory item

B) Average of cost of goods sold for the past three years

C) Major classes or categories of inventory

D) The entire stock of inventory in the aggregate

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

During a period of declining prices,a company would report a lower gross margin using the FIFO cost flow method than with LIFO.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the cost of purchasing inventory is declining,which inventory cost flow method will produce the highest amount of cost of goods sold?

A) Weighted-average

B) LIFO

C) FIFO

D) LIFO, FIFO, and weighted-average will all produce the same amount of cost of goods sold.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Misty Mountain Outfitters is a merchandiser of specialized fly fishing gear.Its cost of goods sold for Year 2 was $295,000,and sales were $690,000.The amount of merchandise on hand was $50,000,and total assets amounted to $585,000.What is the average number of days to sell inventory? (Round to the nearest day.)

A) 26 days

B) 62 days

C) 31 days

D) 40 days

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The lower-of-cost-or-market rule can be applied to which of the following?

A) Major classes or categories of inventory

B) The entire stock of inventory in the aggregate

C) Each individual inventory item

D) All of these answer choices are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

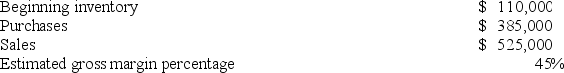

When preparing its quarterly financial statements,Pace Co.uses the gross margin method to estimate ending inventory.The following information is available for the quarter ending March 31,Year 2:

What is the estimated amount of inventory that is on hand on March 31,Year 2?

What is the estimated amount of inventory that is on hand on March 31,Year 2?

A) $236,250

B) $288,750

C) $206,250

D) $258,750

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What happens when a company is operating in an inflationary environment?

A) The company's net income will be higher if it uses LIFO than if it uses FIFO.

B) The company's cost of goods sold will be lower if it uses LIFO as opposed to FIFO.

C) The company's net income will be the same regardless of whether LIFO or FIFO is used.

D) The company's assets will be lower if it uses LIFO as opposed to FIFO cost flow.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] The inventory records for Radford Co. reflected the following: -What is the amount of gross margin assuming the FIFO cost flow method?

A) $2,920

B) $3,420

C) $3,000

D) $4,020

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following circumstances would be a valid reason to estimate the amount of inventory that is on hand at the end of the period?

A) To complete the company's annual income tax return

B) To avoid taking a physical count of inventory

C) To test for financial statement manipulation

D) All of the answer choices are valid reasons for estimating the ending inventory.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Poole Company purchased two identical inventory items.One of the items,purchased in January,cost $4.50.The other,purchased in February,cost $4.75.One of the items was sold in March at a selling price of $7.50.Poole uses LIFO.Which of the following statements is true?

A) The balance in ending inventory would be $4.75.

B) The amount of gross margin would be $2.75.

C) The amount of ending inventory would be $4.625.

D) The amount of cost of goods sold would be $4.50.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The last-in,first-out cost flow method assigns the cost of the items purchased first to ending inventory.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

During a period of rising inventory prices,the amount of ending inventory reported on the balance sheet will be lower using the LIFO cost flow method than with FIFO.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Internal Revenue Service allows a company to use LIFO for income tax purposes only if it also uses LIFO for financial reporting.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 84

Related Exams