A) $128,500

B) $160,000

C) $90,000

D) $76,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

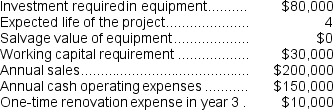

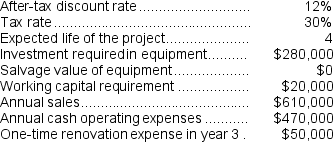

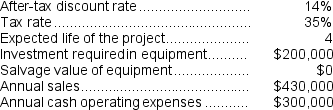

Galati Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation.The depreciation expense will be $20,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 30% and the after-tax discount rate is 8%.

Required:

Determine the net present value of the project.Show your work!

The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation.The depreciation expense will be $20,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 30% and the after-tax discount rate is 8%.

Required:

Determine the net present value of the project.Show your work!

Correct Answer

verified

Correct Answer

verified

Essay

Shanks Corporation is considering a capital budgeting project that involves investing $600,000 in equipment that would have a useful life of 3 years and zero salvage value.The company would also need to invest $20,000 immediately in working capital which would be released for use elsewhere at the end of the project in 3 years.The net annual operating cash inflow,which is the difference between the incremental sales revenue and incremental cash operating expenses,would be $300,000 per year.The project would require a one-time renovation expense of $60,000 at the end of year 2.The company uses straight-line depreciation and the depreciation expense on the equipment would be $200,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35%.The after-tax discount rate is 15%. Required: Determine the net present value of the project.Show your work!

Correct Answer

verified

Correct Answer

verified

Multiple Choice

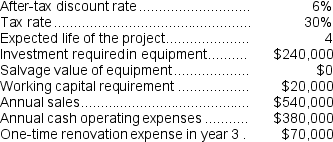

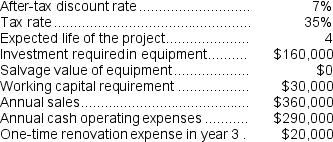

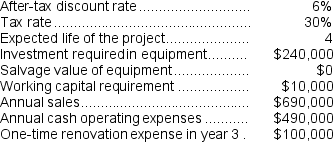

(Appendix 13C) Vanzant Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A) $30,000

B) $21,000

C) $9,000

D) $48,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13C) Hinger Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $350,000 and annual incremental cash operating expenses would be $250,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $40,000 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 11%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. -The total cash flow net of income taxes in year 2 is:

A) $49,500

B) $100,000

C) $75,500

D) $70,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

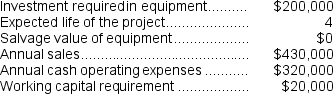

(Appendix 13C) Reye Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

A) $60,000

B) $110,000

C) $18,000

D) $92,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Patenaude Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $230,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $230,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Correct Answer

verified

Correct Answer

verified

Multiple Choice

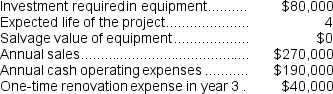

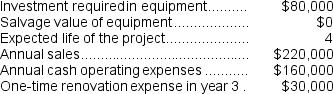

(Appendix 13C) Bourland Corporation is considering a capital budgeting project that would require investing $80,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $250,000 and annual incremental cash operating expenses would be $180,000. The project would also require a one-time renovation cost of $40,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 8%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. -The net present value of the entire project is closest to:

A) $14,590

B) $50,380

C) $70,000

D) $27,310

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

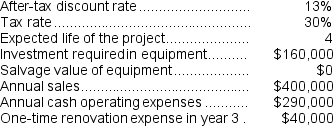

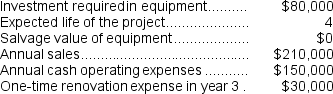

Eison Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment.

The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment.

The income tax expense in year 3 is:

A) $21,000

B) $42,000

C) $15,000

D) $6,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company needs an increase in working capital of $50,000 in a project that will last 4 years.The company's tax rate is 30% and its after-tax discount rate is 8%.The present value of the release of the working capital at the end of the project is closest to:

A) $36,750

B) $15,000

C) $25,726

D) $35,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

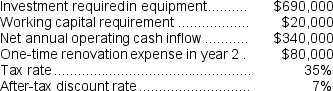

(Appendix 13C) Houze Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A) $23,809

B) $65,000

C) $919

D) $53,660

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13C) Mesko Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A) $71,396

B) $151,396

C) $122,160

D) $130,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13C) Prudencio Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A) $21,000

B) $12,000

C) $9,000

D) $33,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13C) Boynes Corporation is considering a capital budgeting project that would require investing $200,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $490,000 and annual incremental cash operating expenses would be $330,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $70,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 14%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. -The net present value of the entire project is closest to:

A) $259,000

B) $126,876

C) $214,750

D) $132,796

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Income taxes have no effect on whether a capital budgeting project should or should not be accepted in a for-profit company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13C) Rollans Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

A) $105,000

B) $17,500

C) $150,500

D) $28,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13C) Lafromboise Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A) $246,590

B) $238,670

C) $322,000

D) $366,920

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marasco Corporation has provided the following information concerning a capital budgeting project:

The income tax rate is 30%.The after-tax discount rate is 13%.The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $20,000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.

The net present value of the project is closest to:

The income tax rate is 30%.The after-tax discount rate is 13%.The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $20,000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.

The net present value of the project is closest to:

A) $91,000

B) $128,199

C) $77,650

D) $48,199

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Appendix 13C) Planas Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

The company's income tax rate is 35% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

A) $14,000

B) $21,000

C) $3,500

D) $10,500

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Dunstan Corporation is considering a capital budgeting project that involves investing $450,000 in equipment that would have a useful life of 3 years and zero salvage value.The company would also need to invest $20,000 immediately in working capital which would be released for use elsewhere at the end of the project in 3 years.The net annual operating cash inflow,which is the difference between the incremental sales revenue and incremental cash operating expenses,would be $220,000 per year.The company uses straight-line depreciation and the depreciation expense on the equipment would be $150,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35%.The after-tax discount rate is 11%. Required: Determine the net present value of the project.Show your work!

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 150

Related Exams