A) Operating projection

B) Receivables schedule

C) Balance sheet

D) Cash budget

E) Compromise policy.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

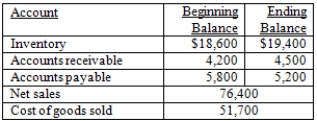

Consider the following financial statement information:  Assume all sales and purchases are on credit.How long is the cash cycle? (Use average balance sheet account balances.)

Assume all sales and purchases are on credit.How long is the cash cycle? (Use average balance sheet account balances.)

A) 80.21 days

B) 116.09 days

C) 101.03 days

D) 113.58 days

E) 73.57 days

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bee's Honey currently has an inventory turnover of 28.6,a payables turnover of 10.8,and a receivables turnover of 14.4.How many days are in the cash cycle?

A) 4.31 days

B) 2.70 days

C) 16.51 days

D) 24.39 days

E) 32.20 days

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Juno's has projected its Q1 sales at $46,000 and its Q2 sales at $48,000.Purchases equal 71 percent of the next quarter's sales.The accounts receivable period is 30 days and the accounts payable period is 45 days.At the beginning of Q1,the accounts receivable balance is $12,200 and the accounts payable balance is $14,800.The firm pays $1,500 a month in cash expenses and $400 a month in taxes.At the beginning Q1,the cash balance is $280 and the short-term loan balance is zero.The firm maintains a minimum cash balance of $250.Assume each month has 30 days.What is the cumulative cash surplus (deficit) at the end of the Q1,prior to any short-term borrowing?

A) $9,210

B) $9,684

C) $8,633

D) $8,880

E) $9,157

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

P&M Industries has projected quarterly sales for the coming year,starting with Quarter 1,of $6,200,$6,500,$6,300,and $6,700,respectively.Sales in the year following this one are projected to be 4 percent greater in each quarter.Assume the company places orders during each quarter equal to 74 percent of projected sales for the next quarter.How much will the firm pay its suppliers in Q3 if the firm has a 30-day payables period?

A) $4,859.33

B) $4,826.67

C) $4,603.18

D) $4,890.22

E) $4,711.46

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Northern Beef has estimated quarterly sales for the coming year,starting with Quarter 1,of $680,$725,$740,and $720,respectively.The accounts receivable balance at the beginning of Q1 is $330 and the collection period is 60 days.How much cash will the firm collect in Q1,Q2,and Q3,respectively?

A) $695.00; $498.03; $730.00

B) $695.00; $466.67; $626.67

C) $556.67; $695.00; $730.00

D) $556.67; $367.33; $626.67

E) $647.33; $626.67; $730.00

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has expected sales for January through April of $9,800,$9,500,$13,800,and $9,500,respectively.Assume each month has 30 days and the accounts receivable period is 38 days.How much does the company expect to collect in the month of May?

A) $10,646.67

B) $15,880.00

C) $9,720.00

D) $12,213.33

E) $15,406.00

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Holiday Tree Farm has a cash balance of $34 and a short-term loan balance of $180 at the beginning of Q1.The net cash inflow for the first quarter is $36 and for the second quarter there is a net cash outflow of $48.All cash shortfalls are funded with short-term debt.The firm pays 2 percent of its prior quarter's ending loan balance as interest each quarter.The minimum cash balance is $20.What is the short-term loan balance at the end of Q2?

A) $184.3

B) $179.2

C) $138.6

D) $128.4

E) $193.1

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is a graphical representation of the operating and cash cycles?

A) Operations line

B) Production period

C) Cash flow time line

D) Inventory flow chart

E) Customer service line

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these is the most indicative of a flexible short-term financial policy?

A) High ratio of short-term debt to long-term debt

B) Relatively small investment in current assets

C) High ratio of current assets to sales

D) Low level of net working capital

E) Relatively low level of liquidity

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will increase the operating cycle?

A) Decreasing the accounts payable period

B) Increasing the accounts payable turnover rate

C) Increasing the cash cycle

D) Decreasing the accounts receivable turnover rate

E) Decreasing the inventory period

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Lumber Yard has projected sales for April through July of $152,400,$161,800,$189,700,and $196,400,respectively.The firm collects 52 percent of its sales in the month of sale,46 percent in the month following the month of sale,and the remainder in the second month following the month of sale.What is the amount of the July collections?

A) $189,819

B) $181,508

C) $122,852

D) $175,500

E) $192,626

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The length of time a retailer owes its supplier for an inventory purchase is called the:

A) inventory period.

B) accounts receivable period.

C) accounts payable period.

D) operating cycle.

E) cash cycle.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ds Hardware's monthly purchases are equal to 72 percent of the following month's sales.The accounts payable period for purchases is 45 days.All other expenses are paid when incurred.Assume each month has 30 days.The company has compiled the following information: What is the projected amount of disbursements for the month of September?

A) $16,910

B) $19,708

C) $19,490

D) $17,356

E) $20,311

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is true?

A) A decrease in the accounts receivable turnover rate decreases the cash cycle.

B) Paying a supplier within the discount period rather than waiting until the end of the normal credit period will decrease the cash cycle.

C) The number of days in the cash cycle can be positive, negative, or equal to zero.

D) An increase in the inventory turnover rate must increase the cash cycle.

E) The payables period must be shorter than the receivables period.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts receivable financing is the term used to describe which one of the following types of loans that involve either the assignment or the factoring of a firm's accounts receivable?

A) Secured short-term loan

B) Unsecured short-term loan

C) Secured long-term loan

D) Unsecured long-term loan

E) Trust receipt loan

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is true?

A) The inventory period increases as the inventory turnover rate increases.

B) The length of the inventory period depends on the length of the cash cycle.

C) The inventory period is the average number of days a firm holds inventory on its shelves.

D) The inventory period is equal to the operating cycle minus the accounts payable period.

E) The inventory period has no effect on the cash cycle.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

BL Motors has sales for the year of $287,400,cost of goods sold equal to 68 percent of sales,and an average inventory of $37,800.The profit margin is 7 percent and the tax rate is 34 percent.How many days on average does it take the firm to sell an inventory item?

A) 75.68 days

B) 81.46 days

C) 70.60 days

D) 78.74 days

E) 82.03 days

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these activities is a source of cash?

A) Decreasing long-term debt

B) Increasing inventory

C) Repurchasing shares of stock

D) Increasing fixed assets

E) Decreasing accounts receivable

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State Street Market currently has 68days in its cash cycle and 115days in its operating cycle.The firm purchases its entire inventory from one supplier.This supplier has offered a 3 percent discount on all purchases if State Street Market will pay in 10 days.If the market opts to take advantage of the discount offered,its new operating cycle will be _____ days and its new cash cycle will be _____ days.

A) 105; 58

B) 105; 95

C) 115; 68

D) 115; 105

E) 113; 95

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 104

Related Exams