A) Total surplus before the tax is imposed is $250.

B) After the tax is imposed,consumer surplus is 45 percent of its pre-tax value.

C) After the tax is imposed,producer surplus is 45 percent of its pre-tax value.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a tax is imposed on sellers,consumer surplus and producer surplus both decrease.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax of $3 per unit is imposed on a good.The supply curve is a typical upward-sloping straight line,and the demand curve is a typical downward-sloping straight line.The tax decreases consumer surplus by $3,900 and decreases producer surplus by $3,000.The tax generates tax revenue of $6,000.The tax decreased the equilibrium quantity of the good from

A) 2,000 to 1,500.

B) 2,400 to 2,000.

C) 2,600 to 2,000.

D) 3,000 to 2,400.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

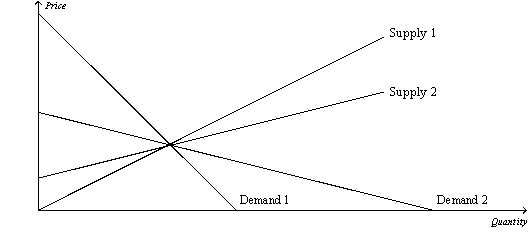

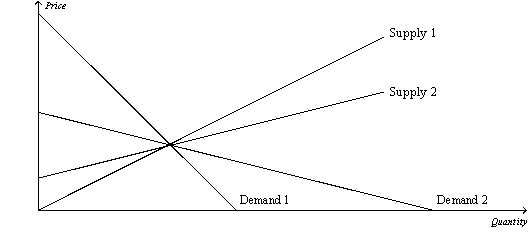

Figure 8-9  -Refer to Figure 8-9.Which of the following statements is correct?

-Refer to Figure 8-9.Which of the following statements is correct?

A) Supply 1 is more elastic than supply 2.

B) Demand 2 is more elastic than demand 1.

C) Demand 1 is more elastic than supply 1.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

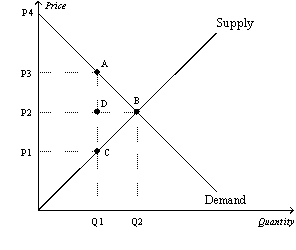

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3.The equilibrium price before the tax is imposed is

-Refer to Figure 8-3.The equilibrium price before the tax is imposed is

A) P1.

B) P2.

C) P3.

D) P4.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deadweight loss is the

A) decline in total surplus that results from a tax.

B) decline in government revenue when taxes are reduced in a market.

C) decline in consumer surplus when a tax is placed on buyers.

D) loss of profits to business firms when a tax is imposed.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diana is a personal trainer whose client Charles pays $80 per hour-long session.Charles values this service at $100 per hour,while the opportunity cost of Diana's time is $75 per hour.The government places a tax of $10 per hour on personal trainers.After the tax,what is likely to happen in the market for personal training?

A) Diana and Charles will agree to a new price somewhere between $85 and $100.

B) Diana and Charles will agree to a new price somewhere between $70 and $110.

C) Diana will no longer offer personal training services to Charles because she must charge more than $100 in order to cover her opportunity costs and pay the tax.

D) The price will remain at $80,and Diana will pay the $10 tax.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-9  -Refer to Figure 8-9.Which of the following combinations will minimize the deadweight loss from a tax?

-Refer to Figure 8-9.Which of the following combinations will minimize the deadweight loss from a tax?

A) supply 1 and demand 1

B) supply 2 and demand 2

C) supply 1 and demand 2

D) supply 2 and demand 1

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ideas is the most plausible?

A) Reducing a high tax rate is less likely to increase tax revenue than is reducing a low tax rate.

B) Reducing a high tax rate is more likely to increase tax revenue than is reducing a low tax rate.

C) Reducing a high tax rate will have the same effect on tax revenue as reducing a low tax rate.

D) Reducing a tax rate can never increase tax revenue.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on a good

A) raises the price that buyers effectively pay and raises the price that sellers effectively receive.

B) raises the price that buyers effectively pay and lowers the price that sellers effectively receive.

C) lowers the price that buyers effectively pay and raises the price that sellers effectively receive.

D) lowers the price that buyers effectively pay and lowers the price that sellers effectively receive.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss from a tax

A) does not vary in amount when the price elasticity of demand changes.

B) does not vary in amount when the amount of the tax per unit changes.

C) is larger,the larger is the amount of the tax per unit.

D) is smaller,the larger is the amount of the tax per unit.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decrease in the size of a tax is most likely to increase tax revenue in a market with

A) elastic demand and elastic supply.

B) elastic demand and inelastic supply.

C) inelastic demand and elastic supply.

D) inelastic demand and inelastic supply.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the price of a good is measured in dollars,then the size of the deadweight loss that results from taxing that good is measured in

A) units of the good that is being taxed.

B) units of a related good that is not being taxed.

C) dollars.

D) percentage change.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A tax on insulin is likely to cause a very large deadweight loss to society.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on a good,the buyers and sellers of the good share the burden,

A) provided the tax is levied on the sellers.

B) provided the tax is levied on the buyers.

C) provided a portion of the tax is levied on the buyers,with the remaining portion levied on the sellers.

D) regardless of how the tax is levied.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a good is taxed,the burden of the tax

A) falls more heavily on the side of the market that is more elastic.

B) falls more heavily on the side of the market that is more inelastic.

C) falls more heavily on the side of the market that is closer to unit elastic.

D) is distributed independently of relative elasticities of supply and demand.

F) None of the above

Correct Answer

verified

Correct Answer

verified

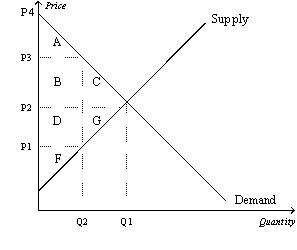

Essay

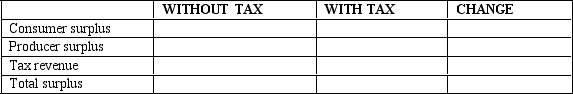

Use the following graph shown to fill in the table that follows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In countries with higher tax rates,people tend to

A) have higher standards of living.

B) take fewer vacations.

C) work less.

D) pay less into Social Security.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Because taxes distort incentives,they cause markets to allocate resources inefficiently.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The elasticities of the supply and demand curves in the market for cigarettes affect how much a tax distorts that market.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 353

Related Exams