A) An investment in a U. S. bond due in two years

B) A one-year certificate of deposit due in six weeks

C) A one-month Treasury bill due in two weeks

D) A promissory note due from a customer in 7 months

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following variations of the accounting equation describes the preparation of the statement of cash flows?

A) Change in cash = Change in (Liabilities + Stockholders' equity - Noncash assets)

B) Change in cash = Change in (Liabilities - Stockholders' equity + Noncash assets)

C) Change in cash = Change in (Liabilities + Stockholders' equity + Noncash assets)

D) Change in cash = Change in (Liabilities - Stockholders' equity - Noncash assets)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A piece of equipment with a cost of $130,000 and accumulated depreciation of $85,000 is sold for $50,000 cash.The amount that should be reported as a cash inflow from investing activities is:

A) $50,000.

B) $5,000.

C) $45,000.

D) $0; this transaction is a financing activity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

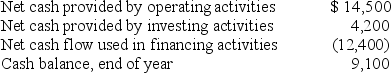

A corporation prepared its statement of cash flows for the year.The following information is taken from that statement:

What is the cash balance at the beginning of the year?

What is the cash balance at the beginning of the year?

A) $5,600

B) $2,800

C) $6,300

D) $15,400

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The approach to preparing the cash flow statement relies on the following rearrangement of the balance sheet equation: Change in cash = Change in (Liabilities + Stockholders' Equity + Noncash Assets).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current year,a company paid $4,500 which it owed from its prior year income tax liability and $30,000 for its current year tax liability.The company still owes $6,000 at the end of the current year.How much should the company report as cash paid for income taxes on its statement of cash flows for the current year?

A) $34,500

B) $40,500

C) $30,000

D) $3,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company uses the indirect method to prepare its statement of cash flows.If Inventory decreases and Unearned Revenue increases during an accounting period,what does the company do with the changes in these accounts to calculate cash flows from operating activities?

A) Both are added to net income.

B) The change in inventory is added to net income; the change in unearned revenue is subtracted.

C) Both are subtracted from net income.

D) The change in unearned revenue is added to net income; the change in inventory is subtracted.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the T-account approach:

A) Net income appears on the debit side of the Cash account under operating activities.

B) Payment of long-term debt appears on the debit side of the Cash account under financing activities.

C) Purchase of equipment appears on the credit side of the Cash account under operating activities.

D) An increase in Accounts Receivable appears on the debit side of the Cash account under operating activities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ABC Company issued 30,000 shares of common stock in January.In August,the company repurchased 5,000 shares for the treasury.When reporting these transactions in the statement of cash flows,ABC Company ______ combine them into one transaction in the ______ activities section.

A) can; financing

B) cannot; financing

C) cannot; investing

D) can; investing

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the direct method is used to prepare the operating activities section of the statement of cash flows.Why is a decrease in Accounts Receivable decrease added to sales revenue when computing cash collected from customers?

A) There were more cash sales than credit sales during the year.

B) There were more collections of Accounts Receivable than sales on account during the year.

C) There were more credit sales than cash sales during the year.

D) There were more sales on account than collections of Accounts Receivable during the year.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The Accumulated Depreciation account includes cash flows that may be categorized as both operating and investing.

B) Inventory includes cash flows that may be categorized as both operating and investing.

C) Retained Earnings includes cash flows that may be categorized as both operating and investing.

D) Bonds Payable includes cash flows that may be categorized as both operating and financing.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows explains the difference between the beginning and ending balances of cash and cash equivalents.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When preparing the operating activities section of the statement of cash flows using the indirect method,an increase in Income Taxes Payable is added to net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Accrual-based net income can be manipulated because it is based on estimates.

B) Cash flows are easily manipulated because they are based on estimates.

C) Accrual-based net income is not easily manipulated because valuation for such items as bad debts and inventory are precise and based on objectively verifiable information.

D) Cash flows are not easily manipulated because they are generated by internal transactions and do not involve external parties.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Investing activities include receiving cash from the sale of land and also the resulting gain or loss on the sale.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the direct method is used to determine the cash flows from operating activities,which of the following adjustments must be made to interest expense to determine total interest payments?

A) Add all changes in Interest Payable

B) Add decreases in Interest Payable and subtract increases in Interest Payable

C) Add increases in Interest Payable and subtract decreases in Interest Payable

D) Subtract all changes in Interest Payable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Treasury stock purchases made with cash are classified as cash outflows from financing activities on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the direct method is used to prepare the operating activities section of the statement of cash flows.Which related balance sheet account will explain the difference between revenues on the income statement and cash collected from customers?

A) Inventory

B) Accounts Payable

C) Cost of Goods Sold

D) Accounts Receivable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has positive cash flow from investing and financing activities,but negative cash flow from operating activities.The likely result is:

A) investors may not buy the company's stock because the receipt of dividends is unlikely.

B) investors will continue to buy stock since the company's growth prospects are good.

C) Creditors will continue to lend money to the company.

D) Creditors will demand immediate repayment of all outstanding debt.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company uses the direct method to prepare its statement of cash flows.If the company's Accounts Receivable increase during the accounting period,the change in Accounts Receivable is:

A) added to the change in the Cash account to calculate cash collected from customers.

B) subtracted from Sales Revenue to calculate the cash collected from customers.

C) added to Sales Revenue to calculate the cash collected from customers.

D) subtracted from the change in the Cash account to calculate cash collected from customers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 208

Related Exams