A) reported within the body of the statement of cash flows.

B) reported in a supplementary schedule to the statement of cash flows.

C) not reported in any part of the financial statement because cash flow is not affected.

D) reported in the body of the income statement.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

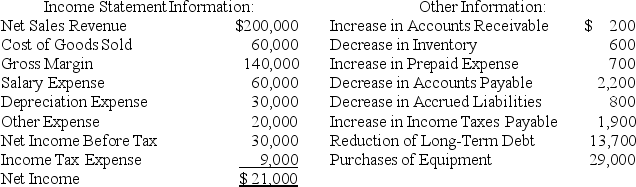

Consider the following information:

Required:

Use the direct method to compute the amount of net cash flows provided by (used in)operating activities.

Required:

Use the direct method to compute the amount of net cash flows provided by (used in)operating activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the direct method is used to prepare the operating activities section of the statement of cash flows.Which of the following statements is correct concerning a decrease in Accounts Payable?

A) Since the cash payments were more than the credit purchases, the decrease must be added to purchases to calculate cash payments to suppliers.

B) Since the cash payments were less than credit purchases, the decrease must be added to purchases to calculate cash payments to suppliers.

C) Since the cash payments were more than credit purchases, the decrease must be subtracted from purchases to cash payments to suppliers.

D) Since the cash payments were less than credit purchases, the decrease must be subtracted from purchases to calculate cash payments to suppliers.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company uses the indirect method to prepare its statement of cash flows.If the Supplies account increases and Salaries and Wages Payable decreases during an accounting period,what does the company do with the changes in these accounts to calculate cash flows from operating activities?

A) Both are added to net income.

B) The change in Salaries and Wages Payable is added to net income; the change in Supplies is subtracted from net income.

C) Both are subtracted from net income.

D) The change in Supplies is added to net income; the change in Salaries and Wages Payable is subtracted from net income.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Using the T-account approach to preparing the statement of cash flows,an increase in Accounts Payable would appear on the debit side of the Cash account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following equations is correct?

A) Change in cash = Change in noncash assets

B) Change in cash = Change in liabilities + Change in stockholders' equity

C) Change in cash = Change in liabilities + Change in stockholders' equity - Change in noncash assets

D) Change cash = Change in liabilities + Change in stockholders' equity + Change in noncash assets

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting records for the Helen Co.show that its cost of goods sold for the year was $600,000.In addition,it had an increase in inventory of $10,000 and a decrease in accounts payable of $12,000.As a result under the direct method,the amount of cash paid to suppliers for the year was:

A) $602,000.

B) $610,000.

C) $612,000.

D) $622,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The direct exchange of debt for equipment would be shown:

A) on the statement of cash flows as an operating activity.

B) on the statement of cash flows as an investing activity.

C) on the statement of cash flows as a financing activity.

D) as a supplementary disclosure to the statement of cash flows.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the calculation of cash flows from operating activities under the direct method is correct?

A) When the direct method is used, each revenue and expense account on the income statement is individually examined to calculate the cash flows from operating activities.

B) Noncash revenues and expenses must be included in cash flows from operating activities when preparing a statement of cash flows using the direct method.

C) Depreciation is reported as a cash inflow in the cash flows from operating activities when the direct method is used.

D) A loss on the sale of a long-term asset is subtracted in the cash flows from operating activities when the direct method is used.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from investing activities include:

A) changes in Accounts Receivable.

B) sale of land.

C) paying principal to lenders.

D) cash dividends paid.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about financing activities is not correct?

A) Cash dividends paid to a company's stockholders are reported as cash outflows from financing activities.

B) When a company issues stock for cash, it reports a cash inflow from financing activities.

C) When a company repurchases stock with cash, it reports a cash outflow for financing activities.

D) When a company repays a loan, it reports a cash inflow from financing activities.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which phrase below best describes the direct method for reporting operating cash flows?

A) A method that incorporates financing and investing activities into cash flows from operations.

B) A method employing accrual-based accounting to convert cash flows to GAAP Net Income.

C) A summary of operating transactions resulting in either a debit or credit to cash.

D) A series of adjustments to Net Income to arrive at operating cash flows.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be included in cash flows from financing activities?

A) Cash proceeds from sales

B) Cash received from a sale of land

C) Cash dividends paid

D) Cash used to purchases of equipment

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Darnell,Inc.'s balance sheet indicated that the cash account increased by $5,400 during the past year.Net cash provided by operating activities was $14,000 and net cash used in investing activities was $6,100.What was the net cash flow effect of the company's financing activities?

A) Net cash provided of $2,500

B) Net cash used of $2,500

C) Net cash used of $14,700

D) Net cash provided of $14,700

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the indirect method is used,details from which of the following balance sheet accounts are used in calculating both operating and financing cash flows?

A) Bonds Payable

B) Taxes Payable

C) Retained Earnings

D) Common Stock

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from investing activities include all of the following except a(n) :

A) purchase of an automobile.

B) sale of a trademark.

C) purchase of stock of another company.

D) issuance of bonds.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

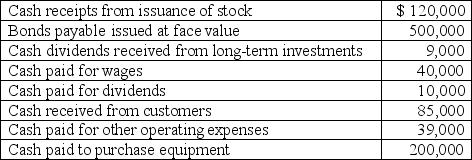

Flynn Corporation had the following cash flows for the current year.The company uses the direct method in preparing the statement of cash flows.

-Use the information above to answer the following question.What is the net cash provided by (used in) investing activities?

-Use the information above to answer the following question.What is the net cash provided by (used in) investing activities?

A) ($200,000)

B) $420,000

C) $410,000

D) ($190,000)

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

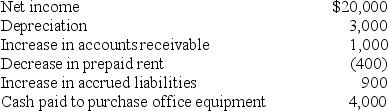

Consider the following information:

What is the net cash provided by operating activities?

What is the net cash provided by operating activities?

A) $17,500

B) $18,500

C) $21,500

D) $23,300

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between net income and cash flow may be due to all of the following except:

A) use of the direct method of presenting cash flows from operating activities.

B) the company being brand new.

C) fraudulent financial reporting.

D) seasonal variations in a company's operating activities.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The starting point for preparing the operating activities section using the indirect method is:

A) current assets.

B) current liabilities.

C) net income.

D) ending cash balance.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 208

Related Exams