B) False

Correct Answer

verified

Correct Answer

verified

True/False

The annual report contains four basic financial statements: the income statement,balance sheet,statement of cash flows,and statement of stockholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The more depreciation a firm has in a given year, the higher its EPS, other things held constant.

B) Typically, a firm's DPS should exceed its EPS.

C) Typically, a firm's EBIT should exceed its EBITDA.

D) If a firm is more profitable than average (e.g., Google) , we would normally expect to see its stock price exceed its book value per share.

E) If a firm is more profitable than most other firms, we would normally expect to see its book value per share exceed its stock price, especially after several years of high inflation.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

EP Enterprises has the following income statement.How much net operating profit after taxes (NOPAT) does the firm have? EBT Taxes $80.00 Net income

A) $81.23

B) $85.50

C) $90.00

D) $94.50

E) $99.23

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be most likely to occur in the year after Congress,in an effort to increase tax revenue,passed legislation that forced companies to depreciate equipment over longer lives? Assume that sales,other operating costs,and tax rates are not affected,and assume that the same depreciation method is used for tax and stockholder reporting purposes.

A) Companies' reported net incomes would decline.

B) Companies' net operating profits after taxes (NOPAT) would decline.

C) Companies' physical stocks of fixed assets would increase.

D) Companies' net cash flows would increase.

E) Companies' cash positions would decline.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

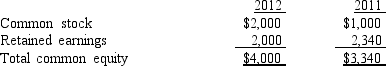

Below is the common equity section (in millions) of Fethe Industries' last two year-end balance sheets:  The company has never paid a dividend to its common stockholders.Which of the following statements is CORRECT?

The company has never paid a dividend to its common stockholders.Which of the following statements is CORRECT?

A) The company's net income in 2011 was higher than in 2012.

B) The company issued common stock in 2012.

C) The market price of the company's stock doubled in 2012.

D) The company had positive net income in both 2011 and 2012, but the company's net income in 2009 was lower than it was in 2011.

E) The company has more equity than debt on its balance sheet.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The maximum federal tax rate on personal income in 2010 was 50%.

B) Since companies can deduct dividends paid but not interest paid, our tax system favors the use of equity financing over debt financing, and this causes companies' debt ratios to be lower than they would be if interest and dividends were both deductible.

C) Interest paid to an individual is counted as income for tax purposes and taxed at the individual's regular tax rate, which in 2010 could go up to 35%, but dividends received were taxed at a maximum rate of 15%.

D) The maximum federal tax rate on corporate income in 2010 was 50%.

E) Corporations obtain capital for use in their operations by borrowing and by raising equity capital, either by selling new common stock or by retaining earnings. The cost of debt capital is the interest paid on the debt, and the cost of the equity is the dividends paid on the stock. Both of these costs are deductible from income when calculating income for tax purposes.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

TSW Inc.had the following data for last year: Net income = $800; Net operating profit after taxes (NOPAT) = $700; Total assets = $3,000; and Total operating capital = $2,000.Information for the just-completed year is as follows: Net income = $1,000; Net operating profit after taxes (NOPAT) = $925; Total assets = $2,600; and Total operating capital = $2,500.How much free cash flow did the firm generate during the just-completed year?

A) $383

B) $425

C) $468

D) $514

E) $566

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items cannot be found on a firm's balance sheet under current liabilities?

A) Accrued payroll taxes.

B) Accounts payable.

C) Short-term notes payable to the bank.

D) Accrued wages.

E) Cost of goods sold.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barnes' Brothers has the following data for the year ending 12/31/12: Net income = $600; Net operating profit after taxes (NOPAT) = $700; Total assets = $2,500; Short-term investments = $200; Stockholders' equity = $1,800; Total debt = $700; and Total operating capital = $2,100.Barnes' weighted average cost of capital is 10%.What is its economic value added (EVA) ?

A) $399.11

B) $420.11

C) $442.23

D) $465.50

E) $490.00

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aubey Aircraft recently announced that its net income increased sharply from the previous year,yet its net cash flow from operations declined.Which of the following could explain this performance?

A) The company's operating income declined.

B) The company's expenditures on fixed assets declined.

C) The company's cost of goods sold increased.

D) The company's depreciation and amortization expenses declined.

E) The company's interest expense increased.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

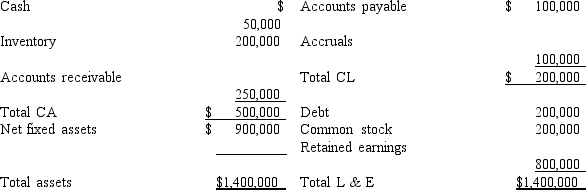

Consider the balance sheet of Wilkes Industries as shown below.Because Wilkes has $800,000 of retained earnings,the company would be able to pay cash to buy an asset with a cost of $200,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies generate income from their "regular" operations and from other sources like interest earned on the securities they hold,which is called non-operating income.Lindley Textiles recently reported $12,500 of sales,$7,250 of operating costs other than depreciation,and $1,000 of depreciation.The company had no amortization charges and no non-operating income.It had $8,000 of bonds outstanding that carry a 7.5% interest rate,and its federal-plus-state income tax rate was 40%.How much was Lindley's operating income,or EBIT?

A) $3,462

B) $3,644

C) $3,836

D) $4,038

E) $4,250

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The balance sheet is a financial statement that measures the flow of funds into and out of various accounts over time,while the income statement measures the firm's financial position at a point in time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Tiemann Technologies reported $10,500 of sales,$6,250 of operating costs other than depreciation,and $1,300 of depreciation.The company had no amortization charges,it had $5,000 of bonds that carry a 6.5% interest rate,and its federal-plus-state income tax rate was 35%.This year's data are expected to remain unchanged except for one item,depreciation,which is expected to increase by $750.By how much will net after-tax income change as a result of the change in depreciation? The company uses the same depreciation calculations for tax and stockholder reporting purposes.

A) -0463.13

B) -10487.50

C) -11.88

D) -537.47

E) -564.34

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edwards Electronics recently reported $11,250 of sales,$5,500 of operating costs other than depreciation,and $1,250 of depreciation.The company had no amortization charges,it had $3,500 of bonds that carry a 6.25% interest rate,and its federal-plus-state income tax rate was 35%.How much was its net cash flow?

A) $3,284.75

B) $3,457.63

C) $3,639.61

D) $3,831.17

E) $4,032.81

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In the statement of cash flows, a decrease in accounts receivable is reported as a use of cash.

B) Dividends do not show up in the statement of cash flows because dividends are considered to be a financing activity, not an operating activity.

C) In the statement of cash flows, a decrease in accounts payable is reported as a use of cash.

D) In the statement of cash flows, depreciation charges are reported as a use of cash.

E) In the statement of cash flows, a decrease in inventories is reported as a use of cash.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 77 of 77

Related Exams