A) $125.

B) $250.

C) $375.

D) $500.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The progressive structure of the income-tax system is based on the

A) benefits-received principle.

B) principle of diminishing returns.

C) ability-to-pay principle.

D) principle that "taxes are the price we pay for civilization."

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Deficit spending" refers to a situation where the government

A) spends borrowed funds.

B) collects more tax revenues than it spends.

C) does not need to borrow funds.

D) is spending less than the year before.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal personal income tax

A) has a regressive structure.

B) is actually less progressive than official tax schedules would indicate because of various tax exemptions and deductions.

C) has become extremely progressive as a result of taxpayers' being pushed into higher tax brackets by higher income levels.

D) has experienced substantial increases in rates during the past two years.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the demand for a product is perfectly inelastic and supply is upsloping, a $1 excise tax per unit on suppliers will

A) raise price by $1.

B) not raise price at all.

C) raise price by more than $1.

D) raise price by less than $1.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

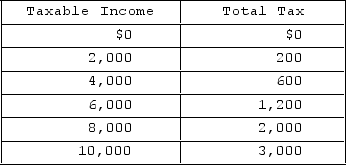

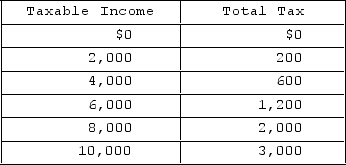

Refer to the personal income tax schedule given in the table. If your taxable income is $4,000, your average tax rate is

Refer to the personal income tax schedule given in the table. If your taxable income is $4,000, your average tax rate is

A) 15 percent; your marginal rate on the last $2,000 is 15 percent.

B) 15 percent; your marginal rate on the last $2,000 is 20 percent.

C) 15 percent; your marginal rate on the last $2,000 cannot be determined from the information given.

D) 20 percent; your marginal rate on the last $2,000 is 15 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The sales tax is a regressive tax because the

A) percentage of income paid as taxes falls as income rises.

B) administrative costs associated with the collection of the tax are relatively high.

C) percentage of income paid as taxes is constant as income rises.

D) tax tends to reduce the total volume of consumption expenditures.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

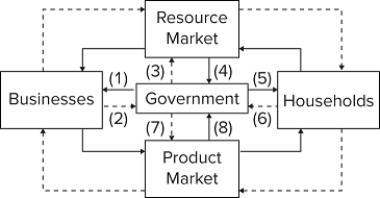

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (1) might represent

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (1) might represent

A) corporate income tax payments.

B) government provision of highways for truck transportation.

C) business property tax payments.

D) transfer payments to low-income families.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For each dollar paid in taxes, approximately how much do households in the top quintile receive back in the form of government expenditures?

A) 12 cents

B) 41 cents

C) 29 cents

D) 71 cents

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most economists believe that property taxes

A) should be eliminated.

B) are progressive.

C) are regressive.

D) should become an important source of revenue for the federal government.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the personal income tax schedule given in the table. If your taxable income is $8,000, your average tax rate is

Refer to the personal income tax schedule given in the table. If your taxable income is $8,000, your average tax rate is

A) 25 percent; your marginal rate on the last $2,000 is 25 percent.

B) 25 percent; your marginal rate on the last $2,000 is 40 percent.

C) 25 percent; your marginal rate on the last $2,000 cannot be determined from the information given.

D) 20 percent; your marginal rate on the last $2,000 is 30 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The basic source of state government's revenue is the property tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The main difference between sales and excise taxes is that

A) sales taxes apply to a wide range of products, while excise taxes apply only to a select group of products.

B) excise taxes apply to a wide range of products, while sales taxes apply only to a select list of products.

C) sales taxes are consumption taxes, while excise taxes are not.

D) excise taxes are consumption taxes, while sales taxes are not.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the demand for automobile tires is highly elastic and that the supply is highly inelastic. The burden of a $2 excise tax on each tire will be

A) borne by resource suppliers that provide the inputs for manufacturing tires.

B) shared about equally by buyers and sellers of tires.

C) borne primarily by sellers of tires.

D) borne primarily by buyers of tires.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the Environmental Protection Agency imposes an excise tax on polluting firms. In which of the following situations would we expect the additional costs to be borne most heavily by consumers?

A) Demand is highly elastic and supply is highly inelastic.

B) Demand and supply are both highly elastic.

C) Demand and supply are both highly inelastic.

D) Demand is highly inelastic and supply is highly elastic.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement best describes the overall tax and transfer systems of the United States?

A) Our tax system makes the after-tax distribution of income much more equal than the before-tax distribution.

B) Our tax system does not by itself reallocate income; transfer payments help redistribute income from rich to poor.

C) Although some federal taxes are progressive, this effect is more than offset by the regressivity of state and local taxes, which make the overall system extremely regressive.

D) Recent changes in corporate income taxes and payroll taxes have made our overall tax system more progressive.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

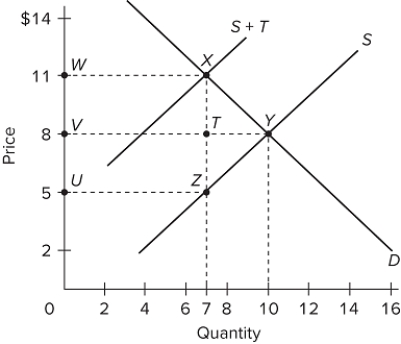

The graph illustrates the market for a product on which an excise tax has been imposed by government. The excise tax on this product as shown in the graph is ultimately paid

The graph illustrates the market for a product on which an excise tax has been imposed by government. The excise tax on this product as shown in the graph is ultimately paid

A) 100 percent by consumers

B) 100 percent by producers

C) 75 percent by consumers and 25 percent by producers

D) 50 percent by consumers and 50 percent by producers

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the supply of a product is perfectly elastic and demand is downsloping, an excise tax of $2 per unit will increase price by

A) more than $2.

B) less than $2.

C) $2 and increase equilibrium output.

D) $2 and reduce equilibrium output.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that government imposes a specific excise tax on product X of $2 per unit and that the price elasticity of demand for X is unitary (coefficient = 1) . If the incidence of the tax is such that consumers pay $0.20 of the tax and the producers pay $1.80, we can conclude that the

A) supply of X is inelastic.

B) supply of X is elastic.

C) supply of X is unitary elastic.

D) demand for X is elastic.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a $0.75 tax is placed on gasoline. Under what circumstances will gasoline sellers end up shouldering the full burden of the tax?

A) if supply is perfectly inelastic and demand is downward-sloping

B) if demand is perfectly inelastic and supply is upward-sloping

C) if supply is upward-sloping and demand is perfectly elastic

D) The consumer and the seller always share the burden of the tax.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 336

Related Exams