A) personal distribution of income to become less equal.

B) personal distribution of income to become more equal.

C) personal distribution of income to be unaffected.

D) functional distribution of income to change in favor of profits and interest.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that there is a supply and demand market for nonpreferred workers. If prejudice against these workers among employers increases, then there will be a(n)

A) increased supply of these workers, a rise in their wage rate, and a decrease in their employment.

B) increased demand for these workers, a rise in their wage rate, and an increase in their employment.

C) decreased supply of these workers, a fall in their wage rate, and a decrease in their employment.

D) decreased demand for these workers, a fall in their wage rate, and a decrease in their employment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The exercise of market power by suppliers in resource markets tends to

A) reduce income inequality, ensuring that all workers receive fair wages.

B) have little impact on the distribution of income.

C) increase income inequality by raising incomes of those able to "rig the market."

D) increase income inequality but is offset by the exercise of market power in product markets.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The lowest quintile of households in the income distribution (as of 2017) receives about

A) 2.4 percent of the total income.

B) 3.1 percent of the total income.

C) 8.2 percent of the total income.

D) 10 percent of the total income.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Universal Basic Income (UBI) , if implemented, would

A) guarantee a job to every able-bodied citizen.

B) dramatically expand spending in the existing welfare programs.

C) guarantee a minimum monthly income to every citizen.

D) be expected to greatly reduce the size of the Federal government's budget.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2017, the poverty line for a family of four was about

A) $12,488.

B) $30,453.

C) $24,858.

D) $32,753.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Since 1980, the distribution of household income in the United States has

A) moved toward greater inequality.

B) moved toward greater equality.

C) remained about the same.

D) fluctuated considerably.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

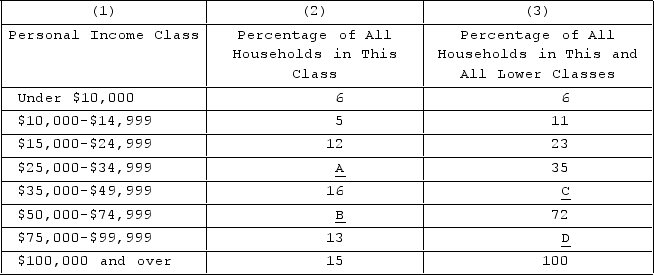

Refer to the table. What percentage should be reported in blank C of column 3?

Refer to the table. What percentage should be reported in blank C of column 3?

A) 6

B) 11

C) 35

D) 51

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Rita obtains 10 units of utility from the last dollar of income received by her, and Joseph obtains 6 units of utility from the last dollar of his income. Assume both Joseph and Rita have the same capacity to derive utility from income. Those who favor an equal distribution of income would

A) advocate redistributing income from Joseph to Rita.

B) advocate redistributing income from Rita to Joseph.

C) be content with this distribution of income between Rita and Joseph.

D) argue that any redistribution of income between them would increase total utility.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S. income-maintenance program consists of two kinds of programs. They are

A) the minimum wage law and Social Security.

B) antidiscrimination law and education and training programs.

C) social insurance and public assistance programs.

D) progressive income taxes and transfer payments.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is not a cash transfer program?

A) TANF

B) Supplemental Security Income (SSI)

C) low-rent public housing

D) Social Security

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The incidence of poverty is very high among the elderly (65 years or older).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the occupational choices of women or minorities are restricted, this results in

A) lower wages for these groups, but has no effect on the efficient allocation of labor resources.

B) lower wages for these groups, but more efficient allocation of labor resources.

C) lower wages for these groups and less efficient allocation of labor resources.

D) higher wages for these groups and more efficient allocation of labor resources.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A major difference between social insurance and welfare is that social insurance

A) exclusively involves older Americans, whereas welfare is confined mainly to mothers with young children.

B) forces recipients to demonstrate need, while welfare does not.

C) is normally financed by earmarked payroll taxes, while welfare is financed out of general tax revenues.

D) provides cash transfers, while welfare does not.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The U.S. poverty rate for the elderly (65 and over)is higher than for the general population.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a cause of growing income inequality in the United States since 1980?

A) exporting to other countries by major U.S. industries

B) industrial restructuring from services to goods production

C) a widening wage gap between skilled and unskilled workers

D) an increase in the progressivity of the federal tax system

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Social insurance is distinguished from public assistance, or welfare, by the fact that

A) all social insurance benefits are paid in cash, while all public assistance benefits are paid in kind (food, housing, medical care) .

B) an individual acquires a right to social insurance benefits by meeting objective eligibility criteria, while public assistance benefits are determined according to individual need.

C) the total amount paid in benefits is much larger in the public assistance programs than in the social insurance programs.

D) payroll taxes are used to finance public assistance programs, while general revenues are used to finance social insurance programs.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As applied to gender discrimination, the crowding model of occupational segregation

A) helps explain why women earn more than men.

B) predicts that men's wages would fall and women's wages would rise if occupational segregation was eliminated.

C) predicts that domestic output would decline if occupational segregation was ended.

D) predicts that competition will eventually totally end discrimination.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

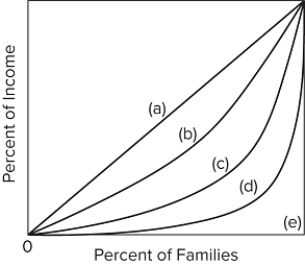

Refer to the diagram, where curves (a) through (e) are for five different countries. The Gini ratio is lowest in country

Refer to the diagram, where curves (a) through (e) are for five different countries. The Gini ratio is lowest in country

A) a.

B) b.

C) c.

D) e.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The Supplemental Nutrition Assistance Program (formerly the food-stamp program)mostly pays out cash-vouchers to eligible households.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 324

Related Exams