A) surplus of $98 billion.

B) surplus of $88 billion.

C) surplus of $99 billion.

D) deficit of $106 billion.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the equilibrium exchange rate changes so that fewer dollars are needed to buy a South Korean won, then

A) Americans will buy fewer Korean goods and services.

B) the won has appreciated in value.

C) fewer U.S. goods and services will be demanded by the South Koreans.

D) the dollar has depreciated in value.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

United States exports, international tourism in the United States, and foreign capital inflow into the United States all give rise to

A) depreciation of the U.S. dollar.

B) a supply of foreign currencies to the United States.

C) a demand for foreign currencies in the United States.

D) decreased foreign-exchange reserves in the United States.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an item in the current account balance of the United States?

A) the purchase of a U.S. company by a foreign company

B) the purchase of stock in a foreign corporation by a U.S. company

C) the purchase of insurance in the United States by a foreign company

D) the purchase of a United States Treasury bond by a wealthy foreigner

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The flow of payments for purchases and sale of financial assets is included in the current account balance of a nation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a European importer can buy $10,000 for 11,100 euros, the exchange rate for the euro is

A) 1 euro = $0.80.

B) 1 euro = $0.90.

C) 1 euro = $0.95.

D) 1 euro = $1.11.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an American can purchase 30,000 British pounds for $105,000, the dollar rate of exchange for the pound is

A) $3.50.

B) $3.00.

C) $0.29.

D) $0.13.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is not a serious disadvantage associated with freely fluctuating exchange rates?

A) uncertainty which tends to diminish trade

B) greater instability in unemployment levels

C) longer lags in eliminating balance of payments surpluses or deficits

D) swings in the terms of trade related to currency appreciation or depreciation

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Fixed exchange rates usually provide more certainty to those engaged in international trade.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

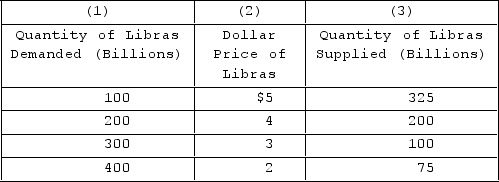

The table indicates the dollar price of libras, the currency used in the hypothetical nation of Libra. Assume that a system of flexible exchange rates is in place. Suppose that Libra decided to import more U.S. products. We would expect the quantity of libras

The table indicates the dollar price of libras, the currency used in the hypothetical nation of Libra. Assume that a system of flexible exchange rates is in place. Suppose that Libra decided to import more U.S. products. We would expect the quantity of libras

A) demanded at each dollar price to rise and the dollar to depreciate relative to the libra.

B) demanded at each dollar price to fall and the dollar to appreciate relative to the libra.

C) supplied at each dollar price to rise and the dollar to appreciate relative to the libra.

D) supplied at each dollar price to fall and the dollar to depreciate relative to the libra.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

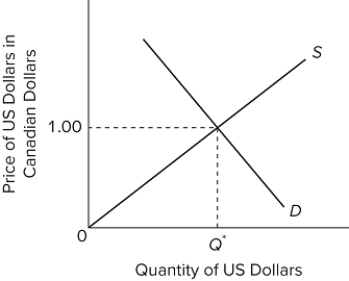

Refer to the graph. If U.S. citizens flock to Canada for summer vacations and buy more Canadian goods and services, then the

Refer to the graph. If U.S. citizens flock to Canada for summer vacations and buy more Canadian goods and services, then the

A) supply curve will shift left.

B) demand curve will shift right.

C) price of U.S. dollars in Canadian dollars will rise.

D) price of U.S. dollars in Canadian dollars will fall.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a system of freely flexible (floating) exchange rates, a U.S. trade deficit with Mexico will tend to cause

A) the U.S. government to ration pesos to U.S. importers.

B) a flow of gold from the United States to Mexico.

C) an increase in the peso price of dollars.

D) an increase in the dollar price of pesos.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the Mexican government decides to fix or peg the dollar-peso exchange rate at P20 = $1. If foreign-exchange traders on one day want to exchange $60 million for pesos, to enforce the peg the Mexican government will need to come up with

A) P1,200 million.

B) P0.33 million.

C) P3 million.

D) P80 million.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the U.S. balance of payments, foreign purchases of assets in the United States are a

A) money outflow.

B) money inflow.

C) current account item.

D) debit, or outpayment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

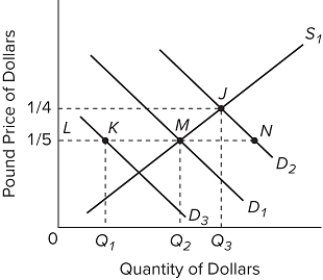

The graph shows the supply and demand curves for dollars in the pound/dollar market. Assume that D₁ and S₁ are the initial demand for and supply of dollars. Now suppose that Great Britain increases its imports of American products. Assuming freely floating exchange rates,

The graph shows the supply and demand curves for dollars in the pound/dollar market. Assume that D₁ and S₁ are the initial demand for and supply of dollars. Now suppose that Great Britain increases its imports of American products. Assuming freely floating exchange rates,

A) the pound price of dollars will fall to 1/5 pound equals $1.

B) the pound price of dollars will rise to 1/4 pound equals $1.

C) the dollar price of pounds will increase to $5 equals 1 pound.

D) a dollar shortage of MN will result in Britain.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a gold standard, a balance of payments disequilibrium would be corrected automatically by

A) the depreciation of that country's currency.

B) an increase in the gold content of that nation's monetary unit.

C) the appreciation of that country's currency.

D) an outflow or inflow of gold.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the balance on the financial account is −$300 billion and the balance on the capital account is +$5 billion. The size of the current account is

A) +$295 billion.

B) −$295 billion.

C) +$305 billion.

D) +$5 billion.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

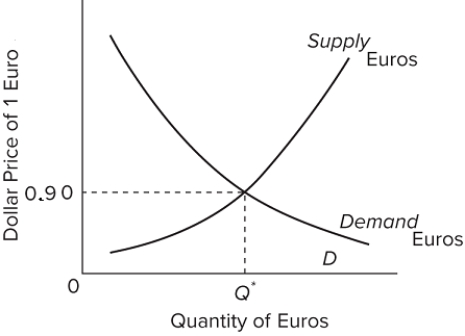

Assume that U.S. and European governments adopt a system of flexible exchange rates. The figure shows the market for euros. If currency traders think the European economy will experience a recession and the U.S. economy will not, then this event will most likely cause the

Assume that U.S. and European governments adopt a system of flexible exchange rates. The figure shows the market for euros. If currency traders think the European economy will experience a recession and the U.S. economy will not, then this event will most likely cause the

A) euro to appreciate.

B) euro to depreciate.

C) U.S. dollar to depreciate.

D) supply of euros to decrease.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the purchasing power parity theory, exchange rates will eventually adjust such that they equalize the various

A) currencies' values in terms of goods and services.

B) inflation rates in the trading nations.

C) interest rates in the trading nations.

D) levels of supply and demand in the foreign exchange markets.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If several nations decide to adopt and use a common currency, then each of these nations would lose the following, except

A) the ability to set its own interest rates.

B) the ability to set its own tax rates.

C) control of its own exchange rate.

D) the use of "external adjustment" tools to deal with current-account balance problems.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 318

Related Exams