A) Z.

B) A plus B.

C) Z minus B.

D) Z minus A.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The current price of an asset is equal to the future value of its expected returns or income streams.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial investment refers to

A) the same idea as economic investment.

B) earning profits from producing goods and services.

C) purchasing or building an asset for monetary gain.

D) making new additions to the capital stock.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

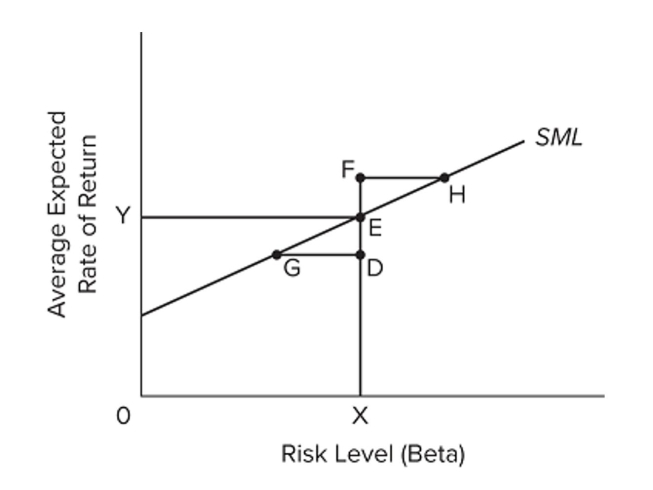

Refer to the graph. Each labeled point represents a different asset. For which of these assets would we not expect arbitrage to change the average expected rate of return?

Refer to the graph. Each labeled point represents a different asset. For which of these assets would we not expect arbitrage to change the average expected rate of return?

A) E only

B) D, E, and F

C) E, G, and H

D) D, E, F, G, and H

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You estimate that a piece of real estate for investment will be worth $700,000 in five years. The current interest rate is 3 percent. What is the present value of this investment?

A) $604,000

B) $624,000

C) $680,000

D) $700,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not common to all investments?

A) Investors are required to pay some price to acquire them.

B) Owners are given the opportunity to receive future payments.

C) Future payments are typically risky.

D) The investment pays a positive rate of interest.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the financial crisis of 2007-2008, investors demanded much higher risk premiums in their investments. This caused the SML to

A) shift up.

B) shift down.

C) become steeper.

D) become flatter.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compound interest

A) describes how quickly an interest-bearing asset increases in value.

B) measures the rate of return of a portfolio of stocks and bonds.

C) measures the after-tax, inflation-adjusted rate of interest.

D) refers to the multiple rates of interest of various types of bonds in a portfolio.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Security Market line (SML) shows how the average expected rates of return on assets vary with

A) stock price.

B) dividend payment.

C) risk level.

D) time preference.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Susan recently purchased a home for $150,000. She plans to rent it out for $1,000 per month for a year. Had the house cost $200,000 instead, her expected rate of return would have

A) decreased by 1 percentage point.

B) decreased by 2 percentage points.

C) increased by 2 percentage points.

D) increased by 3 percentage points.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A 10 percent rate of interest will increase the value of an asset more quickly if the interest is compounded.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Matt, a star basketball player, is looking to join a new NBA team. The Bulls are offering him $24 million for one year. The Heat is offering him $10 million this year and $7.0 million in each of the next Two years. The market interest rate is 5 percent. What is the present value of the offer from The Heat in millions (rounded to the nearest one hundred thousand dollars) ?

A) $22.5 million

B) $23.0 million

C) $24.0 million

D) $25.2 million

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a corporation goes bankrupt,

A) neither stockholders nor bondholders receive any money.

B) stockholders get paid from the sale of company assets before bondholders do.

C) bondholders get paid from the sale of company assets before stockholders do.

D) stockholders must honor the debts to bondholders out of personal assets if necessary.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept of time preference in financial investing rests on the belief that people

A) are indifferent between present and future consumption.

B) are patient.

C) are impatient.

D) intentionally consume 50 percent of assets in the present and 50 percent in the future.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Consider This) According to critics, growth in the popularity of mutual funds has

A) significantly increased market risk for investors.

B) created more macroeconomic instability.

C) led corporate management and fund managers to focus more on short-run share prices than long-run investor returns.

D) discouraged average citizens from investing in stock and bond markets.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the present value of $500 to be received eight years from now if the interest rate is 5 percent?

A) $300

B) $338.42

C) $700

D) $738.72

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Kara has $2,000 to invest today that she wants to grow to $3,000 in five years. What annually compounded rate of interest would she have to earn to reach her goal?

A) 4.6 percent

B) 6.5 percent

C) 8.4 percent

D) 9.3 percent

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value of a future amount of money will be greater the

A) greater the interest rate.

B) greater the amount of time before the future payment is received.

C) lower the interest rate.

D) greater the rate of the expected rate of inflation.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Tani invests $100 in a financial asset earning an annually compounded interest rate of 5 percent. In about how many years will her investment be worth $150?

A) 5.2

B) 6.8

C) 8.3

D) 10

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Last Word) Passively managed funds produce higher rates of return for investors than actively managed funds because

A) trading and management costs are higher with actively managed funds.

B) passively managed funds invest in riskier assets that have higher rates of return.

C) actively managed funds invest in riskier assets that have not reached expected rates of return.

D) actively managed funds are taxed, while passively managed funds are not taxable.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 356

Related Exams