B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the balance on the financial account is +$200 billion and the balance on the capital account is +$2 billion. The size of the current account is

A) +$200 billion.

B) −$202 billion.

C) −$198 billion.

D) +$2 billion.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A nation's balance of trade on goods is equal to its exports of goods less its imports of

A) goods.

B) capital.

C) financial assets.

D) official reserves.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose interest rates fall sharply in the United States but are unchanged in Great Britain. Other things equal, under a system of floating exchange rates, we can expect the demand for pounds in The United States to

A) decrease, the supply of pounds to increase, and the dollar to appreciate relative to the pound.

B) increase, the supply of pounds to increase, and the dollar may either appreciate or depreciate relative to the pound.

C) increase, the supply of pounds to decrease, and the dollar to depreciate relative to the pound.

D) decrease, the supply of pounds to increase, and the dollar to depreciate relative to the pound.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is not a major factor that contributed to large trade deficits in the United States in the period 2002-2007?

A) a declining saving rate coupled with a rising investment rate in the U.S.

B) a U.S. economy growing faster than its trading partners

C) large trade deficits with OPEC economies

D) flexible exchange rate between the U.S. dollar and the Chinese yuan

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Canadian dollar price of United States dollars increases from C$0.80 to C$1.00, it can be concluded that

A) both countries are on the international gold standard.

B) the Canadian dollar has appreciated in value relative to the United States dollar.

C) the United States dollar has depreciated in value relative to the Canadian dollar.

D) the Canadian dollar has depreciated in value relative to the United States dollar.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the balance on the financial account is −$300 billion and the balance on the capital account is +$5 billion. The size of the current account is

A) +$295 billion.

B) −$295 billion.

C) +$305 billion.

D) +$5 billion.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current monetary system for conducting international trade is usually described as a system of

A) fixed exchange rates.

B) freely floating exchange rates.

C) a managed gold standard.

D) managed floating exchange rates.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the consequences of the U.S. trade deficit is that

A) domestic inflation has resulted.

B) the accumulation of American dollars in foreign hands has enabled foreign firms to build factories in America.

C) the distribution of income in the United States has become less unequal.

D) the system of flexible exchange rates has been abandoned in favor of a new gold standard.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The table contains balance of payments data (+ and -) for the hypothetical nation of Zabella. All figures are in billions of dollars. Zabella's balance on the capital and financial account shows a

A) de?cit of $5 billion.

B) surplus of $10 billion.

C) de?cit of $10 billion.

D) surplus of $5 billion.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The table contains balance of payments data for the hypothetical nation Econland . All ?gures are in billions of dollars. There was a

A) trade de?cit but a current account surplus.

B) trade surplus but a current account de?cit.

C) trade surplus and a current account surplus.

D) trade de?cit and a current account de?cit.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The equilibrium exchange rate between two currencies is determined by the supply and demand in the

A) traded goods markets.

B) stock exchange markets.

C) foreign exchange markets.

D) money markets.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not true in the current exchange-rate system?

A) Major currencies like the U.S. dollar, euro, pound, and yen operate mostly in a flexible system responding to supply and demand forces.

B) Some developing nations peg their currencies to the dollar and allow their currencies to fluctuate with it relative to other currencies.

C) Each country uses its own unique currency; for example, only the U.S. uses the U.S. dollar as its currency.

D) Many nations peg their currencies to a "basket," or group, of other currencies, rather than to a single other currency.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is part of the financial account on the U.S. balance of payments?

A) net transfers

B) net investment income

C) U.S. goods exports

D) U.S. purchases of assets abroad

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

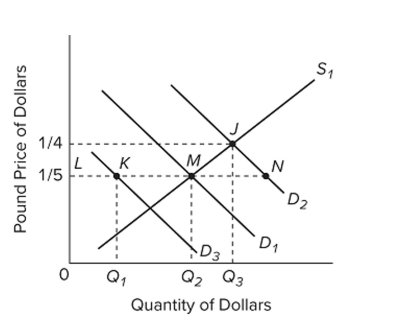

The graph shows the supply and demand curves for dollars in the pound/dollar market. Assume that D1 and S1 are the initial demand for and supply of dollars. The exchange rate will be

The graph shows the supply and demand curves for dollars in the pound/dollar market. Assume that D1 and S1 are the initial demand for and supply of dollars. The exchange rate will be

A) $5 equals 1 pound.

B) $4 equals 1 pound.

C) $1 equals 5 pounds.

D) $0.20 equals 1 pound.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The trade deficit has had the effect of

A) decreasing the Federal budget deficit.

B) increasing economic growth in less-developed nations.

C) increasing direct foreign investment in the United States.

D) decreasing protectionist pressure among U.S. businesses.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The flow of payments for purchases and sale of financial assets is included in the current account balance of a nation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

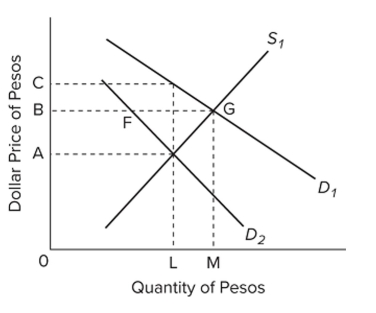

Refer to the diagram. The initial demand for and supply of pesos are shown by . Suppose

The United States reduces its imports of Mexican goods, shifting its demand for pesos from

If the United States and Mexico were both on the international gold standard,

Refer to the diagram. The initial demand for and supply of pesos are shown by . Suppose

The United States reduces its imports of Mexican goods, shifting its demand for pesos from

If the United States and Mexico were both on the international gold standard,

A) gold would ?ow from Mexico to the United States.

B) the exchange rate would rise from B dollars equals 1 peso to C dollars equals 1 peso.

C) gold would ?ow from the United States to Mexico.

D) the exchange rate would fall from B dollars equals 1 peso to A dollars equals 1 peso.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Depreciation of the dollar will

A) decrease the prices of both U.S. imports and exports.

B) increase the prices of both U.S. imports and exports.

C) decrease the prices of U.S. imports but increase the prices to foreigners of U.S. exports.

D) increase the prices of U.S. imports but decrease the prices to foreigners of U.S. exports.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

U.S. exports represent two flows,

A) an outflow of goods or services and an outflow of payments.

B) an inflow of goods or services and an outflow of payments.

C) an outflow of goods or services and an inflow of payments.

D) an inflow of goods or services and an inflow of payments.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 315

Related Exams