A) $3.75

B) $2.40

C) $2.70

D) $3.00

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

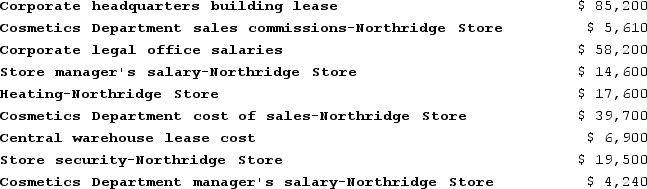

The following cost data pertain to the operations of Quinonez Department Stores, Incorporated, for the month of September.  The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.What is the total amount of the costs listed above that are direct costs of the Cosmetics Department?

The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.What is the total amount of the costs listed above that are direct costs of the Cosmetics Department?

A) $101,250

B) $49,550

C) $45,310

D) $39,700

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

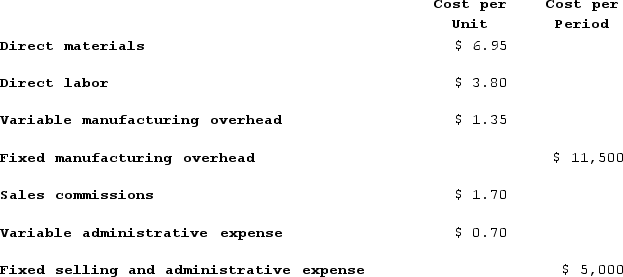

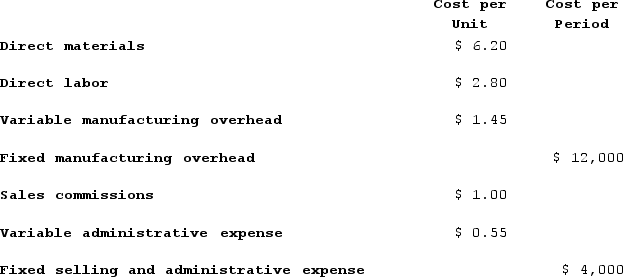

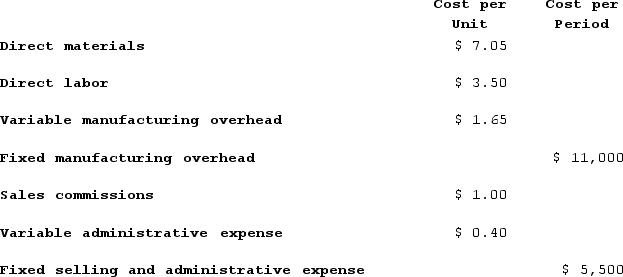

Kesterson Corporation has provided the following information:  The incremental manufacturing cost that the company will incur if it increases production from 5,000 to 5,001 units is closest to:

The incremental manufacturing cost that the company will incur if it increases production from 5,000 to 5,001 units is closest to:

A) $12.10

B) $14.95

C) $17.80

D) $15.80

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A cost can be direct or indirect. The classification can change if the cost object changes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

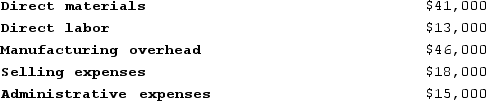

The following costs were incurred in May:  Conversion costs during the month totaled:

Conversion costs during the month totaled:

A) $54,000

B) $133,000

C) $59,000

D) $87,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

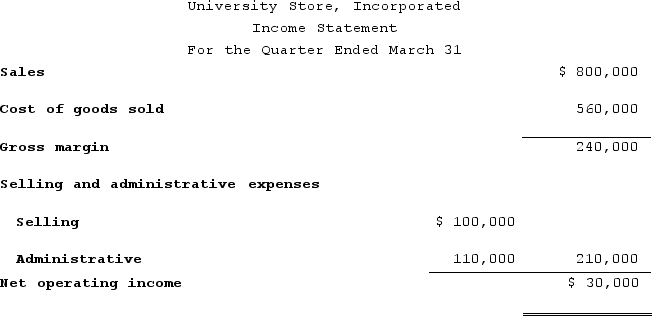

The University Store, Incorporated is the major bookseller for four nearby colleges. An income statement for the first quarter of the year is presented below:  On average, a book sells for $40.00. Variable selling expenses are $3.00 per book; the remaining selling expenses are fixed. The variable administrative expenses are 5% of sales; the remainder of the administrative expenses are fixed.The cost formula for selling and administrative expenses with "X" equal to the number of books sold is:

On average, a book sells for $40.00. Variable selling expenses are $3.00 per book; the remaining selling expenses are fixed. The variable administrative expenses are 5% of sales; the remainder of the administrative expenses are fixed.The cost formula for selling and administrative expenses with "X" equal to the number of books sold is:

A) Y = $105,000 + $3X

B) Y = $105,000 + $5X

C) Y = $110,000 + $5X

D) Y = $110,000 + $33X

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of lubricants used to grease a production machine in a manufacturing company is an example of a(n) :

A) period cost.

B) direct material cost.

C) indirect material cost.

D) opportunity cost.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

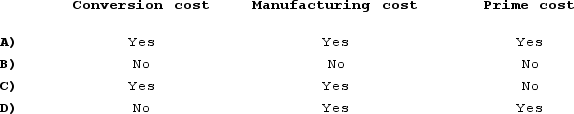

The costs of direct materials are classified as:

A) Choice A

B) Choice B

C) Choice C

D) Choice D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At a sales volume of 38,000 units, Tirri Corporation's property taxes (a cost that is fixed with respect to sales volume) total $733,400.To the nearest whole cent, what should be the average property tax per unit at a sales volume of 37,300 units? (Assume that this sales volume is within the relevant range.)

A) $19.30

B) $19.66

C) $19.72

D) $19.48

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

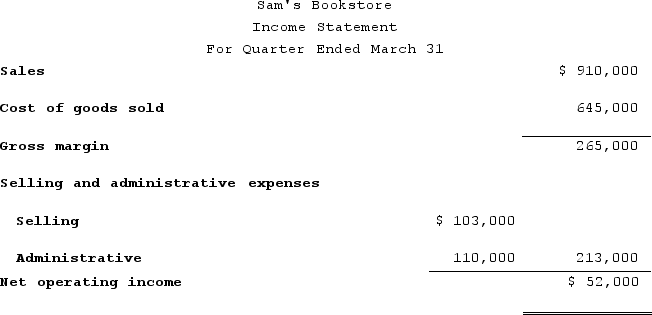

An income statement for Sam's Bookstore for the first quarter of the year is presented below:  On average, a book sells for $65. Variable selling expenses are $6 per book with the remaining selling expenses being fixed. The variable administrative expenses are 5% of sales with the remainder being fixed. The net operating income using the contribution approach for the first quarter is:

On average, a book sells for $65. Variable selling expenses are $6 per book with the remaining selling expenses being fixed. The variable administrative expenses are 5% of sales with the remainder being fixed. The net operating income using the contribution approach for the first quarter is:

A) $265,000

B) $181,000

C) $135,500

D) $52,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

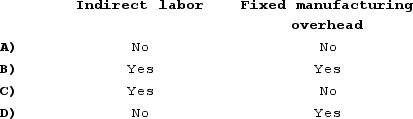

A factory supervisor's wages are classified as:

A) Choice A

B) Choice B

C) Choice C

D) Choice D

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wessner Corporation has provided the following information:  If 5,000 units are produced, the total amount of manufacturing overhead cost is closest to:

If 5,000 units are produced, the total amount of manufacturing overhead cost is closest to:

A) $18,000

B) $19,250

C) $18,625

D) $20,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Conversion cost is the same thing as manufacturing overhead.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At an activity level of 9,000 machine-hours in a month, Moffatt Corporation's total variable maintenance cost is $390,240 and its total fixed maintenance cost is $368,280.What would be the average fixed maintenance cost per unit at an activity level of 9,300 machine-hours in a month? Assume that this level of activity is within the relevant range.

A) $40.92

B) $84.28

C) $39.60

D) $54.93

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Schwiesow Corporation has provided the following information:  If 4,000 units are produced, the total amount of manufacturing overhead cost is closest to:

If 4,000 units are produced, the total amount of manufacturing overhead cost is closest to:

A) $14,600

B) $17,600

C) $11,600

D) $23,600

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If managers are reluctant to lay off direct labor employees when activity declines leads to a decrease in the ratio of variable to fixed costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a period cost in a company that makes clothing?

A) Fabric used to produce men's pants.

B) Advertising cost for a new line of clothing.

C) Factory supervisor's salary.

D) Monthly depreciation on production equipment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

Weingartner Corporation, a merchandising company, reported sales of 4,800 units for July at a selling price of $269 per unit. The cost of goods sold (all variable) was $114 per unit and the variable selling expense was $6 per unit. The total fixed selling expense was $38,100. The variable administrative expense was $14 per unit and the total fixed administrative expense was $59,900. Required:a. Prepare a contribution format income statement for July.b. Prepare a traditional format income statement for July.

Correct Answer

verified

Correct Answer

verified

True/False

Prime cost equals manufacturing overhead cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At an activity level of 8,400 units in a month, Braughton Corporation's total variable maintenance and repair cost is $697,284 and its total fixed maintenance and repair cost is $464,100. What would be the total maintenance and repair cost, both fixed and variable, at an activity level of 8,500 units in a month? Assume that this level of activity is within the relevant range. (Round intermediate calculations to 2 decimal places.)

A) $1,175,210

B) $1,169,685

C) $1,161,384

D) $1,168,297

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 346

Related Exams