A) $253,785

B) $210,618

C) $173,256

D) $207,784

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1 of the current year, the Barton Corporation issued 10% bonds with a face value of $200,000. The bonds are sold for $191,000. The bonds pay interest semiannually on June 30 and December 31 and the maturity date is December 31, five years from now. Barton records straight-line amortization of the bond discount. The bond interest expense for the year ended December 31 is

A) $10,900

B) $18,200

C) $21,800

D) $29,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When there are material differences between the results of using the straight-line method and using the effective interest rate method of amortization, the effective interest rate method should be used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the market rate of interest on bonds is higher than the contract rate, the bonds will sell at

A) a premium

B) their face value

C) their maturity value

D) a discount

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the bonds are sold for more than their face value, the carrying amount of the bonds is equal to

A) face value

B) face value plus the unamortized discount

C) face value minus the unamortized premium

D) face value plus the unamortized premium

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each description below to the appropriate term (a-g). -The rate printed on the bond certificate A)contract rate B)effective rate C)bond discount D)bond premium E)bond F)bond indenture G)principal

Correct Answer

verified

Correct Answer

verified

True/False

Bonds payable should be reported on the balance sheet at face value plus or minus any unamortized premium or discount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If bonds payable are not callable, the issuing corporation

A) can exchange them for common stock

B) can repurchase them in the open market

C) must get special permission from the SEC to repurchase them

D) is more likely to repurchase them if the interest rates increase

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An equal stream of periodic payments is called an annuity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $1,000,000 and Premium on Bonds Payable has a balance of $7,000. If the issuing corporation redeems the bonds at 101, what is the amount of gain or loss on redemption?

A) $3,000 loss

B) $3,000 gain

C) $7,000 loss

D) $7,000 gain

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Interest payments on 12% bonds with a face value of $20,000 and interest paid semiannually would be $2,400 every 6 months.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance in Discount on Bonds Payable that is applicable to bonds due in three years would be reported on the balance sheet in the section entitled

A) investments

B) long-term liabilities

C) current assets

D) intangible assets

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation issues for cash $1,000,000 of 10%, 20-year bonds, interest payable annually, at a time when the market rate of interest is 12%. The straight-line method is adopted for the amortization of bond discount or Premium. Which of the following statements is true?

A) The amount of the annual interest expense is computed at 10% of the bond carrying amount at the beginning of the year.

B) The amount of the annual interest expense gradually decreases over the life of the bonds.

C) The amount of unamortized discount decreases from its balance at issuance date to a zero balance at maturity.

D) The bonds will be issued at a premium.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Glenn Corporation issues 1,000, 10-year, 8%, $2,000 bonds dated January 1 at 96. The journal entry to record the issuance will show a

A) debit to Discount on Bonds Payable for $80,000

B) debit to Cash of $2,000,000

C) credit to Bonds Payable for $1,920,000

D) credit to Cash for $1,920,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

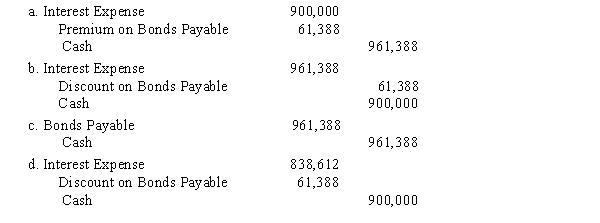

Cramer Corp. issued $20,000,000 of 5-year, 9% bonds at a market (effective) interest rate of 10%, receiving cash of $19,227.757. Interest on the bonds is payable semiannually. What is the entry to record the first semiannual interest payment, and the amortization of the bond discount, using the interest method?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If $1,000,000 of 8% bonds are issued at 102 3/4, the amount of cash received from the sale is

A) $1,080,000

B) $972,500

C) $1,000,000

D) $1,027,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

One reason a dollar today is worth more than a dollar 1 year from today is the time value of money.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the market rate of interest is 8% and a corporation's bonds bear interest at 7%, the bonds will sell at a premium.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Amortization is the allocation process of writing off bond premiums and discounts to interest expense over the life of the bond issue.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $1,000,000 and Discount on Bonds Payable has a balance of $10,000. If the issuing corporation redeems the bonds at 97 1/2 what is the amount of gain or loss on redemption?

A) $10,000 loss

B) $25,000 loss

C) $25,000 gain

D) $15,000 gain

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 172

Related Exams