B) False

Correct Answer

verified

Correct Answer

verified

True/False

A stock split results in a transfer at market value from retained earnings to paid-in capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company with 100,000 authorized shares of $4 par common stock issued 50,000 shares at $9. Subsequently, the company declared a 2% stock dividend on a date when the market price was $10 a share. The effect of the declaration and issuance of the stock dividend is to

A) decrease retained earnings, increase common stock, and increase paid-in capital

B) increase retained earnings, decrease common stock, and decrease paid-in capital

C) increase retained earnings, decrease common stock, and increase paid-in capital

D) decrease retained earnings, increase common stock, and decrease paid-in capital

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 60,000 shares were originally issued and 10,000 were subsequently reacquired. What is the amount of cash dividends to be paid if a $2 per share dividend is declared?

A) $60,000

B) $20,000

C) $120,000

D) $100,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nevada Corporation has 30,000 shares of $25 par stock outstanding that has a current market value of $120. If the corporation issues a 5-for-1 stock split, the number of shares outstanding will be

A) 60,000

B) 6,000

C) 150,000

D) 15,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ability of a corporation to obtain capital is

A) less than the ability of a partnership

B) about the same as the ability of a partnership

C) restricted because of the limited life of the corporation

D) enhanced because of limited liability and ease of share transferability

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary purpose of a stock split is to

A) increase paid-in capital

B) reduce the market price of the stock per share

C) increase the market price of the stock per share

D) increase retained earnings

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The declaration and issuance of a stock dividend does not affect the total amount of a corporation's assets, liabilities, or stockholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

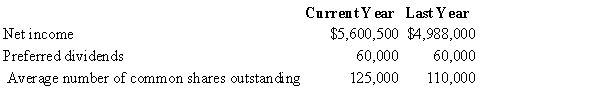

Financial statement data for this year and last year for Hanscombe Corp. are as follows:  Earnings per share for each year were

Earnings per share for each year were

A) Current year: $44.32; Last year: $44.80

B) Current year: $44.80; Last year: $44.32

C) Current year: $44.80; Last year: $45.35

D) Current year: $45.35; Last year: $44.80

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not true about a 2-for-1 split?

A) Par value per share is reduced to half of what it was before the split.

B) Total contributed capital increases.

C) The market price will probably decrease.

D) A stockholder with ten shares before the split owns twenty shares after the split.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The financial loss that each stockholder in a corporation can incur is usually limited to the amount invested by the stockholder.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the following stockholders' equity concepts to the appropriate term (a-h). -The day of the event that creates a liability to company A)cash dividend B)date of record C)Stock Dividends Distributable D)date of declaration E)treasury stock F)preferred stock G)date of payment H)Paid-In Capital in Excess of Par

Correct Answer

verified

Correct Answer

verified

Essay

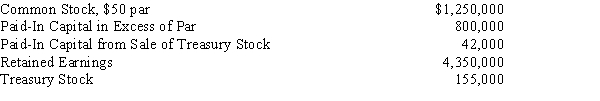

Using the following accounts and balances, prepare the stockholders' equity section of the balance sheet. Fifty thousand shares of common stock are authorized, and 5,000 shares have been reacquired.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:  Determine the dividends per share for preferred and common stock for the first year.

Determine the dividends per share for preferred and common stock for the first year.

A) $0.50 and $0.10

B) $0.00 and $0.10

C) $0.50 and $0.00

D) $2.00 and $0.00

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

The Sneed Corporation issues 10,000 shares of $50 par preferred stock for cash at $75 per share. Journalize the entry to record the sale.

Correct Answer

verified

Correct Answer

verified

Essay

On June 5, Belen Corporation reacquired 3,300 shares of its own common stock at $45 per share. On July 15, Belen sold 2,000 of the reacquired shares at $48 per share. On August 30, Belen sold the remaining shares at $42 per share. Journalize the transactions of June 5, July 15, and August 30.

Correct Answer

verified

Correct Answer

verified

True/False

The declaration of a stock dividend decreases a corporation's stockholders' equity and increases its liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A corporation has 10,000 shares of $100 par stock outstanding. If the corporation issues a 5-for-1 stock split, the number of shares outstanding after the split will be 40,000.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

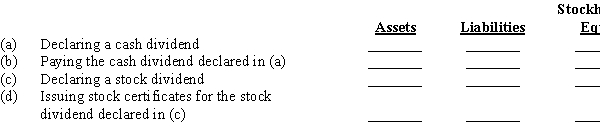

Indicate whether the following actions would (+) increase, (-) decrease, or (0) not affect a company's total assets, liabilities, and stockholders' equity.

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stockholders must receive their current-year dividends before the common stockholders can receive any dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 221

Related Exams