Correct Answer

verified

Correct Answer

verified

Multiple Choice

Department J had no work in process at the beginning of the period, 18,000 units were completed during the period, and 2,000 units were 30% completed at the end of the period. The following manufacturing costs were debited to the departmental work in process account during the period. Assume the company uses FIFO and rounds cost per unit to two decimal places.Direct materials (20,000 at $5) $100,000 Direct labor 142,300 Factory overhead 57,200 -In a process cost system, the cost of completed production in Department A is transferred to Department B by which of the following journal entries?

A) debit Work in Process-Department B and credit Work in Process-Department A

B) debit Work in Process-Department B and credit Finished Goods-Department A

C) debit Work in Process-Department B and credit Cost of Goods Sold-Department A

D) debit Finished Goods-Department A and credit Work in Process-Department B

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

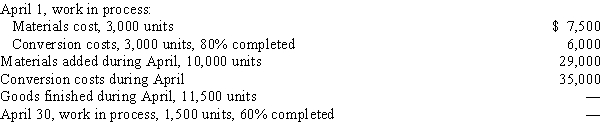

The debits to Work in Process-Assembly Department for April, together with data concerning production, are as follows:  All direct materials are placed in process at the beginning of the process, and the weighted average method is used to cost inventories.

-The conversion cost per equivalent unit (to the nearest cent) for April is

All direct materials are placed in process at the beginning of the process, and the weighted average method is used to cost inventories.

-The conversion cost per equivalent unit (to the nearest cent) for April is

A) $2.70

B) $2.53

C) $3.31

D) $5.60

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If 30,000 units of materials enter production during the first year of operations, 25,000 of the units are finished, and 5,000 are 50% completed, the number of equivalent units of production would be 28,500.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Department S had no work in process at the beginning of the period. It added 12,000 units of direct materials during the period at a cost of $84,000; 9,000 units were completed during the period; and 3,000 units were 30% completed as to labor and overhead at the end of the period. All materials are added at the beginning of the process. Direct labor was $49,500 and factory overhead was $9,900. -The following production data were taken from the records of the Finishing Department for June: Inventory in process, June 1, 25% completed 1,500 units Transferred to finished goods during June 5,000 units Equivalent units of production during June 5,200 units Determine the number of equivalent units of production in the June 30 Finishing Department inventory, assuming that the first-in, first-out method is used to cost inventories. The completion percentage of 25% applies to both direct materials and conversion costs.

A) 575 units

B) 200 units

C) 1,000 units

D) 300 units

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

The cost of energy consumed in producing units in the Bottling Department of Mountain Springs Water Company was $36,850 and $39,060 for June and July, respectively. The number of equivalent units produced in June and July was 55,000 and 62,000 liters, respectively. Evaluate the change in the cost of energy between the two months.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each phrase that follows with the term (a-h) it describes. -Costing system used by a company producing computer chips A)Direct labor and factory overhead B)Direct labor and direct materials C)Transferred-in costs D)Equivalent units E)Process costing F)Job order costing G)First-in, first-out method H)Cost of production report

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each phrase that follows with the term (a-e) it describes. -An assumed flow of costs that most often resembles the physical flow of units A)Cost of production report B)Equivalent units of production C)First-in, first-out (FIFO) method D)Last-in, first-out (LIFO) method E)Whole units F)Yield

Correct Answer

verified

Correct Answer

verified

True/False

Computing the yield of a process will identify the level of materials losses from waste.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If 10,000 units that were 50% completed are in process at November 1, 90,000 units were completed during November, and 20,000 were 20% completed at November 30, the number of equivalent units of production for November was 90,000. (Assume no loss of units in production and that inventories are costed by the first-in, first-out method.)

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

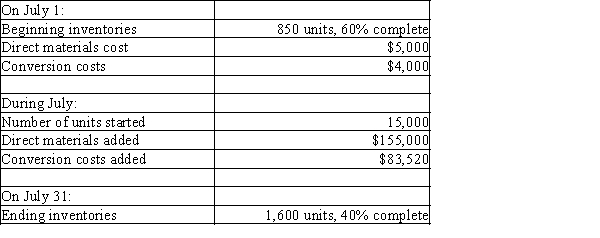

Penny, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Information about July's activities is as follows:

-Using the FIFO method and rounding cost per unit to four decimal places, the cost of goods completed and transferred out during July was

-Using the FIFO method and rounding cost per unit to four decimal places, the cost of goods completed and transferred out during July was

A) $227,270

B) $225,060

C) $236,905

D) $228,200

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following production data were taken from the records of the Finishing Department for June:

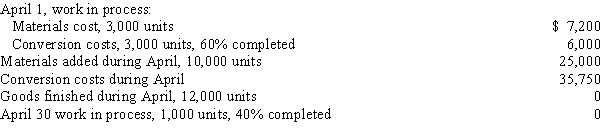

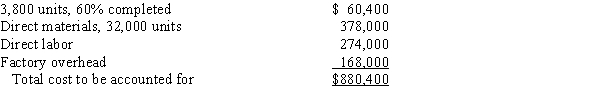

-The debits to Work in Process-Assembly Department for April, together with data concerning production, are as follows:

-The debits to Work in Process-Assembly Department for April, together with data concerning production, are as follows:  All direct materials are added at the beginning of the process, and the first-in, first-out method is used to cost inventories. The materials cost per equivalent unit for April is

All direct materials are added at the beginning of the process, and the first-in, first-out method is used to cost inventories. The materials cost per equivalent unit for April is

A) $2.48

B) $2.08

C) $2.50

D) $5.25

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following costs incurred by a paper manufacturer would be included in the group of costs referred to as conversion costs?

A) accounting department costs

B) raw lumber

C) assembly labor's wages

D) administrative salaries

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Gilbert Corporation had 25,000 finished units and 8,000 units 35% complete. The equivalent units totaled 30,200.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cost of production report reports the cost charged to production and the costs allocated to finished goods and work in process.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Department B had 3,000 units in Work in Process that were 25% completed at the beginning of the period at a cost of $12,500, 13,700 units of direct materials were added during the period at a cost of $28,700, 15,000 units were completed during the period, and 1,700 units were 95% completed at the end of the period. All materials are added at the beginning of the process. Direct labor was $32,450 and factory overhead was $18,710. -The number of equivalent units of production for the period for conversion, if the first-in, first-out method is used to cost inventories, was

A) 14,365

B) 13,615

C) 12,000

D) 15,865

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Department G had 3,600 units, 40% completed at the beginning of the period, 12,000 units were completed during the period, 2,000 units were 20% completed at the end of the period, and the following manufacturing costs were debited to the departmental work in process account during the period:

-Assuming that all direct materials are placed in process at the beginning of production and that the first-in, first-out method of inventory costing is used, the equivalent units for materials and conversion costs, respectively, are

-Assuming that all direct materials are placed in process at the beginning of production and that the first-in, first-out method of inventory costing is used, the equivalent units for materials and conversion costs, respectively, are

A) 14,000 and 12,160

B) 10,400 and 10,960

C) 14,000 and 13,600

D) 10,400 and 10,240

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each business that follows with the job cost system (a or b) it would most likely utilize. -Nail manufacturer A)Job order cost system B)Process cost system

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Department S had no work in process at the beginning of the period. It added 12,000 units of direct materials during the period at a cost of $84,000; 9,000 units were completed during the period; and 3,000 units were 30% completed as to labor and overhead at the end of the period. All materials are added at the beginning of the process. Direct labor was $49,500 and factory overhead was $9,900.

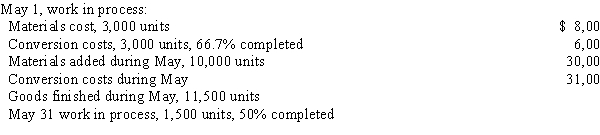

-The debits to Work in Process-Assembly Department for May, together with data concerning production, are as follows:  All direct materials are placed in process at the beginning of the process and the first-in, first-out method is used to cost inventories. The materials cost per equivalent unit for May is

All direct materials are placed in process at the beginning of the process and the first-in, first-out method is used to cost inventories. The materials cost per equivalent unit for May is

A) $3.00

B) $3.80

C) $2.92

D) $2.31

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

The inventory at June 1 and costs charged to Work in Process-Department 60 during June are as follows:  During June, 32,000 units were placed into production and 31,200 units were completed, including those in inventory on June 1. On June 30, the inventory of work in process consisted of 4,600 units that were 85% completed. Inventories are costed by the first-in, first-out method, and all materials are added at the beginning of the process.Determine the following (round unit cost data to four decimal places, i.e., $4.4444, to minimize rounding differences):

a.Equivalent units of production for conversion cost

b.Conversion cost per equivalent unit

c.Total and unit cost of finished goods started in prior period and completed in the current period

d.Total and unit cost of finished goods started and completed in the current period

e.Total cost of work in process inventory, June 30

During June, 32,000 units were placed into production and 31,200 units were completed, including those in inventory on June 1. On June 30, the inventory of work in process consisted of 4,600 units that were 85% completed. Inventories are costed by the first-in, first-out method, and all materials are added at the beginning of the process.Determine the following (round unit cost data to four decimal places, i.e., $4.4444, to minimize rounding differences):

a.Equivalent units of production for conversion cost

b.Conversion cost per equivalent unit

c.Total and unit cost of finished goods started in prior period and completed in the current period

d.Total and unit cost of finished goods started and completed in the current period

e.Total cost of work in process inventory, June 30

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 196

Related Exams