A) flexible

B) continuous

C) zero-based

D) master

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

Prepare a monthly flexible selling expense budget for Cottonwood Company for sales volumes of $300,000, $350,000, and $400,000, based on the following data: Sales commissions 6% of sales Sales manager's salary $120,000 per month Advertising expense $90,000 per month Shipping expense 1% of sales Miscellaneous selling expense $6,000 per month plus 1.5% of sales

Correct Answer

verified

Correct Answer

verified

True/False

Budgetary slack can be avoided if lower and mid-level managers are required to support all of their spending requirements with specific operational plans.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When budget goals are set too tight, the budget becomes less effective as a tool for planning and controlling operations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Budget preparation is best determined in a top-down managerial approach.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The operating budgets of a company include the

A) cash budget

B) capital expenditures budget

C) financial budgets

D) production budget

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Below is budgeted production and sales information for Bluebird Company for the month of December.  The unit selling price for Product XXX is $5 and for Product ZZZ is $14.

-Budgeted production for Product XXX during the month is

The unit selling price for Product XXX is $5 and for Product ZZZ is $14.

-Budgeted production for Product XXX during the month is

A) 522,000 units

B) 552,000 units

C) 518,000 units

D) 520,000 units

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

After the sales budget is prepared, the production budget is normally prepared next.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Budgeting involves (1) establishing specific goals for future operations, (2) executing plans to achieve the goals, and (3) periodically comparing actual results with the goals.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The budgeted direct materials purchases is based on the sum of (1) the materials needed for production and (2) the desired ending materials inventory, less (3) the estimated beginning materials inventory.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Flexible budgeting requires managers to estimate sales, production, and other operating data as though operations were being started for the first time.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Good Night, Inc., manufactures comforters. The estimated inventories on January 1 for finished goods, work in process, and materials were $51,000, $28,000, and $33,000, respectively. The desired inventories on December 31 for finished goods, work in process, and materials were $48,000, $35,000, and $29,000, respectively. Direct materials purchases were $555,000. Direct labor was $252,000 for the year. Factory overhead was $176,000. Prepare a cost of goods sold budget for Good Night, Inc.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The budgetary unit of an organization that is led by a manager who has both the authority over and responsibility for the unit's performance is known as a

A) control center

B) budgetary area

C) responsibility center

D) managerial department

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each phrase that follows with the term (a-f) it describes. -A plan showing the units of goods to be sold and the dollar sales to be derived; usually the starting point in the budgeting process A)Budget B)Capital expenditures budget C)Sales budget D)Production budget E)Cash budget F)Budgeted balance sheet

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business-September, October, and November-are $260,000, $375,000, and $400,000, respectively. The company expects to sell 30% of its merchandise for cash. Of sales on account, 80% are expected to be collected in the month of the sale and 20% in the month following the sale. -The cash collections expected in October from accounts receivable are estimated to be

A) $246,400

B) $262,500

C) $210,000

D) $294,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Principal components of a master budget include

A) production budget

B) sales budget

C) capital expenditures budget

D) all of these choices

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Employees view budgeting more positively when goals are established for them by senior management.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

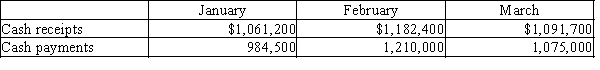

A company is preparing its cash budget. Its cash balance on January 1 is $290,000, and it has a minimum cash requirement of $340,000. The following data have been provided:

-Tara Company's budget shows the following credit sales for the current year: September, $25,000; October, $36,000; November, $30,000; December, $32,000. Experience has shown that payment for credit sales is received as follows: 15% in the month of sale, 60% in the first month after sale, 20% in the second month after sale, and 5% is uncollectible. The amount of cash Tara Company will expect to collect in November as a result of current and past credit sales is

-Tara Company's budget shows the following credit sales for the current year: September, $25,000; October, $36,000; November, $30,000; December, $32,000. Experience has shown that payment for credit sales is received as follows: 15% in the month of sale, 60% in the first month after sale, 20% in the second month after sale, and 5% is uncollectible. The amount of cash Tara Company will expect to collect in November as a result of current and past credit sales is

A) $19,700

B) $28,400

C) $30,000

D) $31,100

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Below is budgeted production and sales information for Flushing Company for the month of December.  The unit selling price for product XXX is $5 and for product ZZZ is $15.

-For April, sales revenue is $700,000, sales commissions are 5% of sales, the sales manager's salary is $98,000, advertising expenses are $90,000, shipping expenses total 2% of sales, and miscellaneous selling expenses are $2,100 plus 1/2 of 1% of sales. Total selling expenses for the month of April are

The unit selling price for product XXX is $5 and for product ZZZ is $15.

-For April, sales revenue is $700,000, sales commissions are 5% of sales, the sales manager's salary is $98,000, advertising expenses are $90,000, shipping expenses total 2% of sales, and miscellaneous selling expenses are $2,100 plus 1/2 of 1% of sales. Total selling expenses for the month of April are

A) $159,100

B) $242,600

C) $186,000

D) $182,100

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The task of preparing a budget should be the sole task of the most important department in an organization.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 197

Related Exams