A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total manufacturing cost variance is

A) the difference between total actual costs and total standard costs for the units produced

B) the flexible budget variance plus the time variance

C) the difference between planned costs and standard costs for the units produced

D) none of these choices

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flapjack Corporation had 8,200 actual direct labor hours at an actual rate of $12.40 per hour. Original production had been budgeted for 1,100 units, but only 1,000 units were actually produced. Labor standards were 7.6 hours per completed unit at a standard rate of $13.00 per hour. -The direct labor rate variance is

A) $4,920 unfavorable

B) $4,920 favorable

C) $4,560 favorable

D) $4,560 unfavorable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Myers Corporation has the following data related to direct materials costs for November: actual cost for 5,000 pounds of material at $4.50 per pound and standard cost for 4,800 pounds of material at $5.10 per pound. The direct materials price variance is

A) $3,000 favorable

B) $3,000 unfavorable

C) $2,880 favorable

D) $2,880 unfavorable

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lucy Corporation purchased and used 129,000 board feet of lumber in production at a total cost of $1,548,000. Original production had been budgeted for 22,000 units with a standard materials quantity of 5.7 board feet per unit and a standard price of $12 per board foot. Actual production was 23,500 units. -The direct materials price variance is

A) $0

B) $59,400 unfavorable

C) $59,400 favorable

D) $6,000 unfavorable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

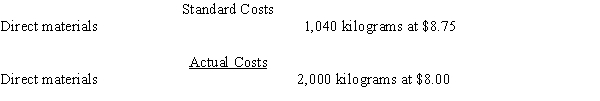

The standard costs and actual costs for direct materials for the manufacture of 3,000 actual units of product are as follows:  The direct materials price variance is

The direct materials price variance is

A) $2,750 unfavorable

B) $2,750 favorable

C) $1,500 favorable

D) $1,500 unfavorable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

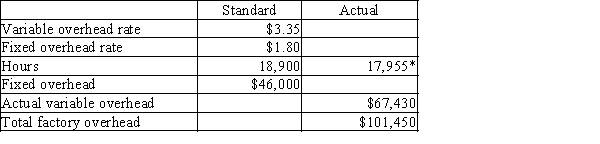

*Actual hours are equal to standard hours for units produced.

-Variances from standard costs are included in reports to

*Actual hours are equal to standard hours for units produced.

-Variances from standard costs are included in reports to

A) suppliers and creditors

B) stockholders

C) management

D) suppliers and creditors, stockholders, and management

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

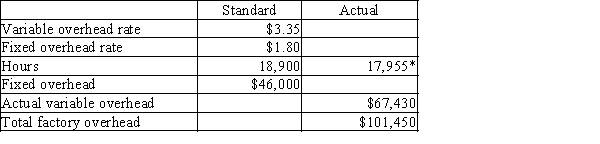

*Actual hours are equal to standard hours for units produced.

-If the total revenue variance is favorable and the revenue price variance is unfavorable, then the revenue volume variance must

*Actual hours are equal to standard hours for units produced.

-If the total revenue variance is favorable and the revenue price variance is unfavorable, then the revenue volume variance must

A) exceed the revenue price variance and be favorable

B) be less than the revenue price variance and be unfavorable

C) be less than the revenue price variance and be favorable

D) be equal to the revenue price variance and be favorable

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The variance from standard for factory overhead resulting from incurring a total amount of factory overhead cost that is greater or less than the amount budgeted for the level of operations achieved is termed the variable factory overhead controllable variance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

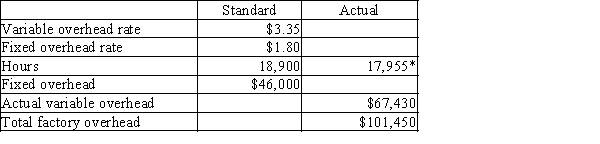

*Actual hours are equal to standard hours for units produced.

-A company records its inventory purchases at standard cost but also records purchase price variances. The company purchased 5,000 widgets at $8.00 each, and the standard cost for the widgets is $7.60. Which of the following would be included in the journal entry?

*Actual hours are equal to standard hours for units produced.

-A company records its inventory purchases at standard cost but also records purchase price variances. The company purchased 5,000 widgets at $8.00 each, and the standard cost for the widgets is $7.60. Which of the following would be included in the journal entry?

A) debit Accounts Payable, $38,000

B) credit Direct Materials Price Variance, $2,000

C) debit Accounts Payable, $2,000

D) debit Direct Materials Price Variance, $2,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the standard to produce a given amount of product is 500 direct labor hours at $15 and the actual direct labor incurred is 600 hours at $17, the direct labor rate variance is $1,200 favorable.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Standard direct materials costs are determined by multiplying the standard price by the standard quantity.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 172 of 172

Related Exams