A) line of credit

B) working capital loan

C) accounts payable

D) None of the above-all current liabilities carry an interest rate.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The awarding of frequent flyer miles by airline companies is accounted for in a manner similar to

A) warranty expenses.

B) accounts payable.

C) contingent liabilities.

D) commitments.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following companies would usually NOT have an unearned revenue account?

A) magazine publishing company

B) property management company

C) airline

D) hardware store

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A line of credit helps a company deal with temporary cash shortages.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

For which of the following reasons would a user examine the current liabilities?

A) to determine how quickly accounts receivable are collected

B) to determine how much cash will be required to meet obligations in the short-term

C) to determine how much cash will be required to meet obligations in the long-term

D) to evaluate company performance

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

All current liabilities have fixed due dates and fixed payment amounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a characteristic of a liability?

A) There is a probable future sacrifice of resources.

B) There is a fixed payment amount and payment date.

C) There is little discretion to avoid the obligation.

D) The event giving rise to the liability has already occurred.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has $5,000,000 in long-term debt outstanding. They expect to repay it evenly over the next four years. Which of the following represents how it will be shown on the year-end balance sheet?

A) Accounts Payable: $1,250,000, Long-Term Debt: $3,750,000

B) Current Portion of Long-Term Debt: $1,250,000, Long-Term Debt: $3,750,000

C) Current Portion of Long-Term Debt: $2,500,000, Long-Term Debt: $2,500,000

D) Long-Term Debt: $5,000,000

F) A) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

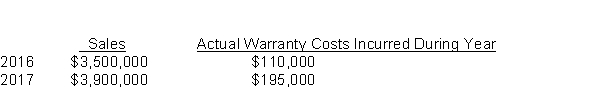

Use the following information for questions 40-42.

Melman Microscopes Inc. offers a two-year warranty against failure of its products. The estimated liability is 1.5% in the year of sale and 3% in the second year. Sales and actual warranty expense for 2016 and 2017 were:  -The warranty expense for 2017 was

-The warranty expense for 2017 was

A) $157,500.

B) $175,500.

C) $195,000.

D) $305,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The difference between the face value of a liability and its present value is due to the time value of money.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

The accounts payable turnover ratio measures

A) number of times the company settles its trade payable.

B) average accounts payable balance.

C) the average number of times the industry settles their trade payable.

D) the average balance of accounts payable to current assets.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maynard Manufacturing has a two-week payroll of $8,200 for its eight employees. Income tax of $1,080 is deducted from the employees' cheques, as well as 4.95% for CPP and 1.88% for EI. Wages deposited in employees' bank accounts would be

A) $6,560.

B) $7,120.

C) $7,640.

D) $8,200.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lokus Lofts is a rental company that requires its tenants to pay rent one month in advance. Lokus should record the cash received as

A) Prepaid Rent.

B) Rent Revenue.

C) Unearned Revenue.

D) Accounts Payable.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the board declares dividends, the correct journal will be

A) Dividends Expense Dividends Payable

B) Dividend Declared Cash

C) Dividends Declared Dividends Payable

D) Dividends Receivable Dividends Revenue

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Typically acquisition costs for inventory can be financed through the use of

A) overdraft protection.

B) accounts payable.

C) working capital.

D) notes payable.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Accounting standards require that liabilities be recorded at their present value.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Bankers will often compare current assets to current liabilities to assess viability.

B) False

Correct Answer

verified

Correct Answer

verified

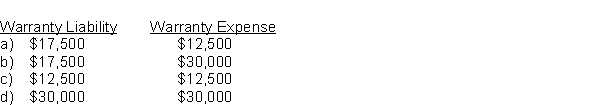

Short Answer

During 2017 Albany Appliances sold 400 appliances worth $2,000,000. Each appliance comes with a one-year warranty, which Albany estimates will cost $75 each. During the year Albany spent $12,500 on warranty costs for the appliances sold in 2017. At the end of the 2017 the warranty liability and the warranty expense related to these sales would be closest to

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following liabilities results from amounts owed by BOTH the employee and the employer?

A) employee income tax payable

B) wages payable

C) employment insurance payable

D) vacation pay payable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are ways that corporations can finance current cash shortages EXCEPT a

A) line of credit.

B) current portion of long-term debt.

C) short-term loan.

D) working capital loan.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 42

Related Exams