B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For each of the following activities that may take place during the accounting period, indicate the effect (a-g) on the statement of cash flows prepared using the indirect method. Choices may be selected as the answer for more than one question. -Decrease in accounts payable balance

A) Increase cash from operating activities

B) Decrease cash from operating activities

C) Increase cash from investing activities

D) Decrease cash from investing activities

E) Increase cash from financing activities

F) Decrease cash from financing activities

G) Noncash investing and financing supplement

I) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows prepared by the indirect method, a $50,000 gain on the sale of investments would be

A) deducted from net income in converting the net income reported on the income statement to cash flows from operating activities

B) added to net income in converting the net income reported on the income statement to cash flows from operating activities

C) added to dividends declared in converting the dividends declared to the cash flows from financing activities related to dividends

D) deducted from dividends declared in converting the dividends declared to the cash flows from financing activities related to dividends

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the section of the statement of cash flows (a-d) where each of the following items would be reported. -Decrease in inventory

A) Operating activities

B) Financing activities

C) Investing activities

D) Schedule of noncash financing and investing

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a gain of $11,000 is realized in selling (for cash) office equipment having a book value of $55,000, the total amount reported in the Cash flows from investing activities section of the statement of cash flows is

A) $44,000

B) $11,000

C) $55,000

D) $66,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Preferred stock issued in exchange for land would be reported on the statement of cash flows in

A) the Cash flows from financing activities section

B) the Cash flows from investing activities section

C) a separate schedule

D) the Cash flows from operating activities section

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Net income was $51,000 for the year. The accumulated depreciation balance increased by $14,000 over the year. There were no sales of fixed assets or changes in noncash current assets or liabilities. Under the indirect method, the cash flow from operations is $37,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from investing activities, as part of the statement of cash flows, include payments for the acquisition of fixed assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the section of the statement of cash flows (a-d) where each of the following items would be reported. -Exchange of land for note payable

A) Operating activities

B) Financing activities

C) Investing activities

D) Schedule of noncash financing and investing

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Sales reported on the income statement were $372,000. The accounts receivable balance declined $4,500 over the year. The amount of cash received from customers was $367,500.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If accounts payable have increased during a period,

A) revenues on an accrual basis are less than revenues on a cash basis

B) expenses on an accrual basis are less than expenses on a cash basis

C) expenses on an accrual basis are the same as expenses on a cash basis

D) expenses on an accrual basis are greater than expenses on a cash basis

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

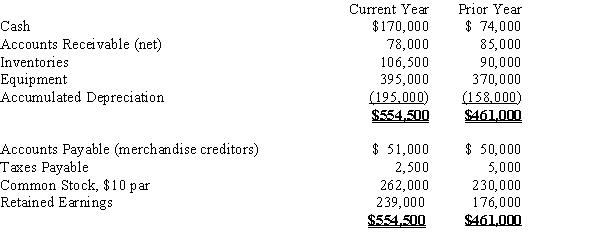

On the basis of the following data for Breach Co. for the current and preceding years ended December 31, prepare a statement of cash flows using the indirect method. Assume that equipment costing $25,000 was purchased for cash and no long-term assets were sold during the period.Stock was issued for cash-3,200 shares at par.Net income for the current year was $76,000.Cash dividends declared and paid were $13,000.

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from investing activities, as part of the statement of cash flows, would include any payments for the purchase of treasury stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If cash dividends of $135,000 were paid during the year and the company sold 1,000 shares of common stock at $30 per share, the statement of cash flows would report net cash flow from financing activities as $165,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company had net income of $252,000. Depreciation expense was $26,000. During the year, accounts receivable and inventory increased by $15,000 and $40,000, respectively. Prepaid expenses and accounts payable decreased by $2,000 and $4,000, respectively. There was also a loss on the sale of equipment of $3,000. How much was the net cash flow from operating activities on the statement of cash flows using the indirect method?

A) $217,000

B) $224,000

C) $284,000

D) $305,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be found in a schedule of noncash investing and financing activities, reported at the end of a statement of cash flows?

A) equipment acquired in exchange for a note payable

B) bonds payable exchanged for capital stock

C) purchase of treasury stock

D) capital stock issued to acquire fixed assets

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

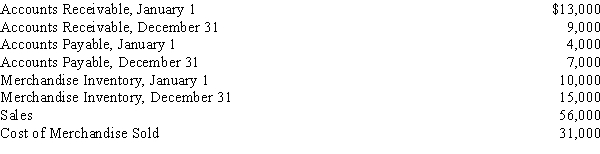

Use the information below for Washington Company to answer the following questions.

The following selected account balances appeared on the financial statements of Washington Company:

Washington Company uses the direct method to calculate net cash flow from operating activities.

-Cash payments for merchandise were

Washington Company uses the direct method to calculate net cash flow from operating activities.

-Cash payments for merchandise were

A) $39,000

B) $33,000

C) $29,000

D) $23,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the section of the statement of cash flows (a-d) where each of the following items would be reported. -Issuance of bond payable

A) Operating activities

B) Financing activities

C) Investing activities

D) Schedule of noncash financing and investing

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The declaration and issuance of a stock dividend would be reported on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In determining the cash flows from operating activities for the statement of cash flows by the indirect method, the depreciation expense for the period is added to the net income for the period.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 189

Related Exams