A) An increase in the personal tax rate.

B) An increase in the company's operating leverage.

C) The Federal Reserve tightens interest rates in an effort to fight inflation.

D) The company's stock price hits a new high.

E) An increase in the corporate tax rate.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

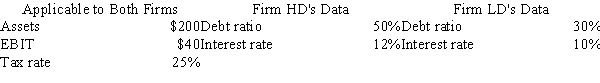

Firms HD and LD are identical except for their level of debt and the interest rates they pay on debt⎯HD has more debt and pays a higher interest rate on that debt.Based on the data given below, what is the difference between the two firms' ROEs?

A) 2.51%

B) 2.65%

C) 2.79%

D) 2.93%

E) 3.07%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose a company issued 30-year bonds 4 years ago, when the yield curve was inverted.Since then long-term rates (10 years or longer) have remained constant, but the yield curve has resumed its normal upward slope.Under such conditions, a bond refunding would almost certainly be profitable.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The MM model with corporate taxes is the same as the Miller model, but with zero personal taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The capital structure that minimizes the interest rate on debt also maximizes the expected EPS.

B) The capital structure that minimizes the required return on equity also maximizes the stock price.

C) The capital structure that minimizes the WACC also maximizes the price per share of common stock.

D) The capital structure that gives the firm the best credit rating also maximizes the stock price.

E) The capital structure that maximizes expected EPS also maximizes the price per share of common stock.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stanovich Enterprises has 10-year, 12.0% semiannual coupon bonds outstanding.Each bond is now eligible to be called at a call price of $1,060.If the bonds are called, the company must replace them with new 10-year bonds.The flotation cost of issuing new bonds is estimated to be $45 per bond.How low would the yield to maturity on the new bonds have to be in order for it to be profitable to call the bonds today, i.e., what is the nominal annual "breakeven rate"?

A) 9.29%

B) 9.78%

C) 10.29%

D) 10.81%

E) 11.35%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Serendipity Inc.is re-evaluating its debt level.Its current capital structure consists of 80% debt and 20% common equity, its beta is 1.60, and its tax rate is 25%.However, the CFO thinks the company has too much debt, and he is considering moving to a capital structure with 40% debt and 60% equity.The risk-free rate is 5.0% and the market risk premium is 6.0%.By how much would the capital structure shift change the firm's cost of equity?

A) −5.40%

B) −6.00%

C) −6.60%

D) −7.26%

E) −7.99%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blueline Publishers is considering a recapitalization plan.It is currently 100% equity financed but under the plan it would issue long-term debt with a yield of 9% and use the proceeds to repurchase common stock.The recapitalization would not change the company's total assets, nor would it affect the firm's return on invested capital (ROIC) , which is currently 15%.The CFO believes that this recapitalization would reduce the WACC and increase stock price.Which of the following would also be likely to occur if the company goes ahead with the recapitalization plan?

A) The company's earnings per share would decline.

B) The company's cost of equity would increase.

C) The company's ROA would increase.

D) The company's ROE would decline.

E) The company's net income would increase.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the firm uses the after-tax cost of new debt as the discount rate when analyzing a refunding decision, and if the NPV of refunding is positive, then the value of the firm will be maximized if it immediately calls the outstanding debt and replaces it with an issue that has a lower coupon rate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Firm A has a higher degree of business risk than Firm B.Firm A can offset this by using less financial leverage.Therefore, the variability of both firms' expected EBITs could actually be identical.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since debt financing is cheaper than equity financing, raising a company's debt ratio will always reduce its WACC.

B) Increasing a company's debt ratio will typically reduce the marginal cost of both debt and equity financing.However, this action still may raise the company's WACC.

C) Increasing a company's debt ratio will typically increase the marginal cost of both debt and equity financing.However, this action still may lower the company's WACC.

D) Since a firm's beta coefficient it not affected by its use of financial leverage, leverage does not affect the cost of equity.

E) Since debt financing raises the firm's financial risk, increasing a company's debt ratio will always increase its WACC.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Best Bagels, Inc.(BB) Best Bagels, Inc.(BB) currently has zero debt.Its earnings before interest and taxes (EBIT) are $130,000, and it is a zero growth company.BB's current cost of equity is 13%, and its tax rate is 25%.The firm has 30,000 shares of common stock outstanding selling at a price per share of $25. -Refer to the data for Best Bagels, Inc.(BB) .BB is considering moving to a capital structure that is comprised of 20% debt and 80% equity, based on market values.The debt would have an interest rate of 8.2%.The new funds would be used to repurchase stock.It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise to 13.9%.If this plan were carried out, what would BB's new value of operations be?

A) $789,474

B) $821,053

C) $853,895

D) $888,051

E) $923,573

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

NorthWest Water (NWW) Five years ago, NorthWest Water (NWW) issued $50,000,000 face value of 30-year bonds carrying a 14% (annual payment) coupon.NWW is now considering refunding these bonds.It has been amortizing $3 million of flotation costs on these bonds over their 30-year life.The company could sell a new issue of 25-year bonds at an annual interest rate of 11.67% in today's market.A call premium of 14% would be required to retire the old bonds, and flotation costs on the new issue would amount to $3 million.NWW's marginal tax rate is 40%.The new bonds would be issued when the old bonds are called. -Refer to the data for NorthWest Water (NWW) .What is the NPV if NWW refunds its bonds today?

A) $1,746,987

B) $1,838,933

C) $1,935,719

D) $2,037,599

E) $2,241,359

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The MM model is the same as the Miller model, but with zero corporate taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a firm refunds a debt issue, the firm's stockholders gain and its bondholders lose.This points out the risk of a call provision to bondholders and explains why a non-callable bond will typically command a higher price than an otherwise similar callable bond.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors would increase the likelihood that a company would call its outstanding bonds at this time?

A) A provision in the bond indenture lowers the call price on specific dates, and yesterday was one of those dates.

B) The flotation costs associated with issuing new bonds rise.

C) The firm's CFO believes that interest rates are likely to decline in the future.

D) The firm's CFO believes that corporate tax rates are likely to be increased in the future.

E) The yield to maturity on the company's outstanding bonds increases due to a weakening of the firm's financial situation.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A change in the personal tax rate should not affect firms' capital structure decisions.

B) "Business risk" is differentiated from "financial risk" by the fact that financial risk reflects only the use of debt, while business risk reflects both the use of debt and such factors as sales variability, cost variability, and operating leverage.

C) The optimal capital structure is the one that simultaneously (1) maximizes the price of the firm's stock, (2) minimizes its WACC, and (3) maximizes its EPS.

D) If changes in the bankruptcy code make bankruptcy less costly to corporations, then this would likely reduce the debt ratio of the average corporation.

E) If corporate tax rates were decreased while other things were held constant, and if the Modigliani-Miller tax-adjusted tradeoff theory of capital structure were correct, this would tend to cause corporations to decrease their use of debt.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The capital structure that minimizes a firm's weighted average cost of capital is also the capital structure that maximizes its stock price.

B) The capital structure that minimizes the firm's weighted average cost of capital is also the capital structure that maximizes its earnings per share.

C) If a firm finds that the cost of debt is less than the cost of equity, increasing its debt ratio must reduce its WACC.

D) Other things held constant, if corporate tax rates declined, then the Modigliani-Miller tax-adjusted tradeoff theory would suggest that firms should increase their use of debt.

E) A firm can use retained earnings without paying a flotation cost.Therefore, while the cost of retained earnings is not zero, its cost is generally lower than the after-tax cost of debt.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The world-famous discounter, Fernwood Booksellers, specializes in selling paperbacks for $7 each.The variable cost per book is $5.At current annual sales of 200,000 books, the publisher is just breaking even.It is estimated that if the authors' royalties are reduced, the variable cost per book will drop by $1.Assume authors' royalties are reduced and sales remain constant; how much more money can the publisher put into advertising (a fixed cost) and still break even?

A) $600,000

B) $466,667

C) $333,333

D) $200,000

E) None of the above

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the information below for Benson Corporation, what is the optimal capital structure?

A) Debt = 50%; Equity = 50%; EPS = $3.05; Stock price = $28.90.

B) Debt = 60%; Equity = 40%; EPS = $3.18; Stock price = $31.20.

C) Debt = 80%; Equity = 20%; EPS = $3.42; Stock price = $30.40.

D) Debt = 70%; Equity = 30%; EPS = $3.31; Stock price = $30.00.

E) Debt = 40%; Equity = 60%; EPS = $2.95; Stock price = $26.50.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 97

Related Exams