B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debit balance in which of the following accounts would indicate a likely error?

A) Salaries Expense

B) Notes Payable

C) Common Stock

D) Supplies

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A dividends account represents the amount of earnings paid to the stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The gross increases in stockholders' equity attributable to business activities are called

A) assets

B) liabilities

C) revenues

D) expenses

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Listed below are accounts to use for transactions a) through d), each identified by a number. Following this list are the transactions. You are to indicate for each transaction the accounts that should be debited and credited by placing the account numbers) in the appropriate box. 1. Cash 2. Accounts Receivable 3. Office Supplies 4. Land 5. Interest Receivable 6. Building 7. Accumulated Depreciation-Building 8. Depreciation Expense-Building 9. Accounts Payable 10. Interest Payable 11. Insurance Payable 12. Utilities Expense 13. Notes Payable 14. Prepaid Insurance 15. Service Revenue 16. Common Stock 17. Insurance Expense 18. Interest Expense 19. Office Supplies Expense 20. Unearned Service Revenue 21. Dividends

Correct Answer

verified

Correct Answer

verified

True/False

The increase side of an account is also the side of the normal balance.

B) False

Correct Answer

verified

Correct Answer

verified

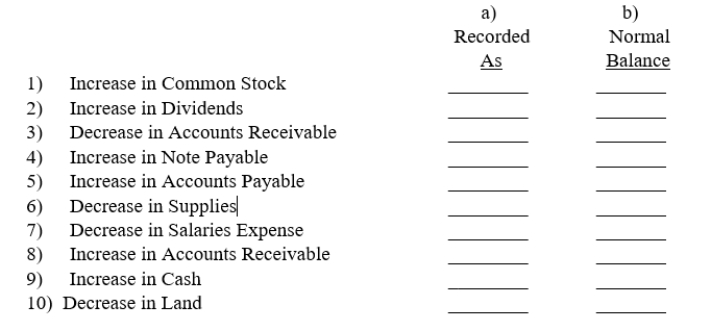

Essay

Increases and decreases in various types of accounts are listed below. In each case, indicate by "Dr." or "Cr." a) whether the change in the account would be recorded as a debit or a credit and b) whether the normal balance of the account is a debit or a credit.

Correct Answer

verified

Correct Answer

verified

True/False

The normal balance of an expense account is a credit.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A trial balance determines the accuracy of the numbers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For each of the following accounts, indicate whether its normal balance is on the credit side or the debit side of the T account. -Accounts Payable

A) Credit side

B) Debit side

D) undefined

Correct Answer

verified

Correct Answer

verified

True/False

The chart of accounts should be the same for each business.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Of the following, which is an internal report that will determine if debit balances equal credit balances in the ledger?

A) chart of accounts

B) income statement

C) trial balance

D) account reconciliation

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which group of accounts is comprised of only assets?

A) Cash, Accounts Payable, Buildings

B) Accounts Receivable, Revenue, Cash

C) Prepaid Expenses, Buildings, Patents

D) Unearned Revenues, Prepaid Expenses, Cash

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For each of the following accounts, indicate whether its normal balance is on the credit side or the debit side of the T account. -Common Stock

A) Credit side

B) Debit side

D) undefined

Correct Answer

verified

A

Correct Answer

verified

True/False

The post reference notation used in the ledger is the account number.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Liabilities are debts owed by the business entity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The chart of accounts for the Corning Company includes the following: Page 3 of the journal contains the following entry: -The chart of accounts for the Miguel Company includes the following: Page 5 of the journal contains the following transaction: What is the posting reference that will be found in the salaries expense account?

A) 5

B) 11

C) 54

D) 21

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

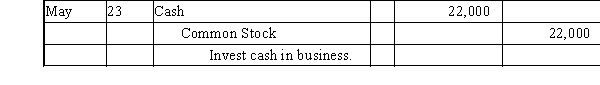

Multiple Choice

This journal entry will

This journal entry will

A) increase Common Stock and decrease Cash

B) increase Cash and decrease Common Stock

C) increase Cash and increase Common Stock

D) decrease Cash and decrease Common Stock

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a transposition error is made on the trial balance, the difference between the debit and credit totals on the trial balance will be

A) zero

B) twice the amount of the transposition

C) one-half the amount of the transposition

D) divisible by 9

F) None of the above

Correct Answer

verified

Correct Answer

verified

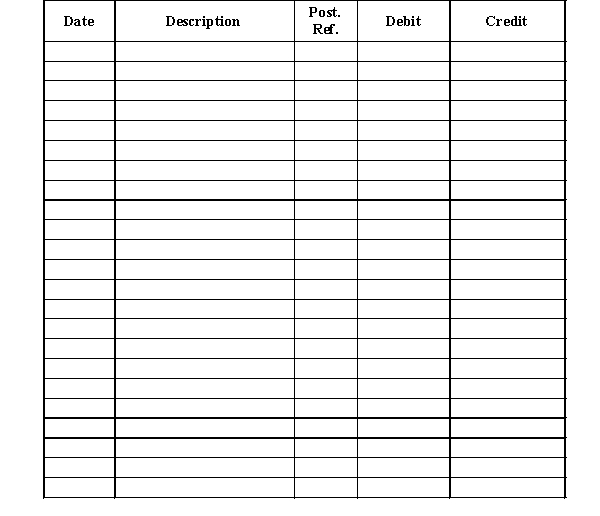

Essay

Journalize the following selected transactions for January. Explanations may be omitted.

Jan.

1Received cash from the sale of common stock, $14,000.

2Received cash for providing accounting services, $9,500.

3Billed customers on account for providing services, $4,200.

4Paid advertising expense, $700.

5 Received cash from customers on account, $2,500.

6 Paid dividends, $1,010.

7 Received telephone bill, $900.

8 Paid telephone bill, $900.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 240

Related Exams