B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's stock basis is reduced by flow-through losses before accounting for distributions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Tax-exempt income at the S corporation level flows through as taxable to the shareholder.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Realized gain is recognized by an S corporation on its distribution of ____________________ property.

Correct Answer

verified

Correct Answer

verified

Essay

With respect to passive losses, there are three classes of income, losses, and credits: ____________________, ____________________, and passive.

Correct Answer

verified

active, po...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

Any distribution of cash or property by a corporation that does not exceed the balance of AAA with respect to S stock during a post-termination transition period of approximately one year is applied against and reduces the basis of the S stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S corporation does not recognize a loss when distributing assets that are worth less than their basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which, if any, of the following items has no effect on the stock basis of an S corporation shareholder?

A) Operating income.

B) Long-term capital gain.

C) Cost of goods sold.

D) Short-term capital loss.

E) All of the above affect stock basis.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The termination of an S election occurs on the day after a corporation ceases to be a qualifying S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The carryover period for the NOLs of a C corporation does not continue to run during S corporation years.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Tax-exempt income is not separately stated on Schedule K of Form 1120S.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Schedule M-3 is the same for a C corporation and an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Stock basis first is increased by income items, then ____________________ by distributions, and finally decreased by ____________________.

Correct Answer

verified

Correct Answer

verified

True/False

It is not beneficial for an S corporation to issue § 1244 stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which corporation is eligible to make the S election?

A) Non-U.S. corporation.

B) Limited liability company.

C) Insurance company.

D) U.S. bank.

E) None of the above can select S status.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which transaction affects the Other Adjustments Account on an S corporation's Schedule M-2?

A) Payroll penalty.

B) Unreasonable compensation.

C) Life insurance proceeds (nontaxable to the recipient S corporation) .

D) Taxable interest.

E) None of the above affects the OAA.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Where the S corporation rules are silent, C corporation provisions apply.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

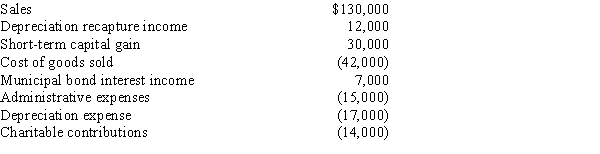

Bidden, Inc., a calendar year S corporation, incurred the following items.

Calculate Bidden's nonseparately computed income.

Calculate Bidden's nonseparately computed income.

Correct Answer

verified

Correct Answer

verified

True/False

Any excess of S corporation losses or deductions over the shareholder's combined stock and debt basis is suspended until there is a subsequent stock or debt basis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's stock basis does not include a ratable share of S corporation liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 135

Related Exams