A) beta.

B) risk.

C) arbitrage.

D) diversification.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stockholder owning 5 percent of a company's stock

A) is guaranteed to receive 5 percent of the company's yearly profits.

B) is personally responsible for 5 percent of the debts if the company goes bankrupt.

C) has 5 percent of her personal assets vulnerable if the company goes bankrupt.

D) gets 5 percent of the votes at the shareholders' meetings.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve uses open-market operations to lower the interest rate on short-term U.S.government bonds, then, as a consequence, asset prices

A) increase and the average expected rate of return on assets decreases.

B) decrease and the average expected rate of return on assets increases.

C) increase and the average expected rate of return on assets increases.

D) decrease and the average expected rate of return on assets decreases.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The vertical intercept of the Security Market Line is determined by the

A) beta of the market portfolio.

B) discount rate.

C) risk-free interest rate.

D) risk premium.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the demand for an asset increases, its price will

A) increase and the rate of return for new investors of this asset will increase.

B) decrease and the rate of return for new investors of this asset will increase.

C) decrease and the rate of return for new investors of this asset will decrease.

D) increase and the rate of return for new investors of this asset will decrease.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The beta of an investment measures the probability-weighted expected rate of return of a portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which institution is least likely to default on a bond?

A) local government

B) small corporation

C) U.S.federal government

D) large corporation

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A promised amount $FV n years into the future is worth how much today, if the interest rate is i percent per year?

A) $FVn/(1 + i) n

B) ($FV/n) (i percent)

C) (1 + i) n/$FV D. [$FV/(1 + i) ]n

E) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market portfolio would have a beta of

A) 0.

B) 1.0.

C) 100.

D) any value.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average expected rate of return is a

A) volume-weighted average.

B) price-weighted average.

C) probability-weighted average.

D) value-weighted average.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nondiversifiable risk refers to potential losses from

A) random fluctuations in specific stocks.

B) bad company policies.

C) portfolio management fraud.

D) events that move all investments in the same direction.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current share price of a corporation's stock is determined by the

A) original purchase price multiplied by 1 plus the interest rate.

B) present value of capital gains and dividends received by stock owners.

C) expected interest and dividend payments.

D) expected capital gains and dividends prospective buyers will earn.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a company declares bankruptcy, stockholders are the first to be paid when company assets are sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a popular type of investment?

A) dividends

B) portfolios

C) mutual funds

D) capital gains

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The estimated value of all financial assets held by U.S.households and nonprofit organizations in 2015 was about

A) $8.1 trillion.

B) $17.9 trillion.

C) $54 trillion.

D) $70 trillion.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to The International Country Risk Guide, financial assets in

A) low-income economies tend to be less risky than in high-income economies.

B) low-income economies tend to be riskier than in high-income economies.

C) low-income economies tend to be about the same level of risk as in high-income economies.

D) all countries carry about the same level of risk.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

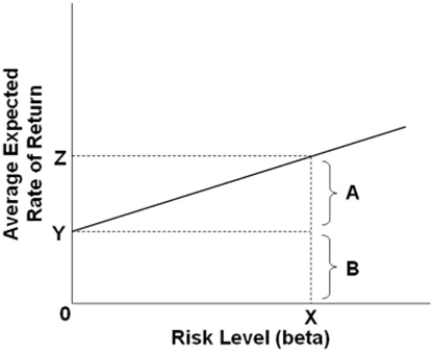

In the accompanying graph, bracket B represents the

In the accompanying graph, bracket B represents the

A) amount of arbitrage for this asset.

B) rate of return for the market portfolio.

C) risk premium for an asset's risk level.

D) compensation for time preference for an asset.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is a feature of all investments?

A) The future payments are typically risky.

B) The periodic payments they provide are regular.

C) They typically are short term.

D) They give the investor a stream of future payments, not just one payment.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Denny buys a rare coin for $200 and sells the coin one year later for $220.Denny's rate of return is

A) 10 percent.

B) 20 percent.

C) 91 percent.

D) 110 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Because of arbitrage, any given financial asset will be expected to return to the Security Market Line.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 323

Related Exams