A) argue that a tax cut will increase aggregate demand by more than it increases real output.

B) contend that the relationship between tax rates and economic incentives is small and of uncertain direction.

C) believe that a decline in tax rates will give rise to budget deficits.

D) make all of the above points.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

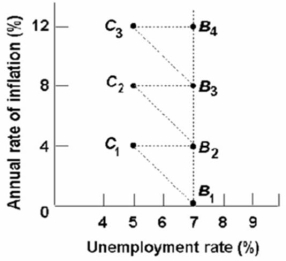

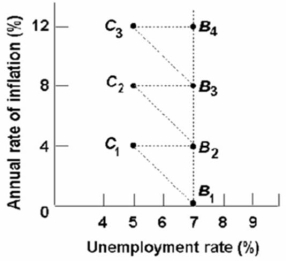

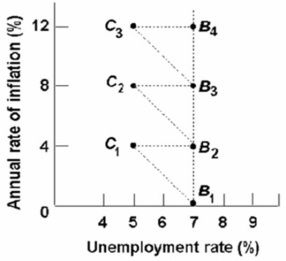

Refer to the above diagram and assume the economy is initially at point b1.Which of the following movements is consistent with The Phillips Curve?

Refer to the above diagram and assume the economy is initially at point b1.Which of the following movements is consistent with The Phillips Curve?

A) the movement from B1 to B2

B) the movement from B1 to C1

C) the movement from C1 to B2

D) the movement from B2 to B1

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An upward shift of the Phillips Curve is consistent with the occurrence of stagflation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Phillips Curve suggests an inverse relationship between increases in the price level and the level of employment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

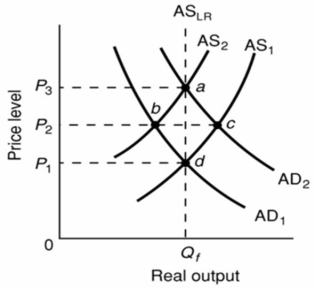

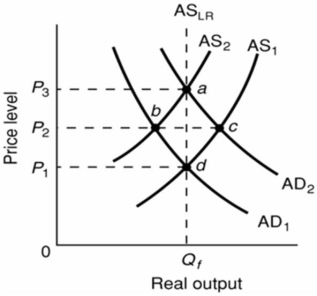

Refer to the above diagram.The initial aggregate demand curve is AD1 and the initial aggregate supply curve is AS1.Demand-pull inflation in the short run is best shown as:

Refer to the above diagram.The initial aggregate demand curve is AD1 and the initial aggregate supply curve is AS1.Demand-pull inflation in the short run is best shown as:

A) a shift of the aggregate demand curve from AD1 to AD2.

B) a move from d to b to a.

C) a move directly from d to a.

D) a shift of the aggregate supply curve from AS1 to AS2.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Phillips Curve suggests a tradeoff between:

A) price level stability and income equality.

B) the level of unemployment and price level stability.

C) unemployment and income equality.

D) economic growth and full employment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation accompanied by falling real output and employment is known as:

A) Laffer's law.

B) Okun's law.

C) stagflation.

D) the Phillips Curve.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a principle of supply-side economics?

A) High marginal tax rates severely discourage work, saving, and investment.

B) Increases in social security taxes and other business taxes shift the aggregate supply curve leftward.

C) The Bank of Canada should adhere to a monetary rule which limits increases in the money supply to a fixed annual rate.

D) Transfer payments reduce incentives to work.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What will occur in the short run if there is cost-push inflation and if the government adopts a hands-off approach to it?

A) an increase in long-run aggregate supply

B) a decrease in long-run aggregate supply

C) low unemployment and a loss of real output

D) high unemployment and a loss of real output

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The short run in macroeconomics is a period in which nominal wages:

A) remain fixed as the price level stays constant.

B) change as the price level stays constant.

C) remain fixed as the price level changes.

D) change as the price level changes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

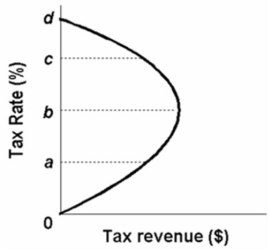

Refer to the above diagram.If tax rates are between b and d, then supply-side economists are of the opinion that a(n) :

Refer to the above diagram.If tax rates are between b and d, then supply-side economists are of the opinion that a(n) :

A) increase in tax revenues will increase tax rates.

B) decrease in tax rates will increase tax revenues.

C) increase in tax rates will increase tax revenues.

D) decrease in tax revenues will decrease tax rates.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A major adverse aggregate supply shock:

A) automatically shifts the aggregate demand curve rightward.

B) causes the Phillips Curve to shift outward.

C) can be caused by rising productivity.

D) can be caused by falling wages.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stagflation refers to:

A) an increase in inflation accompanied by decreases in real output and employment.

B) a decline in the price level accompanied by increases in real output and employment.

C) a simultaneous increase in real output and the price level.

D) a simultaneous reduction in real output and the price level.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An "adverse aggregate supply shock" could result from:

A) a sharp rise in productivity.

B) a rapid rise in oil prices.

C) a decline in wages.

D) an appreciation of the dollar.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the diagram given below.Suppose an economy is initially at point B1.  If workers fully anticipate price level increases and the government uses expansionary policies to bring the unemployment rate below 6 percent, the economy will:

If workers fully anticipate price level increases and the government uses expansionary policies to bring the unemployment rate below 6 percent, the economy will:

A) move from B1 to C1 at which macroeconomic policies will cease to be effective.

B) remain at B1.

C) follow the path indicated by B1, B2, B3, and B4.

D) directly move from B4 to C1.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the diagram below.The initial aggregate demand curve is AD1 and the initial aggregate supply curve is AS1.Assuming no change in aggregate demand, the long-run response to a recession caused by cost-push inflation is best depicted as a:

A) move from a to d along the long-run aggregate supply curve.

B) rightward shift of the aggregate supply curve from AS2 to AS1.

C) move from a to c to d.

D) leftward shift of the aggregate supply curve from AS1 to AS2.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the above graph.The economy is at point B2, and aggregate demand increases.In the short run, the economy will:

Refer to the above graph.The economy is at point B2, and aggregate demand increases.In the short run, the economy will:

A) stay at point B2.

B) move to point C2 and in the long run to B3.

C) move to point B3 and in the long run to C2.

D) move to point B1 and in the long run to B1.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

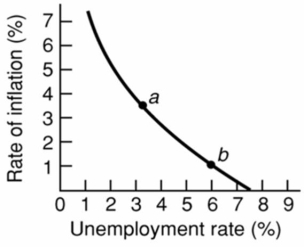

Refer to the above diagram for a specific economy.The shape of this curve suggests that:

Refer to the above diagram for a specific economy.The shape of this curve suggests that:

A) the price level rises at a diminishing rate as the level of aggregate demand increases.

B) full employment and price stability are compatible goals only when aggregate demand is falling.

C) each successive unit of decline in the unemployment rate is accompanied by a smaller increase in the rate of inflation.

D) each successive unit of decline in the unemployment rate is accompanied by a larger increase in the rate of inflation.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The Laffer Curve suggests that lower tax rates will decrease saving and increase consumption.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the government attempts to maintain full employment under conditions of cost-push inflation, deflation is likely to occur.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 122

Related Exams