A) Cash.

B) Accounts Receivable.

C) Equipment

D) Factory building rented to (and occupied by) another company.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chiodini Inc. has a $900,000 investment opportunity that involves sales of $2,430,000, fixed expenses of $1,044,900, and a contribution margin ratio of 50% of sales. The ROI for this year's investment opportunity considered alone is closest to:

A) 16.3%

B) 18.9%

C) 7.0%

D) 135.0%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

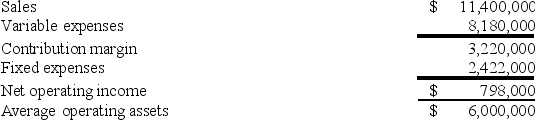

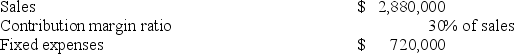

Beery Inc. reported the following results from last year's operations:  At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 12%. If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

The company's minimum required rate of return is 12%. If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

A) $848,700

B) $942,000

C) $24,300

D) $114,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Residual income is the difference between net operating income and the product of average operating assets and the minimum rate of return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

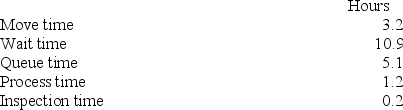

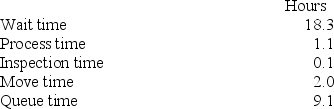

Rotan Corporation keeps careful track of the time required to fill orders. The times recorded for a particular order appear below:  The delivery cycle time was:

The delivery cycle time was:

A) 19.2 hours

B) 20.6 hours

C) 8.3 hours

D) 3.2 hours

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

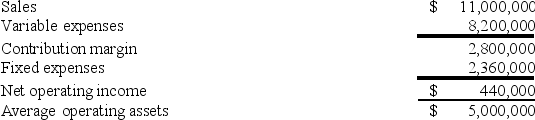

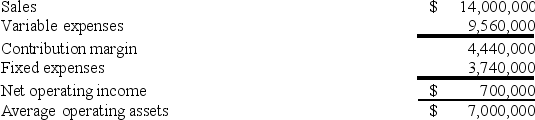

Worsell Inc. reported the following results from last year's operations:  The company's minimum required rate of return is 10%. Last year's residual income was closest to:

The company's minimum required rate of return is 10%. Last year's residual income was closest to:

A) $440,000

B) $490,000

C) ($638,000)

D) ($60,000)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Financial measures such as ROI are generally better than nonfinancial measures of key success drivers such as customer satisfaction as leading indicators of future financial performance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will increase a company's manufacturing cycle efficiency (MCE) ?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonilla Inc. has a $700,000 investment opportunity with the following characteristics: The ROI for the investment opportunity is closest to:

A) 7.0%

B) 128.0%

C) 21.2%

D) 22.4%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kingcade Corporation keeps careful track of the time required to fill orders. Data concerning a particular order appear below:  The throughput time was:

The throughput time was:

A) 30.6 hours

B) 3.2 hours

C) 27.4 hours

D) 12.3 hours

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

ROI and residual income are tools used to evaluate managerial performance in investment centers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

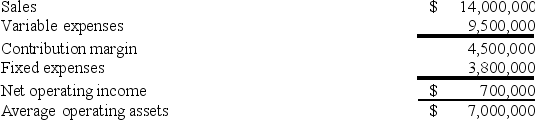

Weafer Inc. reported the following results from last year's operations:  Last year's return on investment (ROI) was closest to:

Last year's return on investment (ROI) was closest to:

A) 10.0%

B) 50.0%

C) 5.0%

D) 63.4%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If net operating income is $70,000, average operating assets are $250,000, and the minimum required rate of return is 16%, what is the residual income?

A) $11,200

B) $40,000

C) $110,000

D) $30,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The basic objective of responsibility accounting is to charge each manager with those costs and/or revenues over which he has control.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

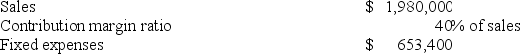

Cirone Inc. reported the following results from last year's operations: At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics: If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

A) 3.1%

B) 8.4%

C) 6.3%

D) 12.1%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Parsa Inc. reported the following results from last year's operations:  At the beginning of this year, the company has a $1,100,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,100,000 investment opportunity with the following characteristics:

The ROI for this year's investment opportunity considered alone is closest to:

The ROI for this year's investment opportunity considered alone is closest to:

A) 7.0%

B) 21.2%

C) 12.6%

D) 72.0%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In November, the Universal Solutions Division of Keaffaber Corporation had average operating assets of $480,000 and net operating income of $46,200. The company uses residual income, with a minimum required rate of return of 11%, to evaluate the performance of its divisions. What was the Universal Solutions Division's residual income in November?

A) ($6,600)

B) $5,082

C) $6,600

D) ($5,082)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Residual income should be used to evaluate an investment center rather than a cost or profit center.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The management of International Cookwares believes that delivery performance measures must be improved if the company is to maintain its competitive edge. The following data are considered to be typical of the time to complete orders. Process time: 4 days Wait time to the start of production: 15 days Move time: 3 days Inspection time: 2 days Queue time during the production process: 8 days What is the manufacturing cycle efficiency?

A) 12.5%

B) 23.5%

C) 76.4%

D) 87.5%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a company contains a number of investment centers of differing sizes, return on investment (ROI) should be used rather than residual income to rank the financial performance of the divisions.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 180

Related Exams