B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accountants do the work involved in recording financial events and transactions, but the actual classifying and interpreting of this data is left to financial managers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Financial accountants prepare reports for owners, creditors, suppliers, and others outside of the organization.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounting recognizes that assets, such as machinery and buildings, lose value over time. Accountants will record a portion of the cost of an asset as an expense each year through the use of

A) asset valuation.

B) asset audits.

C) appreciation.

D) depreciation.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Cash flow statements identify three sources of cash receipts and disbursements: assets, liabilities, and owners' equity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

During periods of rising prices, firms that want to report more attractive profits would tend to favor the FIFO technique of inventory valuation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Profitability ratios are often used to measure management's earnings performance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Leverage ratios indicate the extent to which ________ has been used to fund a business's operations.

A) debt

B) equity

C) owner invested capital

D) profit

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ shows the assets, liabilities, and owners' equity of a firm, at a specific point in time.

A) income statement

B) balance sheet

C) statement of cash flows

D) trial balance

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

According to the Adapting to Change box, the SEC is determined to crack down on and punish those accused of fraud. However, so many auditors and CPAs are trained in how to search for fraud that there are too many cases to prosecute.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paige noted that she disbursed $7,847 in payments for operations in her travel agency and received $7,162 in cash receipts for services rendered. She had no cash receipts or disbursements from investments or financing activities. Thus, Paige had a

A) positive disbursement.

B) negative cash flow.

C) bad debt allowance.

D) tax credit payment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peak Performance Sporting Goods Company has just applied for a bank loan in order to expand the business. Using the most recent balance sheet data provided by the company owner, you calculate that the company's current ratio is 2.5. In your presentation to the company boss, you remark

A) Peak Performance is currently having trouble meeting its short-term obligations.

B) Peak Performance has $2.50 that it owes each month, for every $1.00 of cash that it is generating.

C) Peak Performance has $2.50 of current assets for each $1.00 of current liabilities.

D) Due to the fact that most of Peak Performance's current assets are tied up in inventory, there is no need to worry about whether Peak Performance will be able to make loan payments.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

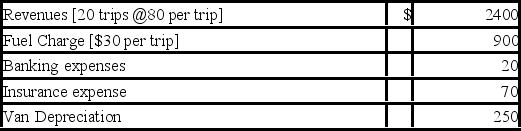

Kayla and Kingston run a shuttle service from Water Tower Place to Chicago O'Hare airport. Last month, they recorded the following:  If 25% of their net income is paid to the government in taxes, what is their net income after taxes?

If 25% of their net income is paid to the government in taxes, what is their net income after taxes?

A) $1410.00

B) $1160.00

C) $682.00

D) $870.00

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Patents and copyrights are classified as ________ on the Balance Sheet.

A) fixed assets

B) intangible assets

C) current assets

D) owners' equity

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A hospital emergency room serves several patients from a ten-car pile-up on the local interstate. Most of the victims require bandages, antibiotics, foot and arm casts, topical ointments, and pain pills. These items are part of the costs of goods sold for the hospital emergency room.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quinn is an accountant employed by CCDL Enterprises. Recently, she has spent much of her time working on defining measures of costs for the production department and checking to ensure that various departments are staying within their budgets. Quinn is a

A) public accountant whose work is mainly concerned with auditing.

B) public accountant whose work is mainly concerned with financial accounting.

C) private accountant whose work is mainly concerned with managerial accounting.

D) private accountant whose work is mainly concerned with financial accounting.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Accounting, as the language of business, is solely concerned with providing information useful to managers of profit-seeking firms.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The U.S. government is a user of a firm's accounting information.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An independent audit is an evaluation and unbiased opinion about the accuracy of a company's financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Although a firm may use different inventory valuation methods, generally accepted accounting principles (GAAP) states that these methods must produce the same dollar value for the cost of goods sold.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 362

Related Exams