A) Combine homogenous costs in appropriate pools.

B) Select appropriate cost drivers.

C) Calculate an appropriate rate for each pool.

D) Allocate costs based on predetermined rates for cost pools.

E) Apply a volume-related measure per unit of product.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After all activity costs are accumulated in an activity cost pool account,overhead rates are computed and costs are allocated to cost objects based on:

A) Direct factors.

B) Indirect factors.

C) Cost drivers.

D) Joint cost principles.

E) Opportunity cost principles.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In activity-based costing,low-volume complex products are usually undercosted and high volume simpler products are overcosted,because the method fails to reflect the different uses of indirect resources.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In activity-based costing,all overhead is lumped together and a predetermined overhead rate per unit of an allocation base is computed and used to assign overhead to jobs and processes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A plantwide overhead rate method is adequate when a company produces only one product or has multiple products that use about the same amount of indirect resources.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

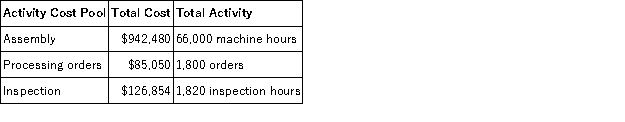

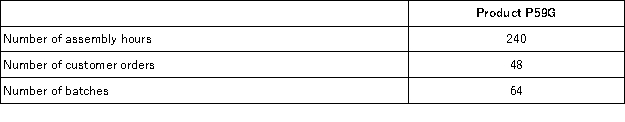

Kozlov Corporation has provided the following data from its activity-based costing system:  The company makes 430 units of product A21W a year,requiring a total of 690 machine-hours,40 orders,and 10 inspection-hours per year.The product's direct materials cost is $35.72 per unit and its direct labor cost is $29.46 per unit.According to the activity-based costing system,the average cost of product A21W is closest to:

The company makes 430 units of product A21W a year,requiring a total of 690 machine-hours,40 orders,and 10 inspection-hours per year.The product's direct materials cost is $35.72 per unit and its direct labor cost is $29.46 per unit.According to the activity-based costing system,the average cost of product A21W is closest to:

A) $94.11 per unit

B) $89.72 per unit

C) $65.18 per unit

D) $92.49 per unit

E) $64.99 per unit

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Activity cost pools are not a necessary part of the allocation of overhead costs using activity-based costing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

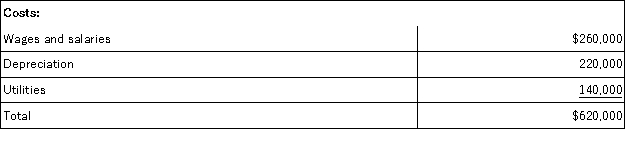

Borden Corporation uses an activity-based costing system with three activity cost pools.The company has provided the following data concerning its costs and its activity based costing system:  Distribution of resource consumption:

Distribution of resource consumption:  How much cost,in total,would be allocated in the first-stage allocation to the Setting Up activity cost pool?

How much cost,in total,would be allocated in the first-stage allocation to the Setting Up activity cost pool?

A) $155,000

B) $279,000

C) $206,000

D) $217,000

E) $194,000

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based costing attempts to better allocate costs to the proper users of overhead by focusing on activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Activity based costing can improve costing activity for:

A) Manufacturing companies only.

B) Service companies only.

C) Merchandising companies only.

D) Any company in any industry.

E) Government entities only.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A system of assigning costs to departments and products on the basis of a variety of activities instead of only one allocation base is called:

A) Plantwide overhead costing.

B) A cost center accounting system.

C) Controllable costing.

D) Activity-based costing.

E) Performance costing.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

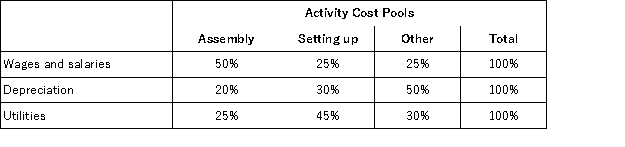

Naples Corporation has provided the following data from its activity-based costing accounting system:  Distribution of resource consumption across activity cost pools:

Distribution of resource consumption across activity cost pools:  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.How much indirect factory wages and factory equipment depreciation cost would be assigned to the Product Processing activity cost pool?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.How much indirect factory wages and factory equipment depreciation cost would be assigned to the Product Processing activity cost pool?

A) $260,000

B) $429,000

C) $169,000

D) $780,000

E) $351,000

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An activity-based cost allocation system:

A) Is one form of a direct or variable costing system.

B) Does not provide total unit cost data.

C) Traces costs to products on the basis of activities performed on them.

D) Does not provide for the allocation of any cost to products that cannot be directly traced to those products.

E) Does not involve the level of detail and the number of allocations that companies make with traditional allocation methods.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

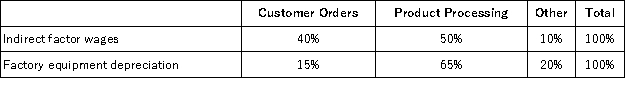

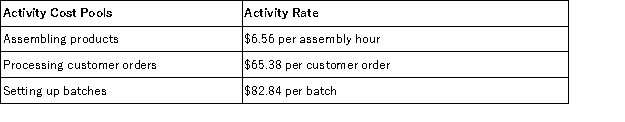

Mirkle Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data for one of the company's products follow:

Data for one of the company's products follow:  The company produced 4,000 units of product during the period.Direct materials cost $7.30 per unit and direct labor cost $5.45 per unit.How much overhead cost would be assigned to Product P59G using the activity-based costing system?

The company produced 4,000 units of product during the period.Direct materials cost $7.30 per unit and direct labor cost $5.45 per unit.How much overhead cost would be assigned to Product P59G using the activity-based costing system?

A) $54,482.56

B) $3,138.24

C) $10,014.40

D) $154.78

E) $5,301.76

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quantum Corporation has provided the following data from its activity-based costing system:  The company makes 430 units of product R32E a year,requiring a total of 1,120 machine-hours,40 orders,and 30 inspection-hours per year.The product's direct materials cost is $49.81 per unit and its direct labor cost is $12.34 per unit.The product sells for $129.90 per unit.According to the activity-based costing system,the product margin for product R32E is:

The company makes 430 units of product R32E a year,requiring a total of 1,120 machine-hours,40 orders,and 30 inspection-hours per year.The product's direct materials cost is $49.81 per unit and its direct labor cost is $12.34 per unit.The product sells for $129.90 per unit.According to the activity-based costing system,the product margin for product R32E is:

A) $4,116.50

B) $29,132.50

C) $6,180.50

D) $5,161.30

E) $4,981.00

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a limitation of activity-based costing?

A) Maintaining an activity-based costing system is more costly than maintaining a traditional direct labor-based costing system.

B) Changing from a traditional direct labor-based costing system to an activity-based costing system changes product margins and other key performance indicators used by managers.Such changes are often resisted by managers.

C) In practice,most managers insist on fully allocating all costs to products,customers,and other costing objects in an activity-based costing system.This results in overstated costs.

D) More accurate product costs may result in increasing the selling prices of some products.

E) Complex products are assigned a larger portion of overheaD.An activity-based costing system is more costly to maintain than a traditional costing system.Activity-based costing produces numbers,such as product margins,that are at odds with the numbers produced by traditional costing systems.Assigning more overhead to complex products is an advantage because it more accurately reflects use of the cost driver.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A factor that causes the cost of an activity to go up or down is a(n) :

A) Direct factor.

B) Indirect factor.

C) Cost driver.

D) Product cost.

E) Contribution factor.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

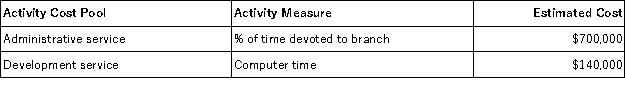

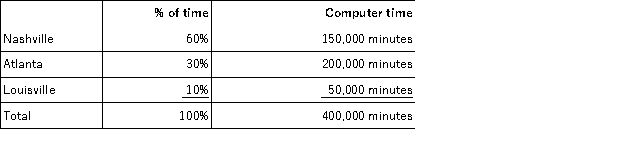

Founder Consulting Corporation has its headquarters in Memphis and operates from three branch offices in Nashville,Atlanta,and Louisville.Two of the company's activity cost pools are Administrative Service and Development Service.These costs are allocated to the three branch offices using an activity-based costing system.Information for next year follows:  Estimated branch data for next year is as follows:

Estimated branch data for next year is as follows:  How much of the headquarters cost allocation should Atlanta expect to receive next year?

How much of the headquarters cost allocation should Atlanta expect to receive next year?

A) $280,000

B) $409,500

C) $472,500

D) $504,000

E) $560,000

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

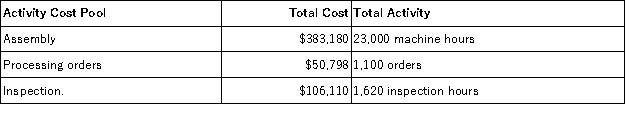

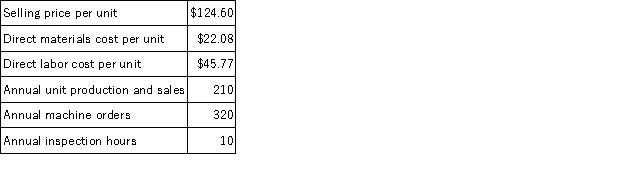

Zephyr Corporation has provided the following data from its activity-based costing system:  Data concerning one of the company's products,Product LM41,appear below:

Data concerning one of the company's products,Product LM41,appear below:  According to the activity-based costing system,the product margin for product LM41 is:

According to the activity-based costing system,the product margin for product LM41 is:

A) $2,891.90

B) $5,931.30

C) $11,917.50

D) $2,236.90

E) $3,178.20

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

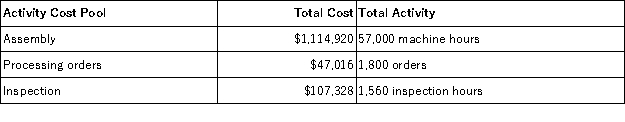

Activity rates from Hilliard Corporation's activity-based costing system are listed below.The company uses the activity rates to assign overhead costs to products:  Last year,Product XL91 involved 2 customer orders,434 assembly hours,and 20 batches.How much overhead cost would be assigned to Product XL91 using the activity-based costing system?

Last year,Product XL91 involved 2 customer orders,434 assembly hours,and 20 batches.How much overhead cost would be assigned to Product XL91 using the activity-based costing system?

A) $1,041.80

B) $2,000.04

C) $66,908.88

D) $146.73

E) $772.52

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 50

Related Exams