A) All of a company's assets.

B) All of a company's assets except inventory.

C) All of a company's non-current assets.

D) Only property,plant and equipment.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company uses the direct method to prepare its statement of cash flows.If the company's inventory and accounts payable both increase during the accounting period,how would these changes affect cash flow calculations?

A) The changes in each account are both added to net income.

B) The change in inventory is subtracted from cost of goods sold and the change in accounts payable is added to cost of goods sold to find the cash paid to suppliers.

C) The changes in each account are both subtracted from net income.

D) The change in inventory is added to cost of goods sold and the change in accounts payable is subtracted from cost of goods sold to find the cash paid to suppliers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two years ago,your company bought $40,000 in bonds from another company.This month,it sold half of those bonds for $20,640 and lent $1,000 to an employee with a promissory note.On the statement of cash flows for this accounting period,your company would report a net cash:

A) outflow of $19,640 from investing activities.

B) inflow of $19,640 from investing activities.

C) inflow of $20,640 from investing activities.

D) outflow of $20,640 from investing activities.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from investing activities include all of the following except:

A) a purchase of an automobile.

B) a sale of a trademark.

C) a purchase of stock of another company.

D) an issuance of bonds.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A toy store with a calendar year-end is likely to have:

A) unpredictable fluctuations in cash flow from quarter to quarter.

B) the largest cash inflow from operations in the second and third quarters (April - September) .

C) a fairly stable cash flow across all four quarters.

D) the largest cash inflow from operations in the fourth and first quarters (October - March) .

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has positive cash flow from investing and financing activities,but negative cash flow from operating activities.The likely result is

A) investors may not buy the company's stock because dividends are unlikely.

B) investors will continue to buy stock since the company's growth prospects are good.

C) creditors will continue to lend money to the company.

D) creditors will demand immediate repayment of all outstanding debt.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A gain or loss from selling equipment is reported under cash flows from operating activities using the direct method.The direct method converts revenues to cash inflows and expenses to cash outflows to arrive at net cash flow from operating activities.Since gains and losses are noncash amounts,they are not used in calculating operating cash flows using the direct method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding preparation of the statement of cash flows is true?

A) GAAP currently allows the indirect method only.

B) IFRS currently allows the direct method only.

C) The IASB and the FASB are considering requiring the direct method.

D) The IASB and the FASB are considering requiring the indirect methoD.GAAP and IFRS currently allow both the direct method and the indirect method.The IASB and the FASB are considering requiring the direct method.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If a company uses the direct method of calculating cash flows from operating activities,it must adjust net income for gains or losses when selling property,plant,and equipment.A company must make adjustments for gains and losses only when the indirect method is used to present cash flows from operating activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using the spreadsheet approach for the indirect method to calculate cash flows from operating activities,net income would be found as:

A) a debit to the Retained Earnings account.

B) the difference between revenues and expenses.

C) a credit to the Retained Earnings account.

D) the difference between gains and losses.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A piece of equipment with a cost of $130,000 and accumulated depreciation of $85,000 is sold for $50,000 cash.The amount that should be reported as a cash inflow from investing activities is:

A) $50,000.

B) $5,000.

C) $45,000.

D) $0.This is a financing activity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The advantages of the direct method include all of the following except:

A) It allows for more detailed analysis of operating cash flows.

B) It provides more information than the indirect method to relate cash inflows and outflows.

C) It allows for more reliable prediction of future cash flows.

D) Comparisons between companies are facilitated since most U.S.companies use the direct methoD.Most U.S.companies use the indirect method.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchased money market funds with cash during the current year.Choose the statement that is true:

A) This transaction will result in a decrease in cash from operating activities.

B) This transaction will result in a decrease in cash from investing activities.

C) This transaction will result in a decrease in cash from financing activities.

D) This transaction will not cause a change in cash from operating,investing,or financing activities.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Free cash flow is a positive cash flow:

A) beyond what is needed to replace current property,plant,and equipment and pay dividends.

B) across all three activity components of the statement of cash flows.

C) beyond what has been allotted for future property,plant,and equipment replacement and expansion.

D) across both financing and investing activities.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the indirect method is used,if prepaid expenses decrease during the accounting period,the change in prepaid expenses is:

A) added to the change in the cash account.

B) subtracted from net income.

C) added to net income.

D) subtracted from the change in the cash account.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represent cash provided by financing activities?

A) Issuing stock in exchange for another company's stock.

B) Paying a bond's face value at maturity.

C) Issuing long-term bonds at a discount.

D) Receiving interest on promissory notes.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

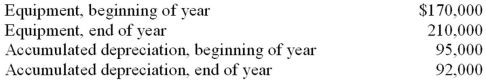

Equipment with a cost of $10,000 and a book value of $3,000 was sold during the year for cash of $9,000.Additional equipment was purchased during the year for cash.Use the information above to answer the question below.The company uses the indirect method in preparing the statement of cash flows.What is the amount of depreciation expense that will be reported in the operating activities section of the statement?

A) $4,000

B) $11,000

C) $7,000

D) $10,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The reporting of financing activities is identical under the indirect and direct methods for the statement of cash flows.The choice between the direct and indirect methods affects only the operating activities section of the statement of cash flows,not the investing or financing activities sections.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from financing activities include all of the following except

A) payment of long-term debt.

B) interest expense.

C) proceeds from stock issuance.

D) dividends paid to stockholders.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company uses the indirect method to prepare its statement of cash flows.If the supplies account increases and accounts payable decreases during an accounting period,what does the company do with the changes in these accounts to calculate cash flows from operating activities?

A) Both are added to net income.

B) The change in accounts payable is added to net income;the change in supplies is subtracted.

C) Both are subtracted from net income.

D) The change in supplies is added to net income;the change in accounts payable is subtracteD.Using the indirect method,both decreases in current assets and increases in current liabilities are added to net income to convert to cash flows from operating activities.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 138

Related Exams