A) 20.7%.

B) 75%.

C) 3.8%.

D) 1.33%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is used to evaluate a company's liquidity?

A) Debt to assets ratio.

B) Asset turnover ratio.

C) Return on equity ratio.

D) Current ratio.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is used to evaluate a company's efficiency in using its assets?

A) Current ratio.

B) Debt to assets ratio.

C) Return on assets ratio.

D) Asset turnover ratio.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

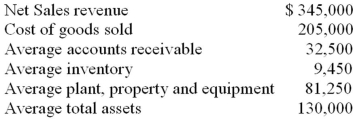

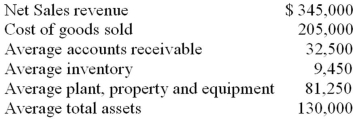

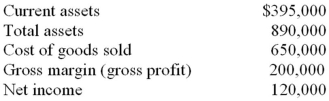

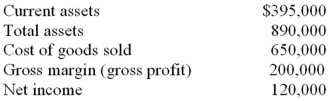

The following information is available for a company for the current year: Which of the following is closest to the company's inventory turnover ratio for the current year?

A) 4.61

B) 3.44

C) 21.69

D) 13.76

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debt to assets ratio of .50 indicates that the company has:

A) more liabilities than stockholders' equity.

B) equal amounts of liabilities and stockholders' equity.

C) more stockholders' equity than liabilities.

D) no liabilities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios does not use total revenue in its calculation?

A) Net profit margin.

B) Asset turnover.

C) Return on equity.

D) Fixed asset turnover.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is calculated by dividing net income by net sales?

A) Gross profit margin.

B) Current ratio.

C) Net profit margin.

D) Asset turnover.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following could explain why a company has a lower net profit margin ratio but a higher EPS than one of its competitors?

A) The company sells a higher percentage of goods on credit.

B) The company has fewer shares of outstanding common stock relative to its net income.

C) The company earns a higher percentage of net income from non-operating activities.

D) The company pays a higher dividenD.Net profit margin = net income/sales

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following could indicate bad news?

A) An increase in asset turnover ratio.

B) A decrease in days to sell.

C) A decrease in EPS.

D) A decrease in the debt to assets ratio.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

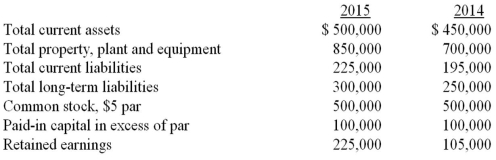

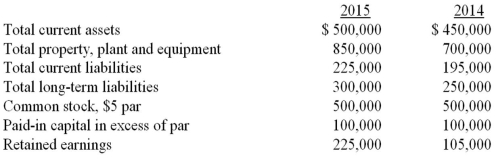

Use the information above to answer the following question.If net income for 2015 is $120,000,which of the following is closest to the company's return on equity for 2015?

A) 20%

B) 14.5%

C) 15.7%

D) 13.3%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the effects of a business decision on a financial ratio is true?

A) If a company is expanding its facilities,its fixed asset turnover ratio is likely to fall temporarily.

B) If a company extends its payment period for customers,its accounts receivable ratio is likely to rise.

C) If a company eases its credit granting policies,its days to collect ratio is likely to fall.

D) If a company builds up inventories,its days to sell ratio is likely to fall.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The higher the accounts receivable turnover,the slower accounts receivable are being collected.The higher the accounts receivable turnover,the faster accounts receivable are being collected.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.If sales revenue for 2015 is $850,000,which of the following is closest to the asset turnover ratio for 2015?

A) 0.68

B) 0.63

C) 0

D) 0.74

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Trend data can be measured in dollar amounts or percentages.Trend data show changes over time.These changes can be measured in dollars or in percentages.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measures would assist in assessing the profitability of a company?

A) Asset turnover.

B) Times interest earned ratio.

C) Inventory turnover ratio.

D) Debt to assets ratio.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an analyst wants to examine a company's current ability to generate income,which of the following would best be considered?

A) Liquidity.

B) Market share.

C) Profitability.

D) Solvency.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information is available for a company for the current year: Which of the following is closest to the company's days to sell ratio for the current year?

A) 16.83

B) 79.18

C) 26.53

D) 34.37

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information is taken from the financial statements of a company for the current year: On a common size income statement for this year,what is the percentage that would be shown for cost of goods sold?

A) 76%

B) 24%

C) 31%

D) 18%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information is taken from the financial statements of a company for the current year: Use the information above to answer the following question.On a common size income statement for the year,what is the percentage that would be shown for sales revenue?

A) 100%

B) 14%

C) 60%

D) 13%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

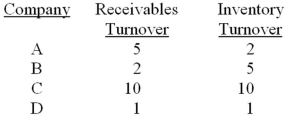

Judging only from the ratios below,which of the following clothing wholesalers is least likely to be having cash flow problems?

A) Company A

B) Company B

C) Company C

D) Company D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 110

Related Exams